As global markets navigate a landscape of mixed economic signals, with small-cap stocks showing notable resilience in the U.S., investors are increasingly turning their attention to Asia, where emerging opportunities abound. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate strong fundamentals and potential for growth amid shifting market conditions and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Namuga | 14.15% | -4.88% | 23.32% | ★★★★★★ |

| GakkyushaLtd | 15.92% | 3.67% | 11.14% | ★★★★★★ |

| ASIX Electronics | NA | -2.46% | -3.16% | ★★★★★★ |

| 104 | NA | 9.90% | 10.14% | ★★★★★★ |

| Q P Group Holdings | 17.07% | -2.56% | -2.55% | ★★★★★★ |

| Subaru Enterprise | NA | 1.92% | 4.82% | ★★★★★★ |

| Nice | 78.50% | 1.97% | 13.44% | ★★★★★☆ |

| Jiangsu Longda Superalloy | 21.58% | 19.96% | -4.28% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★☆☆ |

| Lungyen Life Service | 10.77% | 3.67% | 0.09% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Yunfeng Financial Group (SEHK:376)

Simply Wall St Value Rating: ★★★★★☆

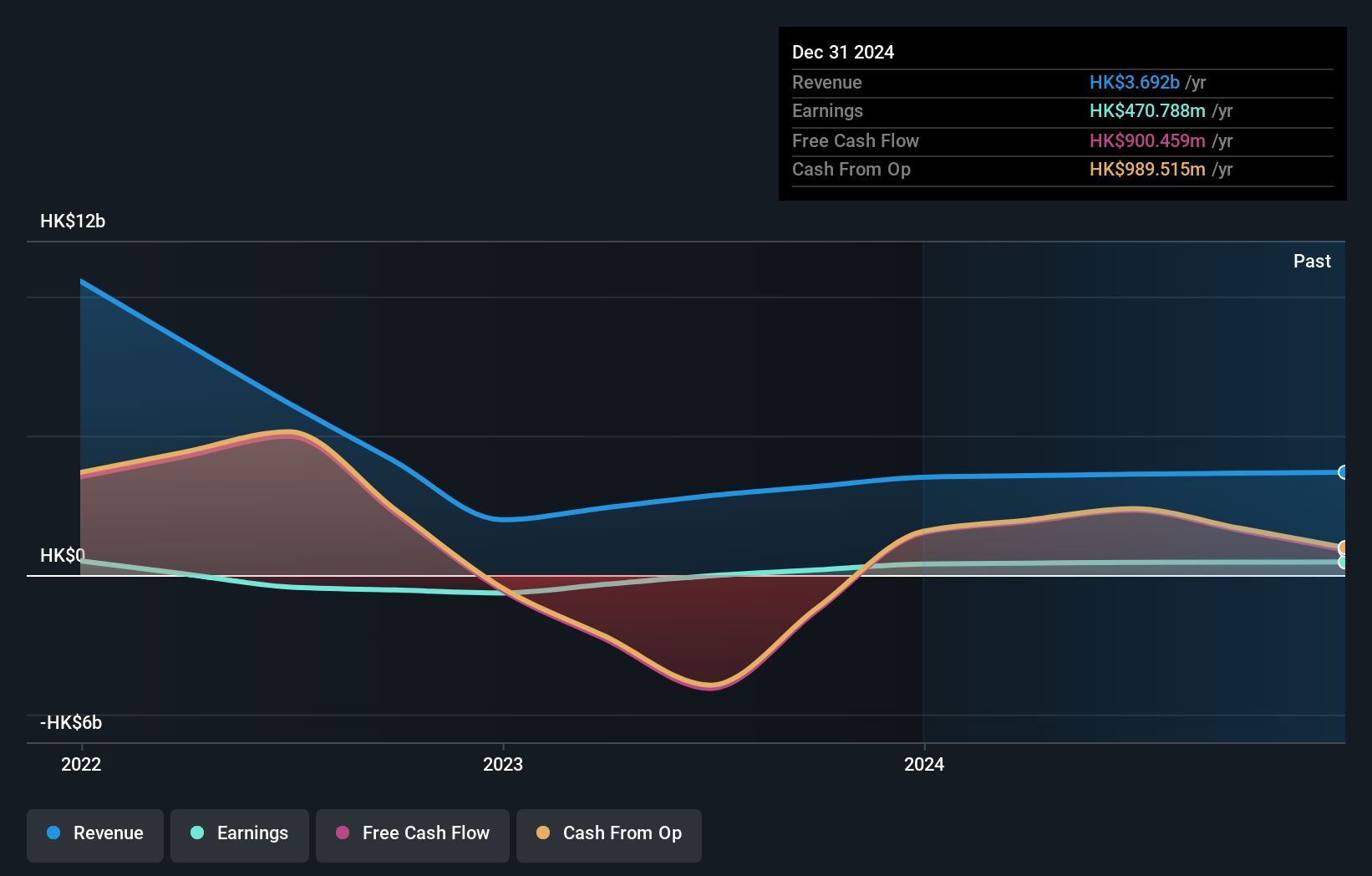

Overview: Yunfeng Financial Group Limited is an investment holding company that offers insurance products in Hong Kong and Macao, with a market capitalization of approximately HK$15.43 billion.

Operations: Yunfeng Financial Group generates revenue primarily from its insurance business, contributing HK$3.99 billion, and other financial services and corporate activities adding HK$241.29 million. The company's net profit margin reflects the profitability of these operations.

Yunfeng Financial Group, a dynamic player in the financial sector, has seen its earnings surge by 64% over the past year, outpacing the insurance industry's growth. The company recently completed a follow-on equity offering of HK$1.17 billion and entered into strategic alliances with Ant Digital Technologies and Pharos Network Technology Limited, strengthening its foothold in digital finance. Despite a volatile share price recently, Yunfeng's debt-to-equity ratio improved from 25.7 to 18.7 over five years, showcasing prudent financial management. With EBIT covering interest payments 7 times over, Yunfeng appears well-positioned for future opportunities in blockchain integration and Web3 finance innovations.

Hubei DOTI Micro Technology (SZSE:301183)

Simply Wall St Value Rating: ★★★★★★

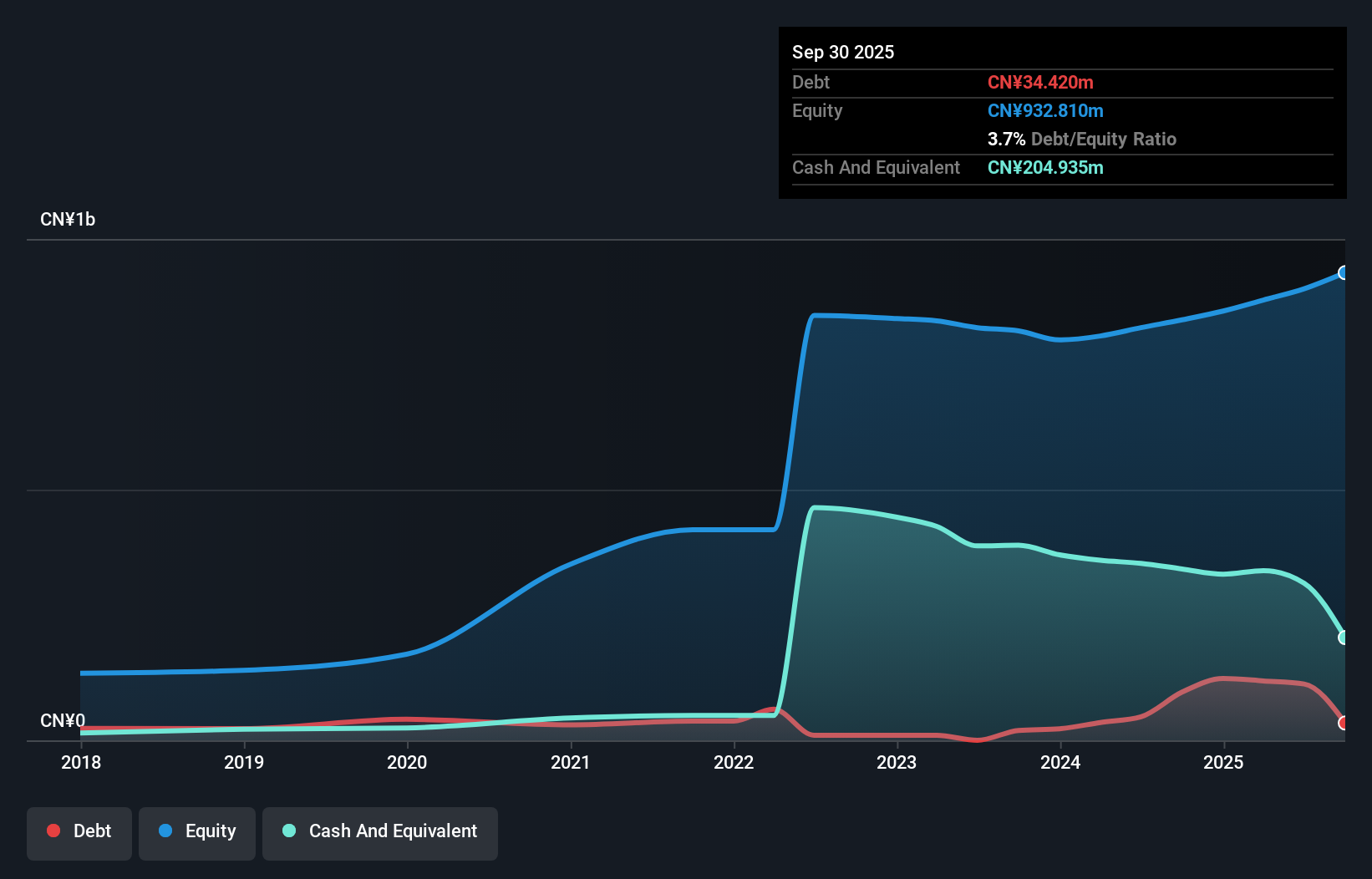

Overview: Hubei DOTI Micro Technology Co., Ltd. specializes in the research, development, production, and sales of precision optoelectronic thin film components both in China and internationally, with a market cap of CN¥9.78 billion.

Operations: Hubei DOTI Micro Technology generates revenue primarily from the sale of precision optoelectronic thin film components. The company focuses on both domestic and international markets, contributing to its financial performance.

Hubei DOTI Micro Technology, a smaller player in the tech space, has shown impressive earnings growth of 336% over the past year, outpacing its industry peers. Despite a volatile share price recently, its debt to equity ratio improved from 7.8 to 3.7 over five years, indicating better financial health. For the nine months ending September 2025, sales reached CNY 636 million from CNY 414 million a year earlier and net income doubled to CNY 80 million. With basic earnings per share rising from CNY 0.5 to CNY 1, it seems poised for continued growth if current trends persist.

Elite Advanced Laser (TWSE:3450)

Simply Wall St Value Rating: ★★★★★☆

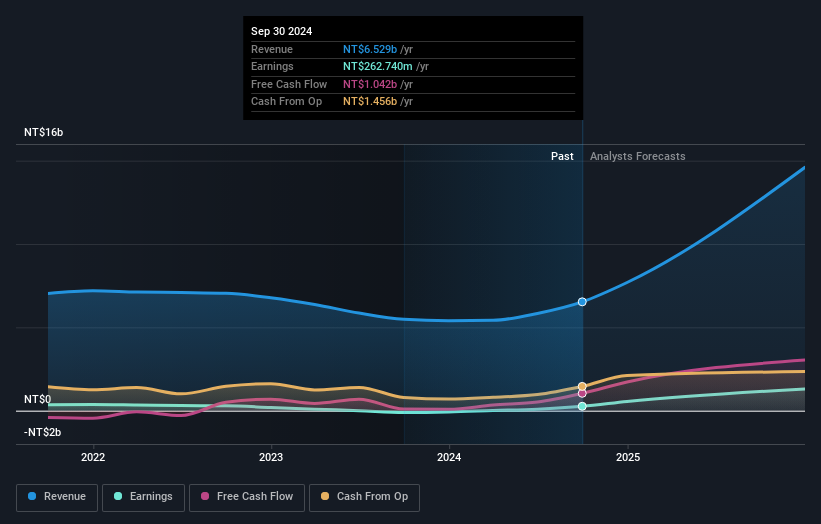

Overview: Elite Advanced Laser Corporation offers electronic manufacturing services in Taiwan with a market capitalization of NT$36.78 billion.

Operations: The company generates revenue through its electronic manufacturing services in Taiwan. With a market capitalization of NT$36.78 billion, it focuses on providing specialized manufacturing solutions.

Elite Advanced Laser, a smaller player in the semiconductor industry, has demonstrated significant financial growth. Over the past year, earnings surged by 203.9%, outpacing the industry's 2.4% growth rate. Despite its volatile share price recently, it remains a good value at 55.5% below estimated fair value and benefits from high-quality earnings with sufficient interest coverage due to more cash than total debt. However, its debt-to-equity ratio climbed from 3.2% to 17.2% over five years, indicating rising leverage concerns while free cash flow stays positive and future earnings are forecasted to grow annually by 64.65%.

- Dive into the specifics of Elite Advanced Laser here with our thorough health report.

Gain insights into Elite Advanced Laser's past trends and performance with our Past report.

Key Takeaways

- Click this link to deep-dive into the 2509 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:376

Yunfeng Financial Group

An investment holding company, provides insurance products in Hong Kong and Macao.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026