As global markets navigate a complex landscape of trade tensions and shifting monetary policies, Asian economies are displaying resilience with strong corporate earnings and robust export data. In this environment, dividend stocks can offer stability and income potential for investors seeking to capitalize on Asia's economic strengths.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.16% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.75% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.72% | ★★★★★★ |

| NCD (TSE:4783) | 4.67% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

| Daicel (TSE:4202) | 4.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

Click here to see the full list of 1100 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Best Pacific International Holdings (SEHK:2111)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Best Pacific International Holdings Limited, with a market cap of HK$3.48 billion, operates in the manufacturing and trading of elastic fabric, elastic webbing, and lace.

Operations: Best Pacific International Holdings Limited generates revenue from two main segments: Manufacturing and Trading of Elastic Webbing, which accounts for HK$985.68 million, and Manufacturing and Trading of Elastic Fabric and Lace, contributing HK$4.08 billion.

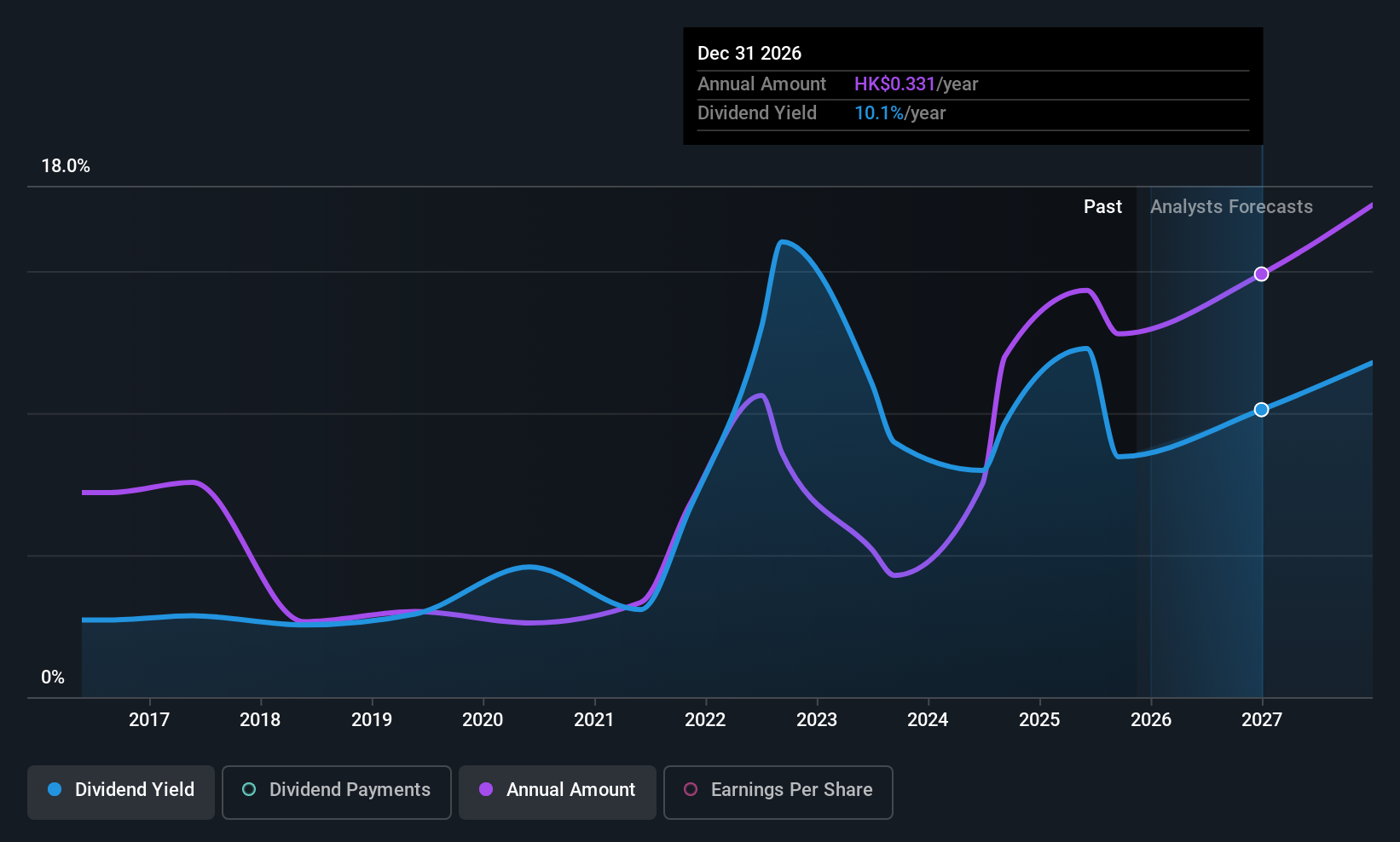

Dividend Yield: 9.5%

Best Pacific International Holdings recently declared a final dividend of HK15.91 cents per share for 2024, reflecting its commitment to rewarding shareholders. Despite past volatility in dividend payments, the company's current payout ratio is sustainable at 50%, with dividends well-covered by earnings and cash flows (75.6%). Trading at good value, it offers a competitive yield in the Hong Kong market's top quartile. However, investors should note its historically unstable dividend track record.

- Click to explore a detailed breakdown of our findings in Best Pacific International Holdings' dividend report.

- In light of our recent valuation report, it seems possible that Best Pacific International Holdings is trading behind its estimated value.

PICC Property and Casualty (SEHK:2328)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PICC Property and Casualty Company Limited, along with its subsidiaries, operates in the property and casualty insurance sector in the People's Republic of China, with a market cap of HK$408.82 billion.

Operations: PICC Property and Casualty Company Limited's revenue segments include Insurance - Motor Vehicle at CN¥294.67 billion, Insurance - Agriculture at CN¥55.30 billion, Insurance - Accidental Injury and Health at CN¥48.92 billion, Insurance - Liability at CN¥37.15 billion, Insurance - Others at CN¥30.57 billion, and Insurance - Commercial Property at CN¥16.95 billion.

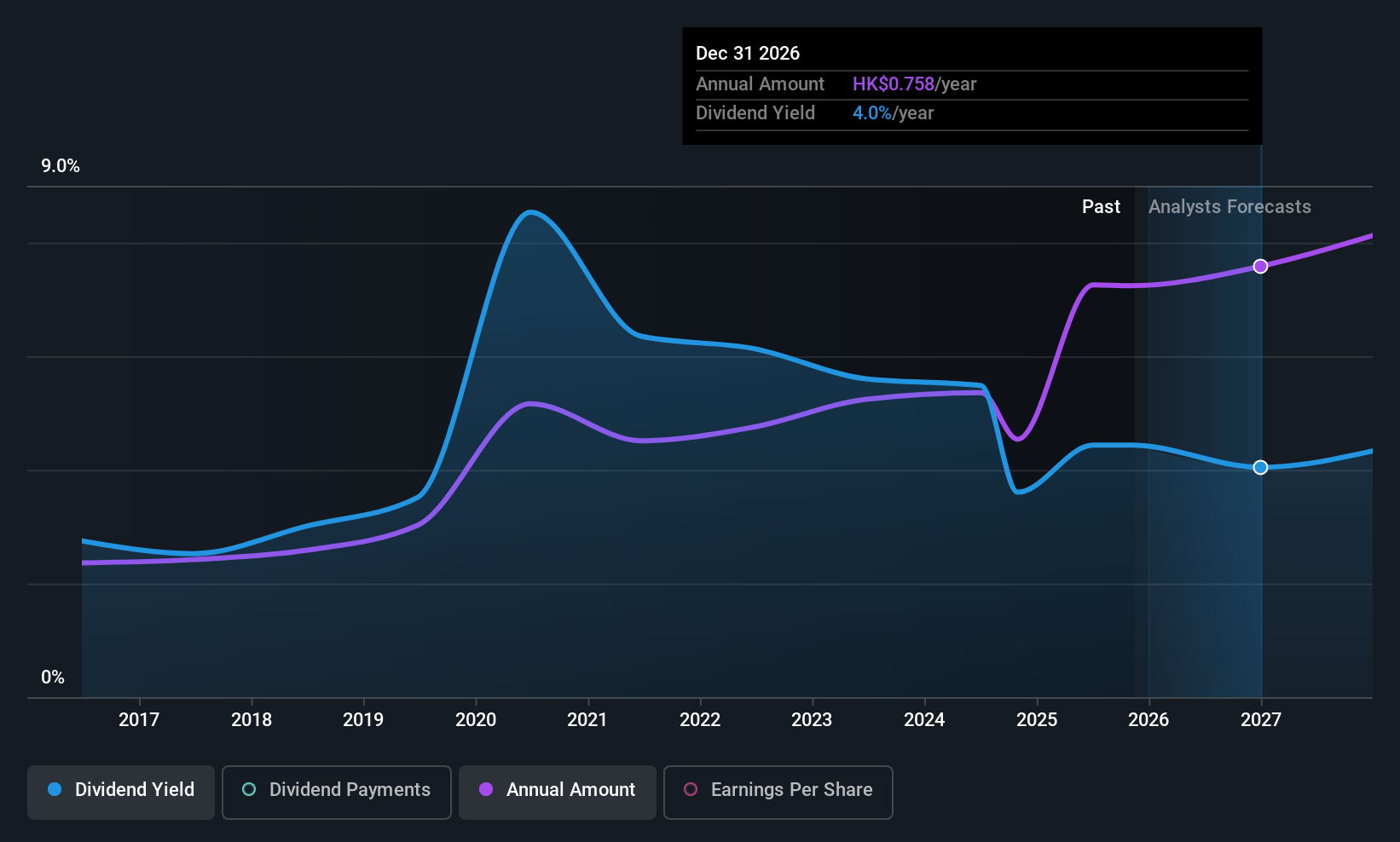

Dividend Yield: 4%

PICC Property and Casualty's dividend strategy is supported by a sustainable payout ratio of 37.3%, with dividends well-covered by both earnings and cash flows, maintaining stability over the past decade. Despite a dividend yield of 3.95% being lower than top-tier payers in Hong Kong, the company remains an attractive option due to its reliable dividend history and trading significantly below estimated fair value. Recent board changes may influence future governance but do not affect current dividend policies.

- Take a closer look at PICC Property and Casualty's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that PICC Property and Casualty is priced lower than what may be justified by its financials.

Dafeng TV (TWSE:6184)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dafeng TV Ltd., along with its subsidiaries, operates in the cable television system and broadband sector in Taiwan, with a market cap of NT$8.32 billion.

Operations: Dafeng TV Ltd.'s revenue is primarily generated from its Cable TV System Department, contributing NT$1.48 billion, and its Broadband Service Department, which adds NT$860.59 million.

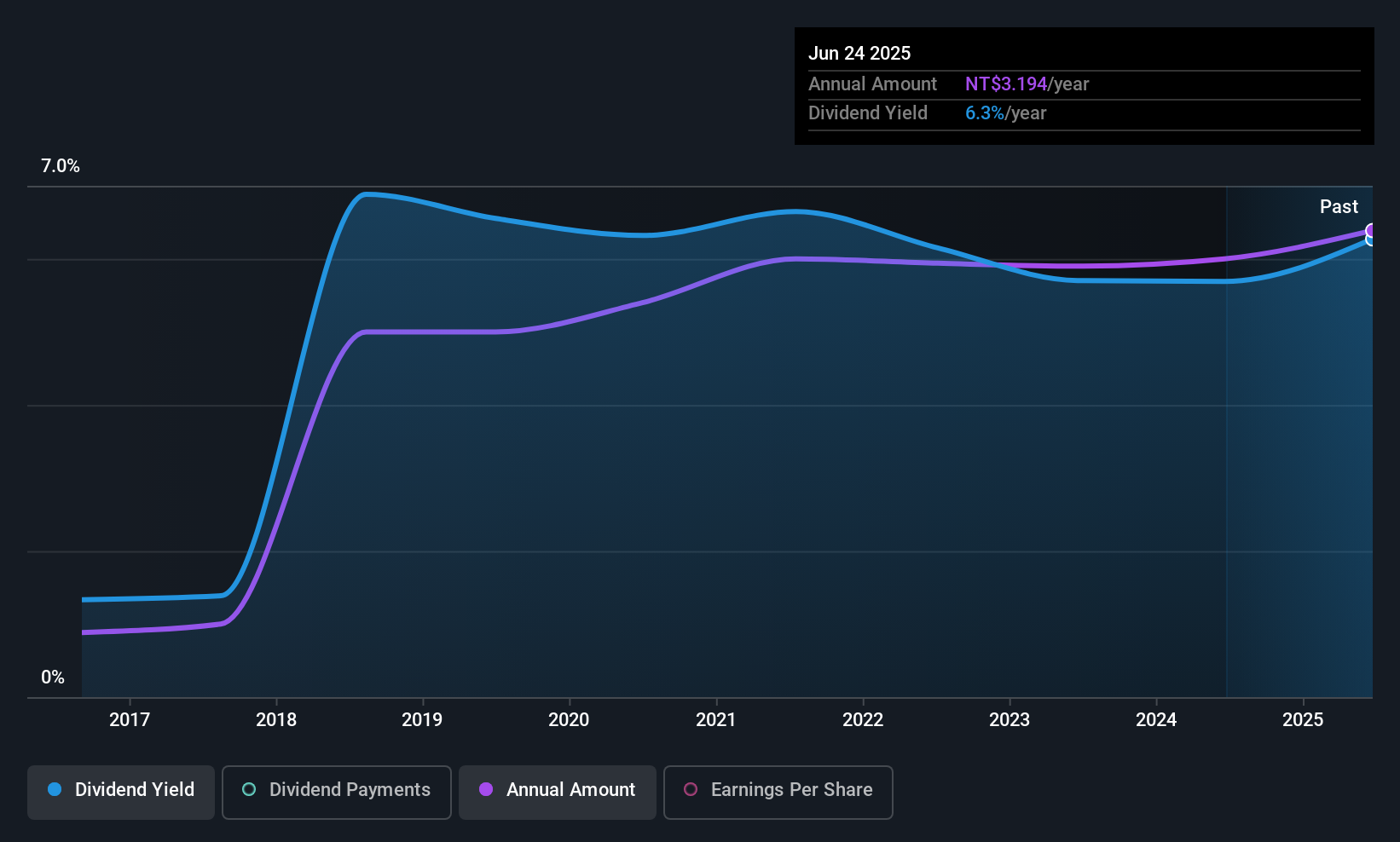

Dividend Yield: 5.7%

Dafeng TV's dividend yield of 5.69% ranks in the top 25% of Taiwan's market, with payouts covered by earnings and cash flows, despite an 87.6% payout ratio. However, its dividends have been volatile and unreliable over the past decade, experiencing significant annual drops. While recent amendments to its Articles of Incorporation and changes in the Compensation Committee may impact future governance, they do not currently affect dividend policies or coverage stability.

- Get an in-depth perspective on Dafeng TV's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Dafeng TV's current price could be quite moderate.

Seize The Opportunity

- Embark on your investment journey to our 1100 Top Asian Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2328

PICC Property and Casualty

Engages in property and casualty insurance business in People’s Republic of China.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives