China Life Insurance (SEHK:2628) Is Up 8.4% After Issuing Strong 2025 Profit Growth Guidance

Reviewed by Sasha Jovanovic

- Earlier this month, China Life Insurance provided earnings guidance for the first three quarters of 2025, projecting net profit attributable to equity holders in the range of RMB156.79 billion to RMB177.69 billion, an increase of approximately 50% to 70% year-on-year compared to 2024.

- This anticipated surge in profit was attributed by the company to improved value creation, asset allocation strategies, and significantly higher investment returns amid a recovering stock market.

- We'll now explore how this substantial profit guidance, driven by enhanced investment returns, impacts China Life Insurance's investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

China Life Insurance Investment Narrative Recap

To be a shareholder in China Life Insurance, you have to believe in the company’s ability to drive long-term value from its core insurance business and capitalize on investment opportunities during market recoveries. The recent strong profit guidance for 2025, backed by higher investment returns, meaningfully strengthens the short-term outlook, but it also highlights the growing reliance on equity markets as a catalyst; however, any sharp market reversal remains a key risk to watch.

Of the latest company updates, the recent interim dividend approval stands out alongside the profit guidance, as it underlines management's confidence in ongoing cash generation and financial stability. This steady dividend, in the context of soaring earnings, reinforces the importance of portfolio returns and capital management as primary themes for the company’s ongoing performance.

However, investors should also be aware that while profits are rising, reliance on investment income continues to expose China Life Insurance to...

Read the full narrative on China Life Insurance (it's free!)

China Life Insurance's narrative projects CN¥746.6 billion revenue and CN¥67.9 billion earnings by 2028. This requires 33.5% yearly revenue growth and a CN¥41.7 billion earnings decrease from CN¥109.6 billion today.

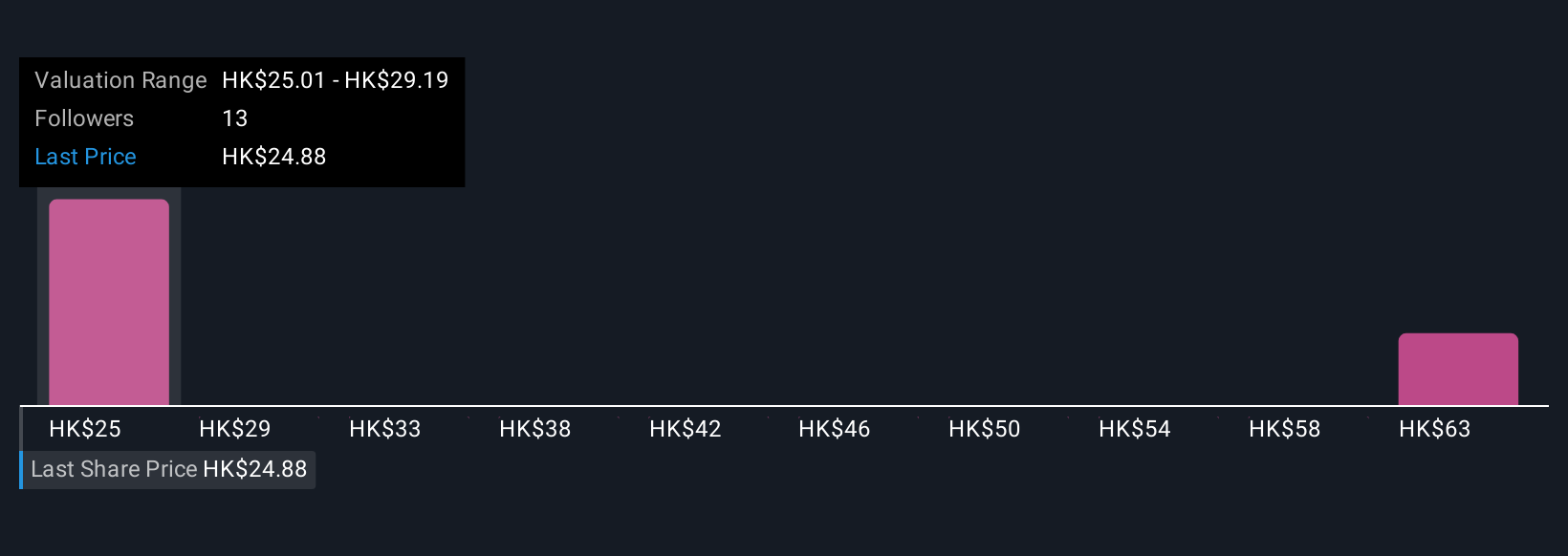

Uncover how China Life Insurance's forecasts yield a HK$25.01 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for China Life Insurance range from HK$25.01 to HK$66.86 across two inputs, revealing strikingly varied outlooks. Consider how recent profit volatility highlights the weight of investment income in earnings as you weigh these different viewpoints.

Explore 2 other fair value estimates on China Life Insurance - why the stock might be worth over 2x more than the current price!

Build Your Own China Life Insurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Life Insurance research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Life Insurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Life Insurance's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2628

China Life Insurance

Operates as a life insurance company in the People’s Republic of China.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives