Is China Taiping Still Attractive After Its 75% Rally and Strong Earnings Momentum?

Reviewed by Simply Wall St

Are you wondering what to do with China Taiping Insurance Holdings stock after its whirlwind year? You are not alone. Investors watching this insurer have seen the share price soar by 45.3% year-to-date and a staggering 75.8% over the past 12 months. Even after a 14% dip in the last month, the stock closed at 16.24, marking an impressive long-term journey from where it stood just a few years ago. Over the past three years, the price has surged by an eye-catching 142.4%, and even looking five years back, the gain is a solid 60.6%.

What is driving all this action? Beyond general market optimism, China Taiping’s strong returns seem to reflect optimism around its strategic positioning and possibly improved sentiment from investors as global markets shift to re-rate insurance groups. Of course, with rapid gains come questions about whether the stock is still undervalued or if the best could be behind us.

This is where valuation comes in. According to our latest checks, China Taiping Insurance Holdings scores a 5 out of a possible 6 for undervaluation, meaning it passes nearly every major test we look at when assessing if a stock is a bargain. That is not something you see every day, and it raises a vital question: are investors missing something, or is this truly an opportunity?

Next, let us break down what those valuation checks really tell us, and then I want to share an even more insightful way to approach valuation that could change how you look at this company entirely.

Why China Taiping Insurance Holdings is lagging behind its peersApproach 1: China Taiping Insurance Holdings Excess Returns Analysis

The Excess Returns valuation model examines how much profit a company generates above its cost of equity, focusing on high-quality returns on invested capital and sustainable growth. For China Taiping Insurance Holdings, this involves analyzing how much value the company can create for shareholders based on current and future profitability.

Based on the latest analysis:

- Book Value: HK$20.66 per share

- Stable EPS: HK$3.09 per share

(Source: Weighted future Return on Equity estimates from 9 analysts.) - Cost of Equity: HK$1.75 per share

- Excess Return: HK$1.33 per share

- Average Return on Equity: 11.92%

- Stable Book Value: HK$25.88 per share

(Source: Weighted future Book Value estimates from 8 analysts.)

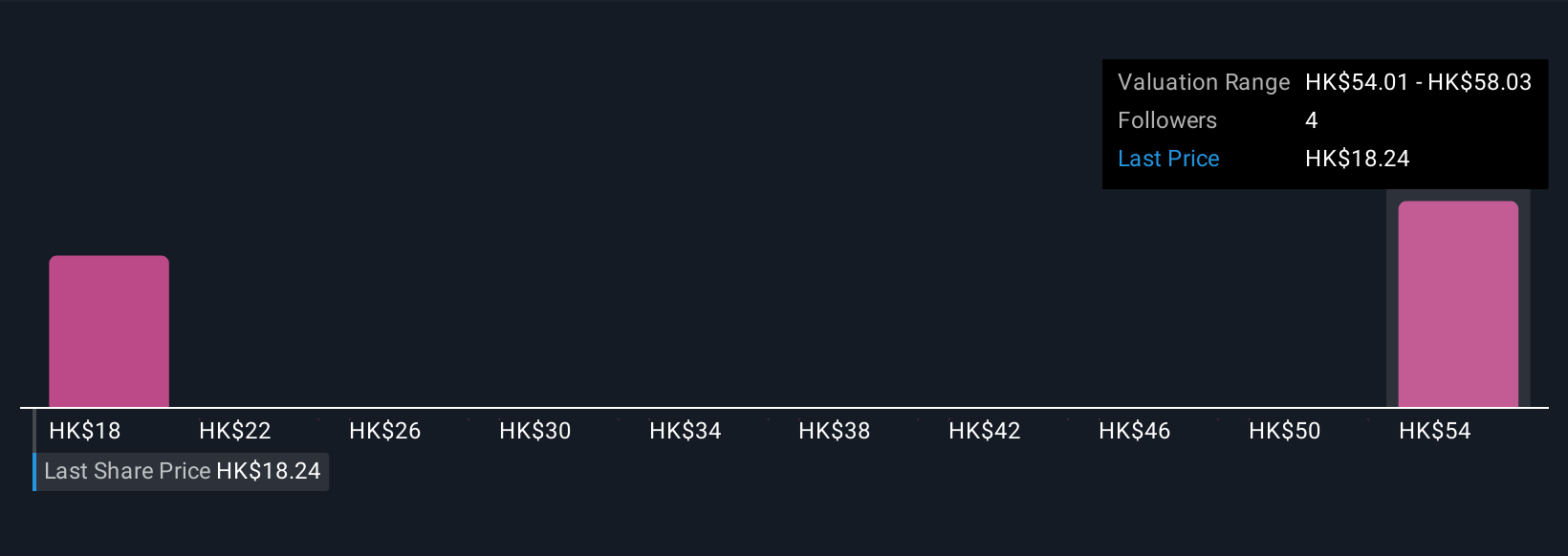

This model estimates the intrinsic value of China Taiping at HK$58.56 per share, which is a 72.3% discount compared to the recent share price of HK$16.24. In other words, the stock is trading significantly below what analysts estimate is its fundamental value based on its ability to generate strong returns above its cost of equity.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for China Taiping Insurance Holdings.

