- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1091

We Think South Manganese Investment (HKG:1091) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that South Manganese Investment Limited (HKG:1091) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for South Manganese Investment

How Much Debt Does South Manganese Investment Carry?

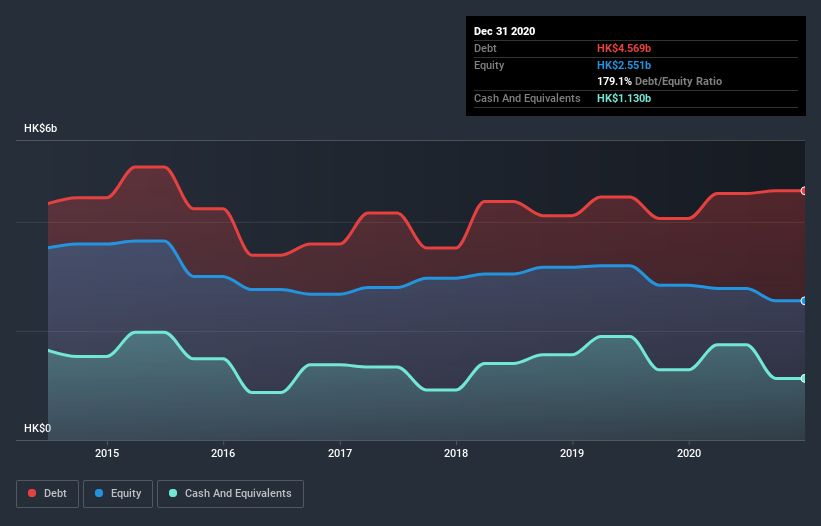

As you can see below, at the end of December 2020, South Manganese Investment had HK$4.48b of debt, up from HK$4.06b a year ago. Click the image for more detail. On the flip side, it has HK$1.13b in cash leading to net debt of about HK$3.35b.

A Look At South Manganese Investment's Liabilities

We can see from the most recent balance sheet that South Manganese Investment had liabilities of HK$4.29b falling due within a year, and liabilities of HK$2.22b due beyond that. On the other hand, it had cash of HK$1.13b and HK$1.45b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$3.93b.

The deficiency here weighs heavily on the HK$1.49b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, South Manganese Investment would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

South Manganese Investment shareholders face the double whammy of a high net debt to EBITDA ratio (7.5), and fairly weak interest coverage, since EBIT is just 0.37 times the interest expense. This means we'd consider it to have a heavy debt load. However, it should be some comfort for shareholders to recall that South Manganese Investment actually grew its EBIT by a hefty 114%, over the last 12 months. If that earnings trend continues it will make its debt load much more manageable in the future. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since South Manganese Investment will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, South Manganese Investment produced sturdy free cash flow equating to 77% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both South Manganese Investment's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that South Manganese Investment's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with South Manganese Investment , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade South Manganese Investment, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1091

South Manganese Investment

An investment holding company, engages in the manganese mining, ore processing, and downstream processing operations in Mainland China, rest of Asia, Europe, and North America.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.