Investors Still Waiting For A Pull Back In ZhongAn Online P & C Insurance Co., Ltd. (HKG:6060)

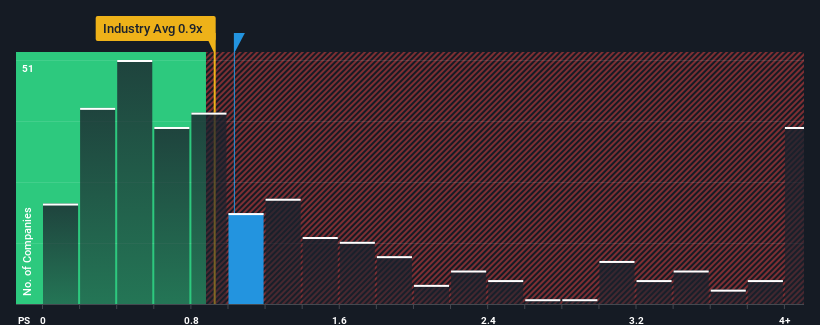

When close to half the companies in the Insurance industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.4x, you may consider ZhongAn Online P & C Insurance Co., Ltd. (HKG:6060) as a stock to potentially avoid with its 1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ZhongAn Online P & C Insurance

What Does ZhongAn Online P & C Insurance's P/S Mean For Shareholders?

Recent times haven't been great for ZhongAn Online P & C Insurance as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ZhongAn Online P & C Insurance will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For ZhongAn Online P & C Insurance?

ZhongAn Online P & C Insurance's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 81% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 45% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 21% per year. Meanwhile, the broader industry is forecast to contract by 1.3% each year, which would indicate the company is doing very well.

In light of this, it's understandable that ZhongAn Online P & C Insurance's P/S sits above the majority of other companies. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We can see that ZhongAn Online P & C Insurance maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for ZhongAn Online P & C Insurance with six simple checks.

If you're unsure about the strength of ZhongAn Online P & C Insurance's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if ZhongAn Online P & C Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6060

ZhongAn Online P & C Insurance

An Internet-based Insurtech company, provides internet insurance and insurance information technology services in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026