Do People's Insurance Company (Group) of China's (HKG:1339) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like People's Insurance Company (Group) of China (HKG:1339), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for People's Insurance Company (Group) of China

People's Insurance Company (Group) of China's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's easy to see why many investors focus in on EPS growth. In previous twelve months, People's Insurance Company (Group) of China's EPS has risen from CN¥0.50 to CN¥0.55. That's a modest gain of 8.9%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of People's Insurance Company (Group) of China's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. It seems People's Insurance Company (Group) of China is pretty stable, since revenue and EBIT margins are pretty flat year on year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

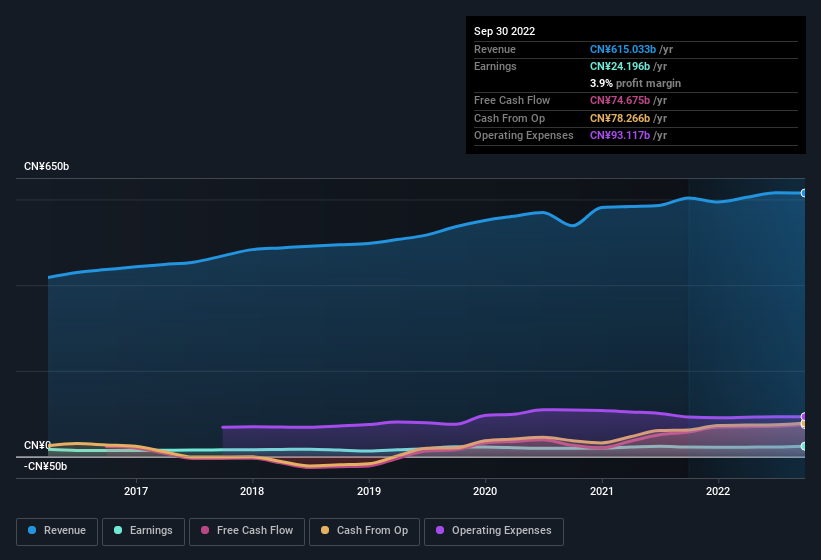

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of People's Insurance Company (Group) of China's forecast profits?

Are People's Insurance Company (Group) of China Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a HK$238b company like People's Insurance Company (Group) of China. But we do take comfort from the fact that they are investors in the company. Indeed, they hold CN¥195m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.08% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations over CN¥54b, like People's Insurance Company (Group) of China, the median CEO pay is around CN¥6.8m.

The People's Insurance Company (Group) of China CEO received total compensation of just CN¥913k in the year to December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is People's Insurance Company (Group) of China Worth Keeping An Eye On?

As previously touched on, People's Insurance Company (Group) of China is a growing business, which is encouraging. The growth of EPS may be the eye-catching headline for People's Insurance Company (Group) of China, but there's more to bring joy for shareholders. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing People's Insurance Company (Group) of China's ROE with industry peers (and the market at large).

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1339

People's Insurance Company (Group) of China

An investment holding company, provides insurance products and services in the People’s Republic of China and Hong Kong.

Undervalued with solid track record and pays a dividend.