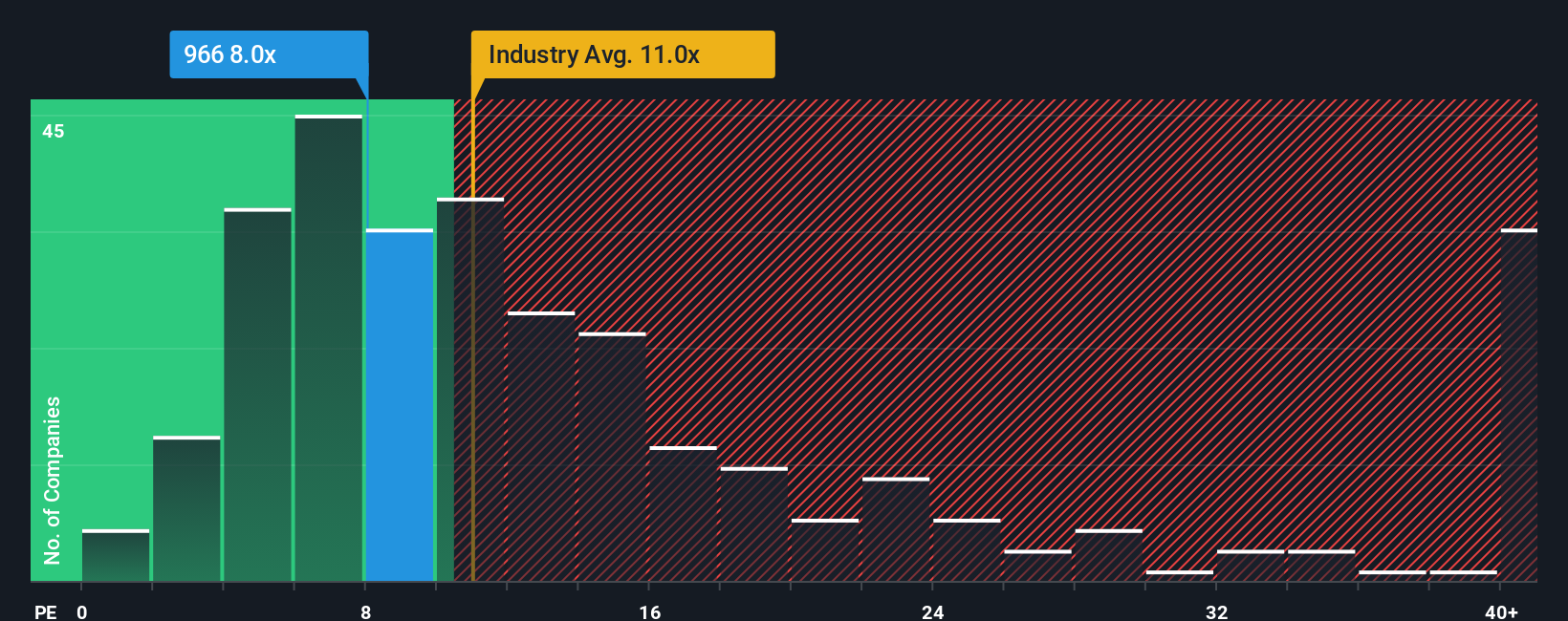

Approach 2: China Taiping Insurance Holdings Price vs Earnings

For profitable companies like China Taiping Insurance Holdings, the price-to-earnings (PE) ratio is a commonly used and effective valuation tool. The PE multiple reflects what investors are willing to pay today for each dollar of a company’s earnings, making it helpful when evaluating companies with consistent and positive profits.

What constitutes a “normal” or “fair” PE ratio can depend on several factors, especially growth expectations and risk. Companies expected to grow earnings rapidly or those considered less risky typically justify a higher PE, while slower growth or higher risk push the fair ratio lower.

In China Taiping’s case, the current PE ratio stands at 7.14x, which is well below the insurance industry average of 12.24x and considerably lower than the peer average of 36.52x. However, Simply Wall St’s proprietary Fair Ratio blends in company-specific factors like projected earnings growth, profit margins, market cap, and overall risks and estimates that a fair multiple for China Taiping is 10.22x.

Looking beyond simple industry comparisons, the Fair Ratio presents a more nuanced and accurate yardstick because it factors in how the company’s unique outlook stacks up against the market, not just its peers. Since China Taiping’s PE ratio of 7.14x is notably lower than the fair valuation benchmark of 10.22x, the shares appear to be undervalued based on this approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your China Taiping Insurance Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your personal story or perspective on a company, connecting what you believe about its future with your own fair value estimates and expectations for growth, profits, and margins. Instead of just looking at numbers, Narratives help you link China Taiping’s business story to specific financial forecasts and a target valuation, making your investment decisions easier and more meaningful.

On Simply Wall St’s platform, Narratives are easy to set up on the Community page and are used by millions of investors. They update automatically when fresh news or company results arrive, helping you stay relevant as conditions change. Narratives empower you to see whether the current share price is below, equal to, or above your fair value, making it clearer when to buy, hold, or sell.

For example, one investor might think China Taiping’s fair value is as high as HK$60 per share based on strong growth, while another believes it is closer to HK$18 due to conservatism about future returns. Both Narratives are visible and updated side by side, letting you compare perspectives and act with confidence.

Do you think there's more to the story for China Taiping Insurance Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:966

China Taiping Insurance Holdings

An investment holding company, underwrites various insurance and reinsurance products in the People’s Republic of China, Hong Kong, Macau, Singapore, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives