What PICC Property and Casualty (SEHK:2328)'s Interim Dividend Decision Reveals About Management’s Confidence

Reviewed by Sasha Jovanovic

- On October 30, 2025, PICC Property and Casualty Company Limited approved an ordinary interim dividend of RMB 0.24 per share for the first half of 2025, with the ex-dividend date on November 4 and payment slated for December 12.

- This dividend announcement can be viewed as a sign of management's confidence in the company's financial stability and operating outlook.

- We’ll consider how the newly approved interim dividend highlights management’s confidence in the business and its impact on the investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

PICC Property and Casualty Investment Narrative Recap

To be a shareholder in PICC Property and Casualty, you need to believe in the company's ability to deliver steady profit growth amid changing market conditions, balancing investment in technology, evolving insurance demands, and capital market shifts. The newly approved interim dividend underscores management’s ongoing confidence but does not materially change the most pressing short-term catalyst: successful execution of product and digital innovation. The main risk, rising catastrophe claims and operational expenses, remains unchanged by this announcement.

Among recent company developments, PICC’s guidance from October 16, forecasting a 40% to 60% year-on-year net profit increase for the first three quarters of 2025, is especially relevant. This strengthens the investment narrative around robust earnings growth, reinforcing the significance of ongoing innovations and efficiency improvements as potential drivers of future profitability. Yet, even with management’s optimism, underlying risks tied to claims volatility and expense pressures persist.

On the other hand, investors should also be aware of how heightened catastrophe and claims expenses could affect…

Read the full narrative on PICC Property and Casualty (it's free!)

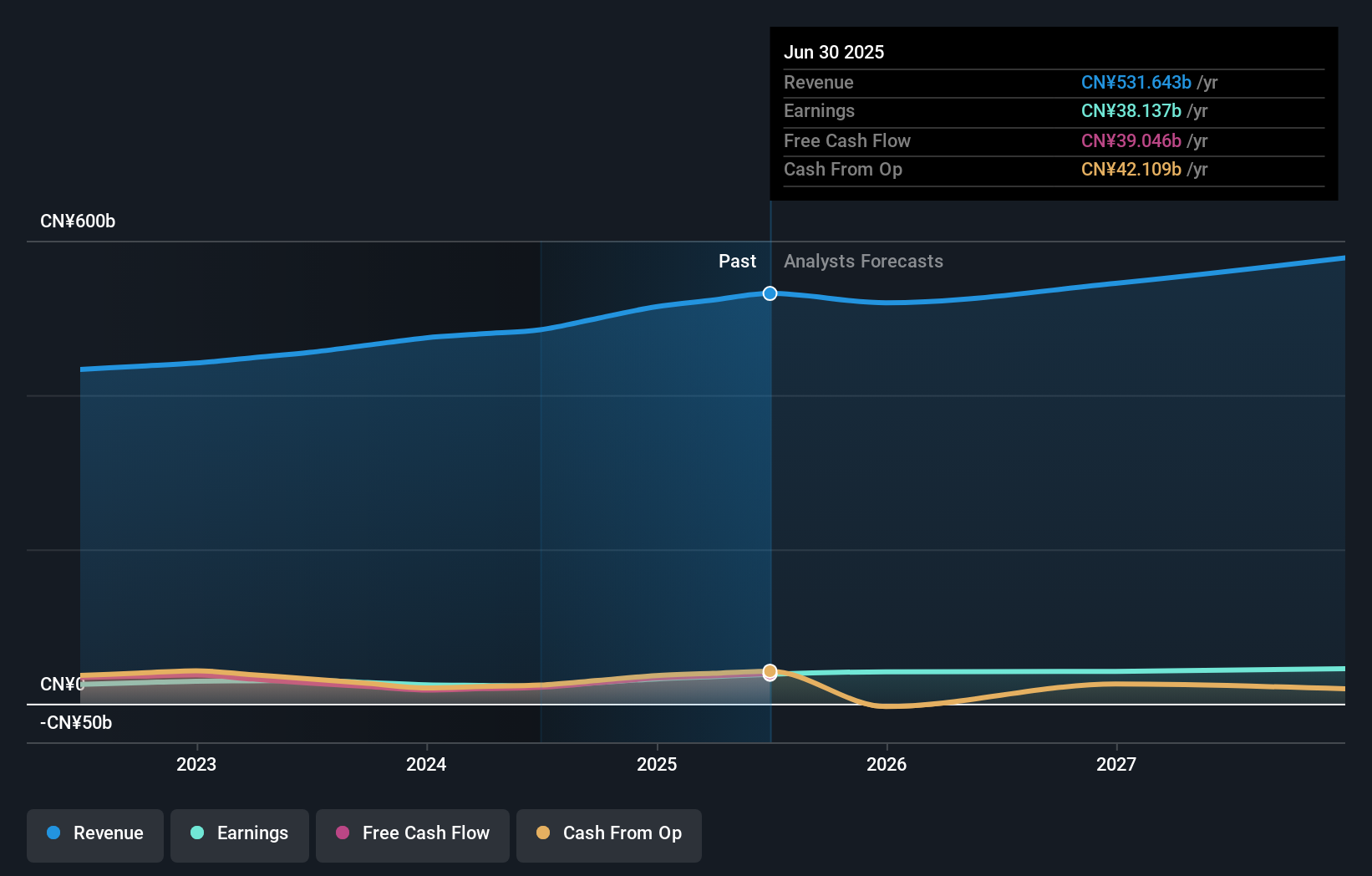

PICC Property and Casualty is projected to reach CN¥583.2 billion in revenue and CN¥43.9 billion in earnings by 2028. This forecast is based on an annual revenue growth rate of 3.1%, with earnings expected to rise by approximately CN¥5.8 billion from the current CN¥38.1 billion.

Uncover how PICC Property and Casualty's forecasts yield a HK$19.46 fair value, in line with its current price.

Exploring Other Perspectives

With two community-driven fair value estimates for PICC Property and Casualty ranging from HK$19.46 to HK$40.32, retail investor perspectives vary widely on future potential. These differing views reflect broader uncertainty sparked by risks such as rising catastrophe claims, making it valuable to compare several analyses before forming your own outlook.

Explore 2 other fair value estimates on PICC Property and Casualty - why the stock might be worth over 2x more than the current price!

Build Your Own PICC Property and Casualty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PICC Property and Casualty research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free PICC Property and Casualty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PICC Property and Casualty's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2328

PICC Property and Casualty

Engages in property and casualty insurance business in People’s Republic of China.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives