Amidst global economic uncertainties, including tariff tensions and inflation concerns impacting major markets, the Asian stock landscape presents a unique set of challenges and opportunities. Penny stocks, often associated with smaller or newer companies, continue to attract attention for their potential growth at lower price points. By focusing on those with strong financials and solid fundamentals, investors can uncover hidden gems that may offer both stability and upside in the evolving market environment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Lever Style (SEHK:1346) | HK$1.26 | HK$799.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.15 | HK$47.57B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.09B | ★★★★★☆ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.04 | CN¥3.52B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.48 | SGD457.62M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.44 | THB2B | ★★★★☆☆ |

| China Zheshang Bank (SEHK:2016) | HK$2.38 | HK$80.47B | ★★★★★★ |

| Playmates Toys (SEHK:869) | HK$0.61 | HK$719.8M | ★★★★★★ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.16 | HK$4.42B | ★★★★★★ |

Click here to see the full list of 1,166 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ming Fai International Holdings (SEHK:3828)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ming Fai International Holdings Limited is an investment holding company involved in the manufacture and trading of hospitality supplies and operating supplies and equipment across various regions including Hong Kong, North America, Europe, China, Australia, other Asia Pacific areas, and internationally with a market cap of HK$726.92 million.

Operations: Ming Fai International Holdings generates revenue from several segments, including the Hospitality Supplies Business with contributions from The People's Republic of China (HK$549.02 million), other Asia Pacific regions (HK$379.50 million), North America (HK$305.16 million), Europe (HK$267.19 million), Hong Kong Special Administrative Region of The PRC (HK$211.35 million), and Australia (HK$90.09 million); the Health Care and Hygienic Products Business in North America (HK$145.35 million) and other areas; as well as the Operating Supplies and Equipment Business in The PRC (HK$154.24 million) and elsewhere.

Market Cap: HK$726.92M

Ming Fai International Holdings presents a compelling case for penny stock investors, given its favorable Price-To-Earnings ratio of 6.1x compared to the Hong Kong market's 10.5x, and its strong financial position with cash exceeding total debt. The company has demonstrated robust earnings growth of 38.4% over the past year, driven by increased demand in travel-related sectors and improved profit margins through cost control measures. Despite a low Return on Equity at 9.6%, Ming Fai's seasoned board and stable weekly volatility offer additional stability for investors seeking exposure in this segment of the market.

- Take a closer look at Ming Fai International Holdings' potential here in our financial health report.

- Explore historical data to track Ming Fai International Holdings' performance over time in our past results report.

Boustead Singapore (SGX:F9D)

Simply Wall St Financial Health Rating: ★★★★★★

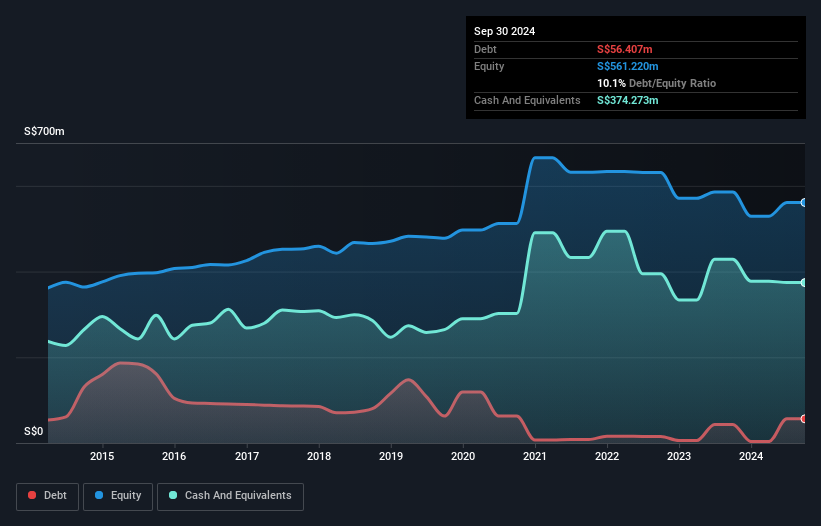

Overview: Boustead Singapore Limited is an investment holding company offering energy engineering, real estate, geospatial, and healthcare technology solutions across various regions including Singapore and beyond, with a market capitalization of SGD521.12 million.

Operations: The company's revenue is primarily derived from its Real Estate Solutions segment at SGD304.22 million, followed by Geospatial at SGD216.35 million, Energy Engineering at SGD161.11 million, and Healthcare technology solutions contributing SGD12.79 million.

Market Cap: SGD521.12M

Boustead Singapore offers a compelling opportunity among penny stocks with its robust financial health and diversified revenue streams. The company has more cash than total debt, ensuring strong liquidity, while short-term assets significantly exceed both short- and long-term liabilities. Its earnings have grown by 47.9% over the past year, surpassing the industry average, with improved profit margins from 7.3% to 10.6%. Despite a low Return on Equity at 14.3%, Boustead's stable Price-To-Earnings ratio of 7.1x below the Singapore market average suggests potential value for investors seeking stability in this sector.

- Get an in-depth perspective on Boustead Singapore's performance by reading our balance sheet health report here.

- Examine Boustead Singapore's past performance report to understand how it has performed in prior years.

Tiansheng Pharmaceutical Group (SZSE:002872)

Simply Wall St Financial Health Rating: ★★★★★★

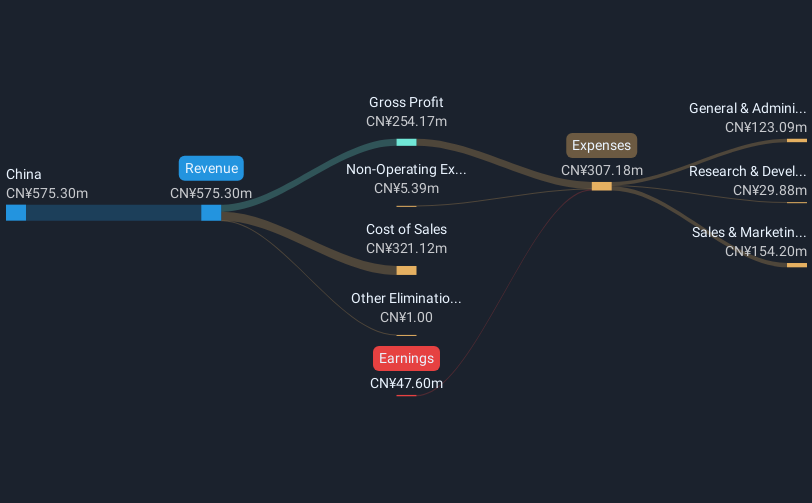

Overview: Tiansheng Pharmaceutical Group Co., Ltd. is involved in pharmaceutical manufacturing and distribution, with a market cap of CN¥1.33 billion.

Operations: The company's revenue is derived entirely from its operations in China, totaling CN¥575.30 million.

Market Cap: CN¥1.33B

Tiansheng Pharmaceutical Group, with a market cap of CN¥1.33 billion, presents an intriguing case among penny stocks. Despite being unprofitable, the company has managed to reduce its losses by 31.5% annually over the past five years. Its financial position is strengthened by short-term assets of CN¥697.2 million exceeding both short- and long-term liabilities, and a satisfactory net debt to equity ratio of 7.3%. The management team and board are experienced with an average tenure of 4.3 years each, providing stability as Tiansheng navigates its path towards profitability amidst industry challenges.

- Unlock comprehensive insights into our analysis of Tiansheng Pharmaceutical Group stock in this financial health report.

- Review our historical performance report to gain insights into Tiansheng Pharmaceutical Group's track record.

Key Takeaways

- Click this link to deep-dive into the 1,166 companies within our Asian Penny Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiansheng Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002872

Tiansheng Pharmaceutical Group

Engages in the pharmaceutical manufacturing and circulation activities.

Flawless balance sheet and good value.

Market Insights

Community Narratives