Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Mayer Holdings Limited (HKG:1116) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Mayer Holdings

What Is Mayer Holdings's Net Debt?

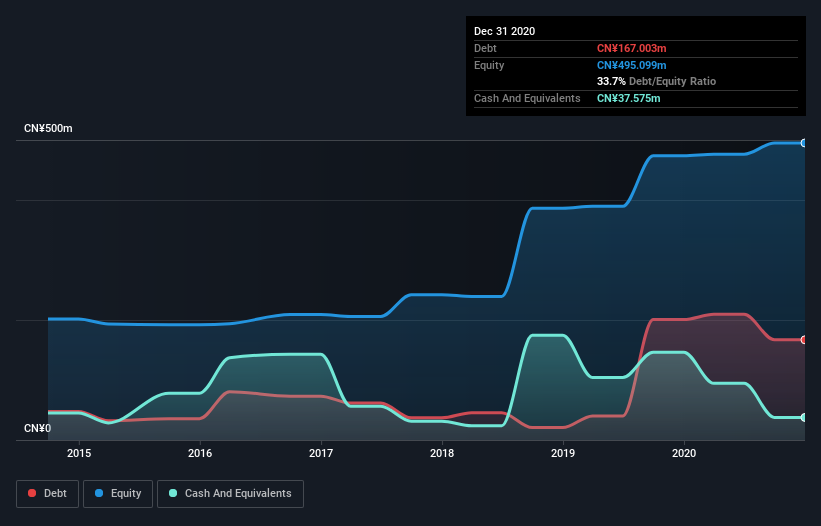

You can click the graphic below for the historical numbers, but it shows that Mayer Holdings had CN¥167.0m of debt in December 2020, down from CN¥200.8m, one year before. On the flip side, it has CN¥37.6m in cash leading to net debt of about CN¥129.4m.

A Look At Mayer Holdings' Liabilities

The latest balance sheet data shows that Mayer Holdings had liabilities of CN¥278.6m due within a year, and liabilities of CN¥885.0k falling due after that. Offsetting this, it had CN¥37.6m in cash and CN¥239.2m in receivables that were due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that Mayer Holdings' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the CN¥411.4m company is struggling for cash, we still think it's worth monitoring its balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Mayer Holdings's net debt is sitting at a very reasonable 2.2 times its EBITDA, while its EBIT covered its interest expense just 4.1 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Pleasingly, Mayer Holdings is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 327% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Mayer Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, Mayer Holdings saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Mayer Holdings's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to grow its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that Mayer Holdings is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with Mayer Holdings , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1116

Mayer Holdings

An investment holding company, processes, manufactures, trades in, and sells steel sheets and pipes, and other steel products in the People’s Republic of China.

Imperfect balance sheet minimal.

Market Insights

Community Narratives