Amidst a backdrop of global economic shifts and fluctuating markets, the Hong Kong stock market has shown resilience, with notable gains in the Hang Seng Index. This environment underscores the potential value of dividend stocks for investors seeking steady income streams. In considering dividend stocks, it's important to look for companies with strong fundamentals and a history of consistent payouts, particularly in a market that is navigating through economic uncertainties and policy adjustments.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| CITIC Telecom International Holdings (SEHK:1883) | 9.44% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.85% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.05% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.74% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.00% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.26% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 8.35% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.37% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.30% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.95% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top SEHK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

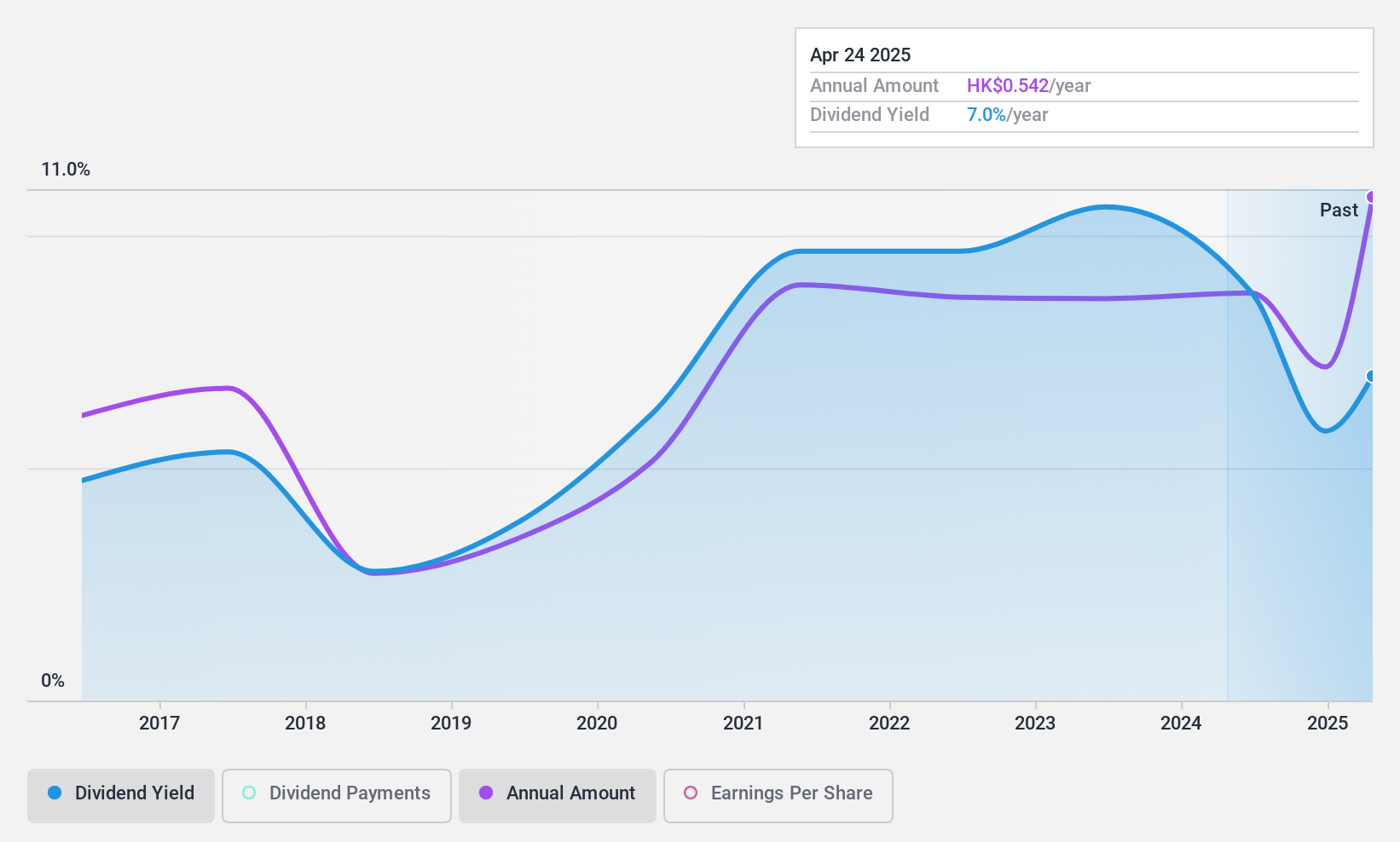

Bank of Chongqing (SEHK:1963)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Chongqing Co., Ltd. offers a range of banking and financial services to both corporate and individual clients in the People’s Republic of China, with a market capitalization of approximately HK$24.45 billion.

Operations: Bank of Chongqing Co., Ltd. generates its revenue primarily from banking and related financial services tailored to meet the needs of corporate and individual clients in China.

Dividend Yield: 8.6%

Bank of Chongqing recently announced a final dividend of RMB 4.08 per 10 shares for the year ended December 31, 2023, reflecting its commitment to returning value to shareholders. Despite a reasonably low payout ratio of 29.8%, the bank's dividend history has been marked by volatility and unreliability over the past decade, casting some uncertainty on future payouts. Recent executive changes, including board resignations and new appointments, could influence strategic directions and potentially impact governance and dividend policies moving forward.

- Navigate through the intricacies of Bank of Chongqing with our comprehensive dividend report here.

- The analysis detailed in our Bank of Chongqing valuation report hints at an deflated share price compared to its estimated value.

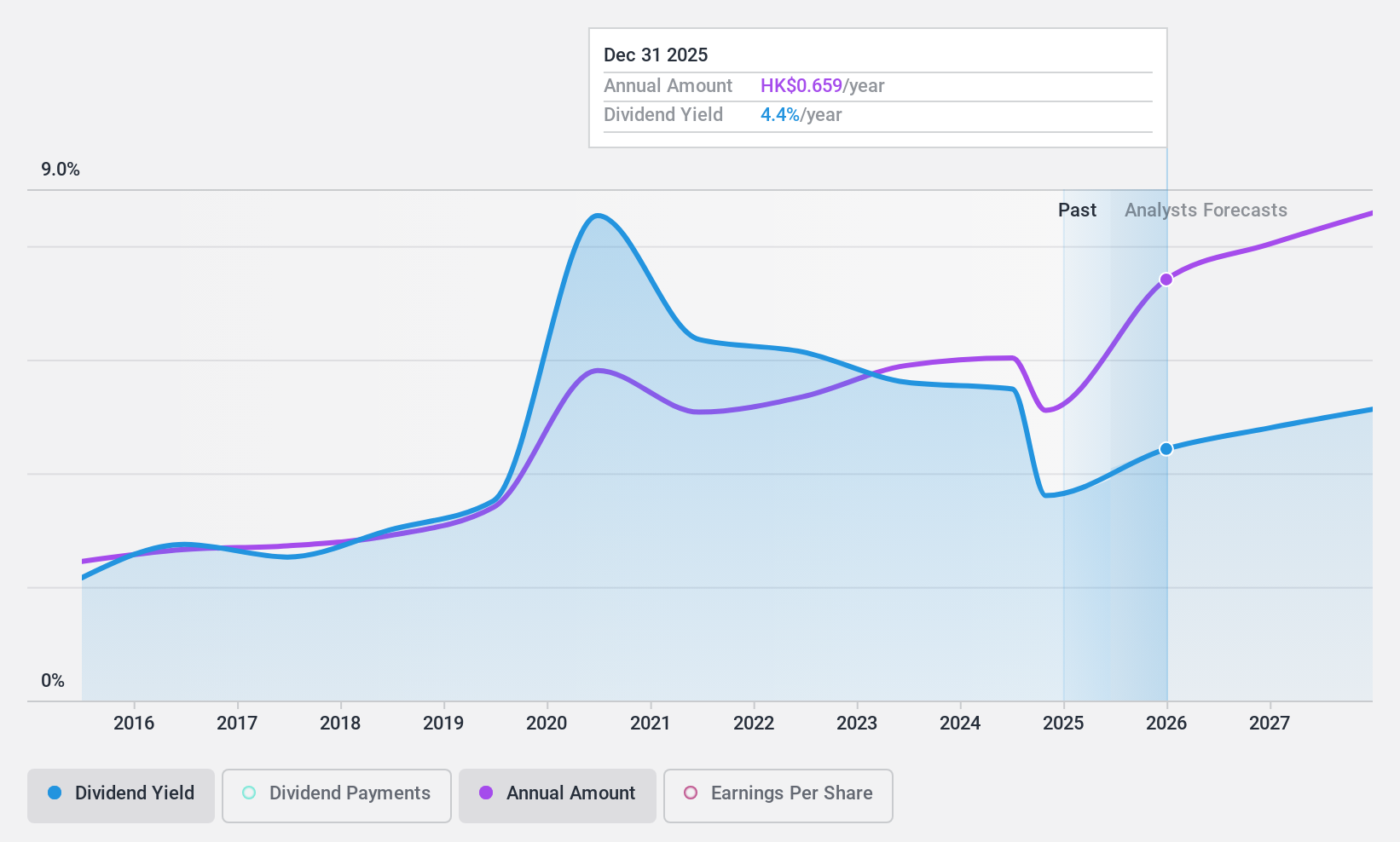

PICC Property and Casualty (SEHK:2328)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PICC Property and Casualty Company Limited operates as a property and casualty insurance provider in the People’s Republic of China, with a market capitalization of approximately HK$212.64 billion.

Operations: PICC Property and Casualty's revenue is primarily derived from various insurance segments, with Motor Vehicle Insurance generating CN¥282.11 billion, followed by Agriculture Insurance at CN¥52.79 billion, Accidental Injury and Health Insurance contributing CN¥43.75 billion, Liability Insurance at CN¥32.74 billion, Commercial Property Insurance bringing in CN¥16.10 billion, and Other types of insurance accounting for CN¥26.59 billion.

Dividend Yield: 5.5%

PICC Property and Casualty's dividend yield of 5.5% is modest relative to Hong Kong's top dividend payers. Despite this, the company maintains a sustainable payout with earnings and cash flows covering dividends at ratios of 44.2% and 61.1%, respectively. However, its dividend history shows instability over the past decade, including periods of significant fluctuation. Recently, PICC reported robust half-year premium income of RMB 311.996 billion but also experienced notable board resignations that could impact future operations and dividend strategies.

- Dive into the specifics of PICC Property and Casualty here with our thorough dividend report.

- Upon reviewing our latest valuation report, PICC Property and Casualty's share price might be too pessimistic.

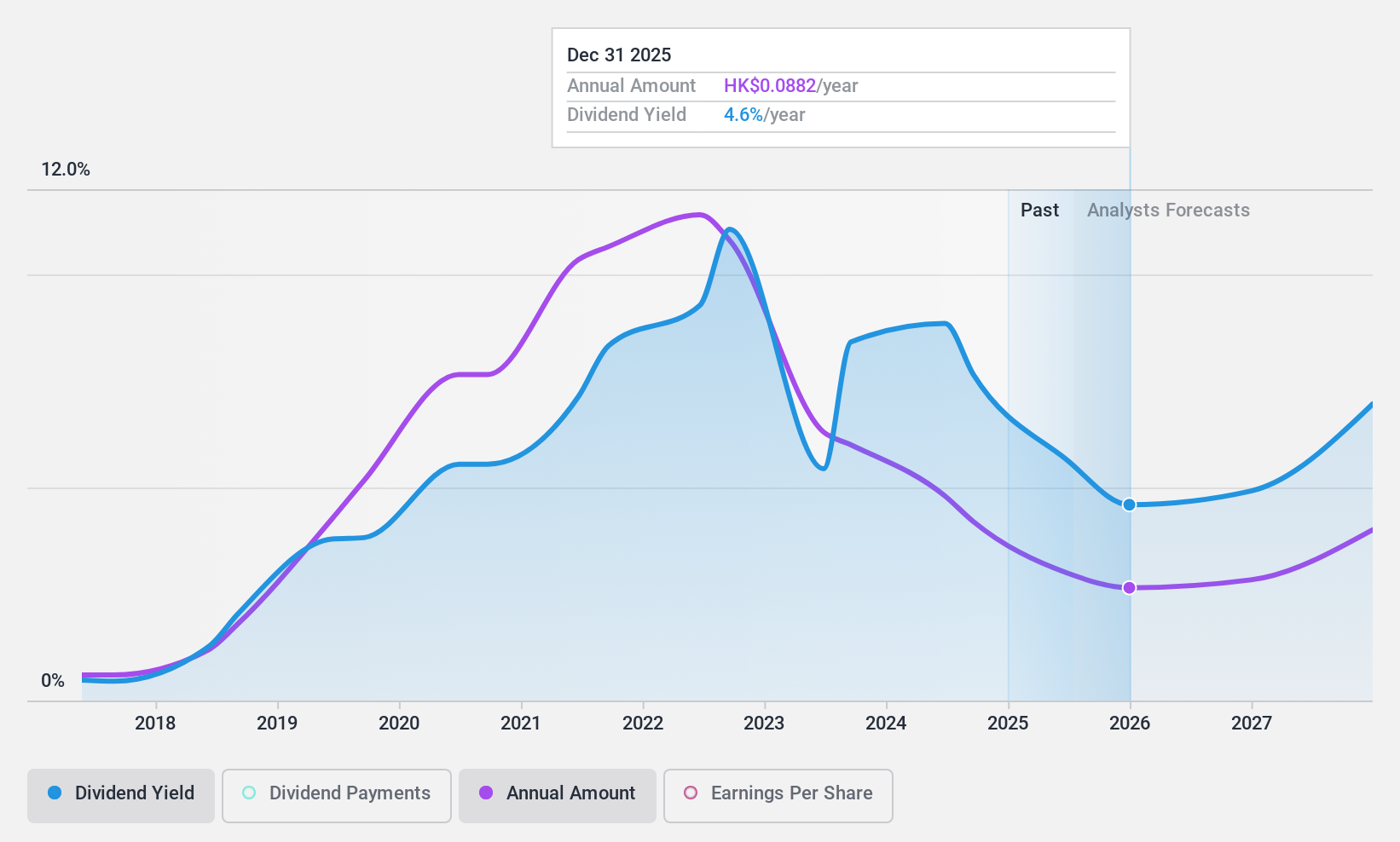

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Overseas Grand Oceans Group Ltd. operates as an investment holding company, focusing on the investment, development, and leasing of real estate properties in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$6.76 billion.

Operations: China Overseas Grand Oceans Group Ltd. generates revenue primarily through property investment and development, amounting to CN¥56.08 billion, and property leasing, which contributes CN¥242.46 million.

Dividend Yield: 8.3%

China Overseas Grand Oceans Group has a low payout ratio of 22.5%, indicating that its dividends are well-covered by earnings and cash flows, with a cash payout ratio of just 5.8%. Despite trading at a P/E ratio significantly lower than the Hong Kong market average, the company's dividend yield of 8.35% ranks in the top quartile for Hong Kong dividend payers. However, its dividend history over the past decade has been marked by volatility and inconsistency, including a recent reduction to HK$0.11 per share as announced on June 24, 2024. Recent sales data also show declining performance with year-to-date property sales down by over 26% compared to last year.

- Get an in-depth perspective on China Overseas Grand Oceans Group's performance by reading our dividend report here.

- Our expertly prepared valuation report China Overseas Grand Oceans Group implies its share price may be lower than expected.

Key Takeaways

- Dive into all 92 of the Top SEHK Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Chongqing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1963

Bank of Chongqing

Provides various banking and related financial services for corporate and individual customers in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives