- China

- /

- Electrical

- /

- SHSE:601126

Asian Dividend Stocks: Top 3 Picks

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade tensions and economic uncertainties, Asia's stock markets have shown mixed performance, with Japan experiencing gains while China faces challenges. In such an environment, dividend stocks can offer a stable income stream and potential for growth, making them an attractive option for investors seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.97% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.12% | ★★★★★★ |

Click here to see the full list of 1235 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

Dream International (SEHK:1126)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dream International Limited is an investment holding company that designs, develops, manufactures, and sells plush stuffed toys, plastic figures, dolls, die-casting products, and fabrics across various international markets with a market cap of HK$4.09 billion.

Operations: Dream International Limited generates its revenue primarily from plush stuffed toys (HK$2.77 billion), plastic figures (HK$2.31 billion), and tarpaulin (HK$373.31 million).

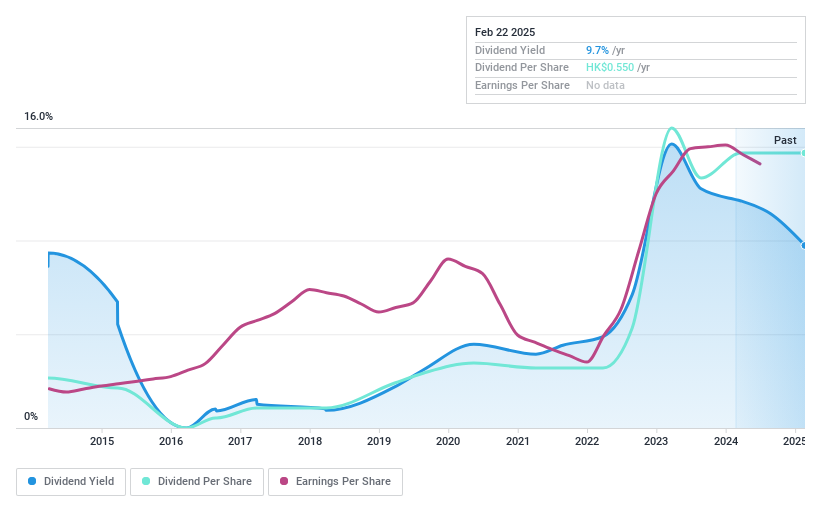

Dividend Yield: 9.9%

Dream International's dividend payments are covered by both earnings and cash flows, with a payout ratio of 55% and a cash payout ratio of 76.3%. Although its dividend yield is in the top 25% in Hong Kong, historical volatility raises concerns about reliability. Recent news highlights an increase in the final dividend to HK40 cents per share for 2024, totaling HK$270.75 million, pending approval. Despite stable coverage, past instability may affect long-term sustainability perceptions.

- Click here and access our complete dividend analysis report to understand the dynamics of Dream International.

- Our valuation report unveils the possibility Dream International's shares may be trading at a discount.

PICC Property and Casualty (SEHK:2328)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PICC Property and Casualty Company Limited, along with its subsidiaries, operates in the property and casualty insurance sector in the People's Republic of China, with a market cap of HK$331.42 billion.

Operations: PICC Property and Casualty Company Limited generates revenue from various segments, including Insurance - Motor Vehicle (CN¥294.67 billion), Insurance - Agriculture (CN¥55.30 billion), Insurance - Accidental Injury and Health (CN¥48.92 billion), Insurance - Liability (CN¥37.15 billion), Insurance - Others (CN¥30.57 billion), and Insurance - Commercial Property (CN¥16.95 billion).

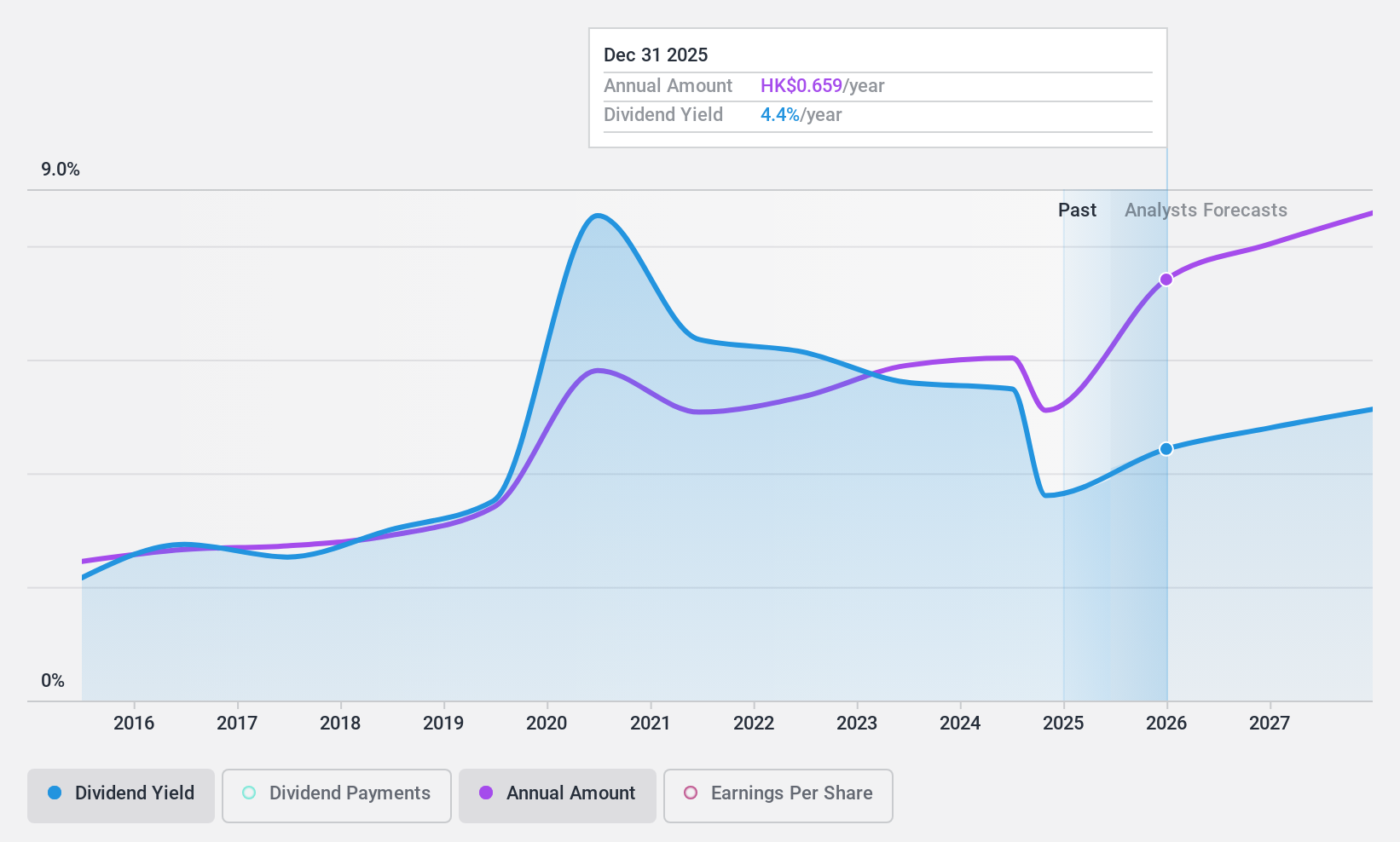

Dividend Yield: 4.7%

PICC Property and Casualty's dividend payments, while covered by earnings and cash flows with a payout ratio of 37.3% and a cash payout ratio of 44.4%, have been historically volatile, raising concerns about reliability. The company's recent announcement of a final dividend decrease to RMB 0.332 per share for 2024 reflects this instability. Despite these challenges, the company's net income increased to ¥32.17 billion in 2024, suggesting potential for future growth in profitability.

- Click here to discover the nuances of PICC Property and Casualty with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, PICC Property and Casualty's share price might be too pessimistic.

Beijing Sifang AutomationLtd (SHSE:601126)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Sifang Automation Co., Ltd provides power transmission, transformation protection, and automation systems both domestically and internationally, with a market cap of CN¥14.39 billion.

Operations: Beijing Sifang Automation Co., Ltd generates revenue through its offerings in power generation systems, enterprise power solutions, and power distribution and consumption systems both within China and on a global scale.

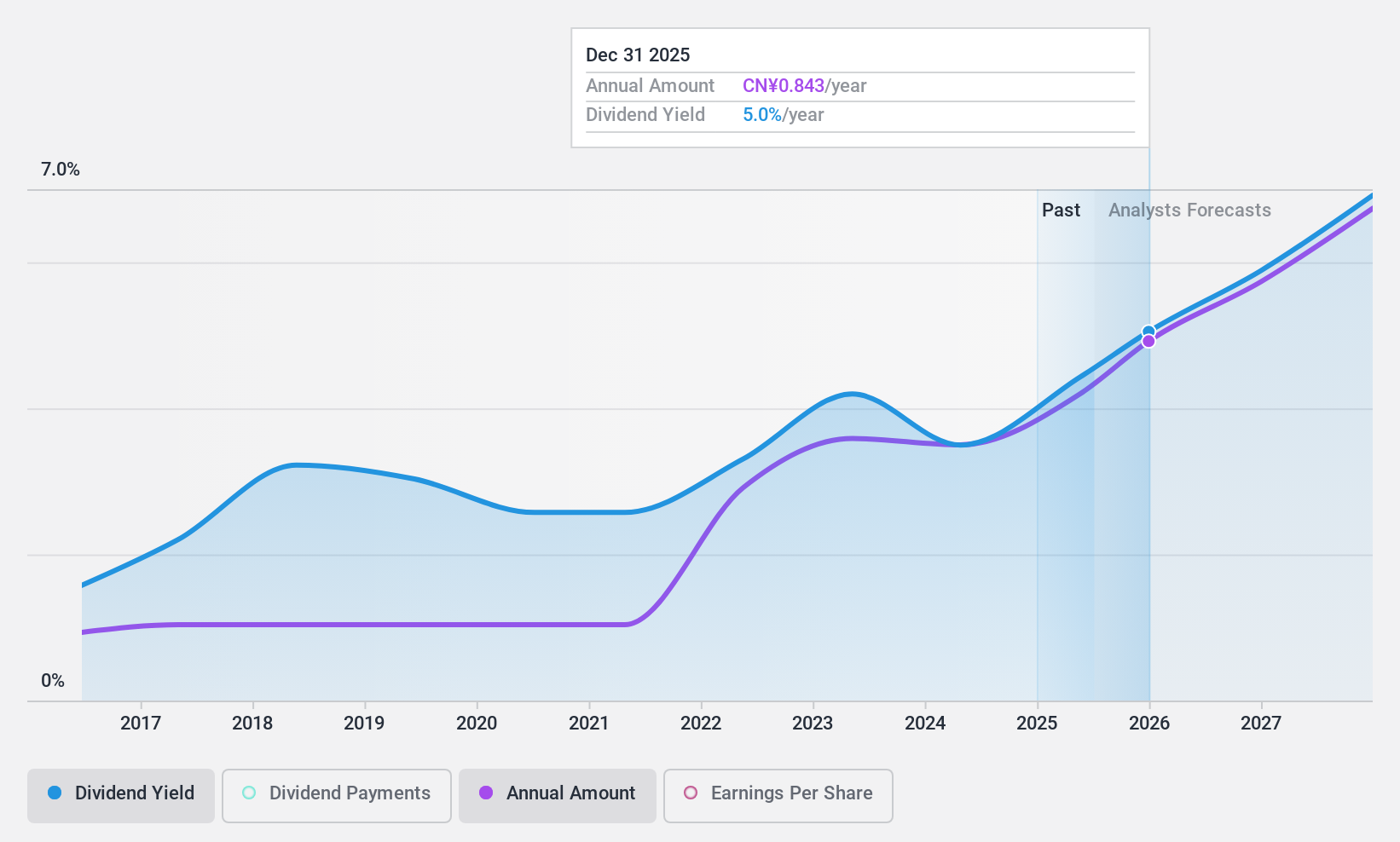

Dividend Yield: 4.2%

Beijing Sifang Automation's dividends are covered by earnings and cash flows, with a payout ratio of 76.5% and a cash payout ratio of 52.3%. Despite being in the top 25% for dividend yield in China at 4.17%, its dividend history has been unstable over the past decade. Recent earnings growth, with Q1 net income reaching ¥241.5 million from ¥181.06 million last year, indicates potential for sustained profitability amidst volatility concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Beijing Sifang AutomationLtd.

- Our expertly prepared valuation report Beijing Sifang AutomationLtd implies its share price may be lower than expected.

Next Steps

- Embark on your investment journey to our 1235 Top Asian Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Sifang AutomationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601126

Beijing Sifang AutomationLtd

Supplies power transmission, transformation protection, automation systems, power generation, enterprise power, and power distribution and consumption systems in China and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives