Stock Analysis

- Hong Kong

- /

- Personal Products

- /

- SEHK:2367

Mobvista Leads Trio Of SEHK Stocks Estimated As Below Intrinsic Value

Reviewed by Simply Wall St

Amidst a generally subdued global market landscape, the Hong Kong stock market has faced its own set of challenges, with the Hang Seng Index experiencing a notable decline recently. This environment may present opportunities for investors to consider stocks that could be perceived as undervalued relative to their intrinsic worth. In assessing what makes a good stock investment, particularly in these conditions, it's crucial to look for companies with robust fundamentals and potential resilience against ongoing economic pressures. These attributes can position such stocks as compelling considerations for those looking to invest in a market poised for eventual recovery.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| China Resources Mixc Lifestyle Services (SEHK:1209) | HK$25.85 | HK$48.58 | 46.8% |

| China Cinda Asset Management (SEHK:1359) | HK$0.65 | HK$1.29 | 49.6% |

| Zijin Mining Group (SEHK:2899) | HK$16.48 | HK$31.44 | 47.6% |

| United Energy Group (SEHK:467) | HK$0.305 | HK$0.57 | 46.5% |

| Genscript Biotech (SEHK:1548) | HK$8.32 | HK$15.79 | 47.3% |

| WuXi XDC Cayman (SEHK:2268) | HK$17.30 | HK$31.96 | 45.9% |

| AK Medical Holdings (SEHK:1789) | HK$4.31 | HK$7.86 | 45.2% |

| CGN Mining (SEHK:1164) | HK$2.61 | HK$5.20 | 49.8% |

| Vobile Group (SEHK:3738) | HK$1.25 | HK$2.32 | 46.1% |

| Q Technology (Group) (SEHK:1478) | HK$4.12 | HK$7.39 | 44.2% |

Below we spotlight a couple of our favorites from our exclusive screener

Mobvista (SEHK:1860)

Overview: Mobvista Inc. operates globally, providing advertising and marketing technology services to enhance the mobile internet ecosystem, with a market capitalization of approximately HK$3.77 billion.

Operations: The company generates revenue primarily through two segments: Marketing Technology Business, which brought in $16.26 million, and Advertising Technology Services, contributing $1.09 billion.

Estimated Discount To Fair Value: 34.5%

Mobvista, priced at HK$2.52, is trading below its estimated fair value of HK$3.85, indicating potential undervaluation based on discounted cash flow analysis. Despite a forecasted revenue growth rate of 15.6% per year outpacing the Hong Kong market's 7.8%, its return on equity is expected to remain low at 14.3%. Earnings are projected to grow by 23.9% annually, surpassing the market's average of 11.3%. Recent financials show a significant increase in sales and net income in Q1 2024 compared to the previous year.

- Our comprehensive growth report raises the possibility that Mobvista is poised for substantial financial growth.

- Navigate through the intricacies of Mobvista with our comprehensive financial health report here.

Everest Medicines (SEHK:1952)

Overview: Everest Medicines Limited is a biopharmaceutical company focused on the discovery, licensing, development, and commercialization of therapeutic and vaccine solutions for unmet medical needs in Greater China and other Asia Pacific regions, with a market capitalization of approximately HK$6.28 billion.

Operations: The company's revenue from pharmaceuticals totaled CN¥125.93 million.

Estimated Discount To Fair Value: 20.7%

Everest Medicines, with a current price of HK$19.58, appears undervalued as it trades 20.7% below the calculated fair value of HK$24.68. The company is poised for significant growth with revenue expected to increase by 38.6% annually, outperforming the Hong Kong market's average of 7.8%. Despite this rapid growth and a forecast to turn profitable within three years, concerns exist due to shareholder dilution over the past year and a low projected return on equity of 1.3%.

- Upon reviewing our latest growth report, Everest Medicines' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Everest Medicines' balance sheet health report.

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company that specializes in the research, development, manufacture, and sale of bioactive material-based beauty and health products in the People's Republic of China, with a market capitalization of approximately HK$46.27 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥3.52 billion.

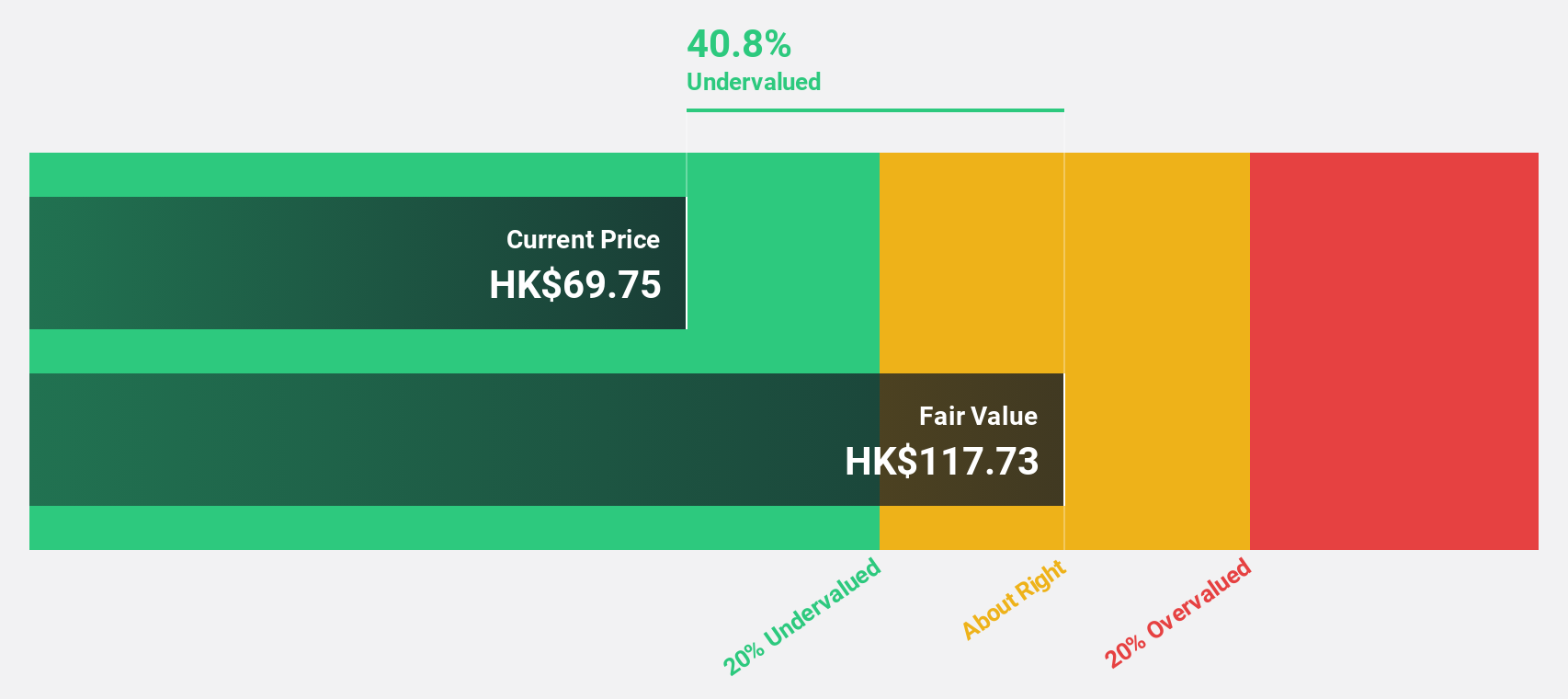

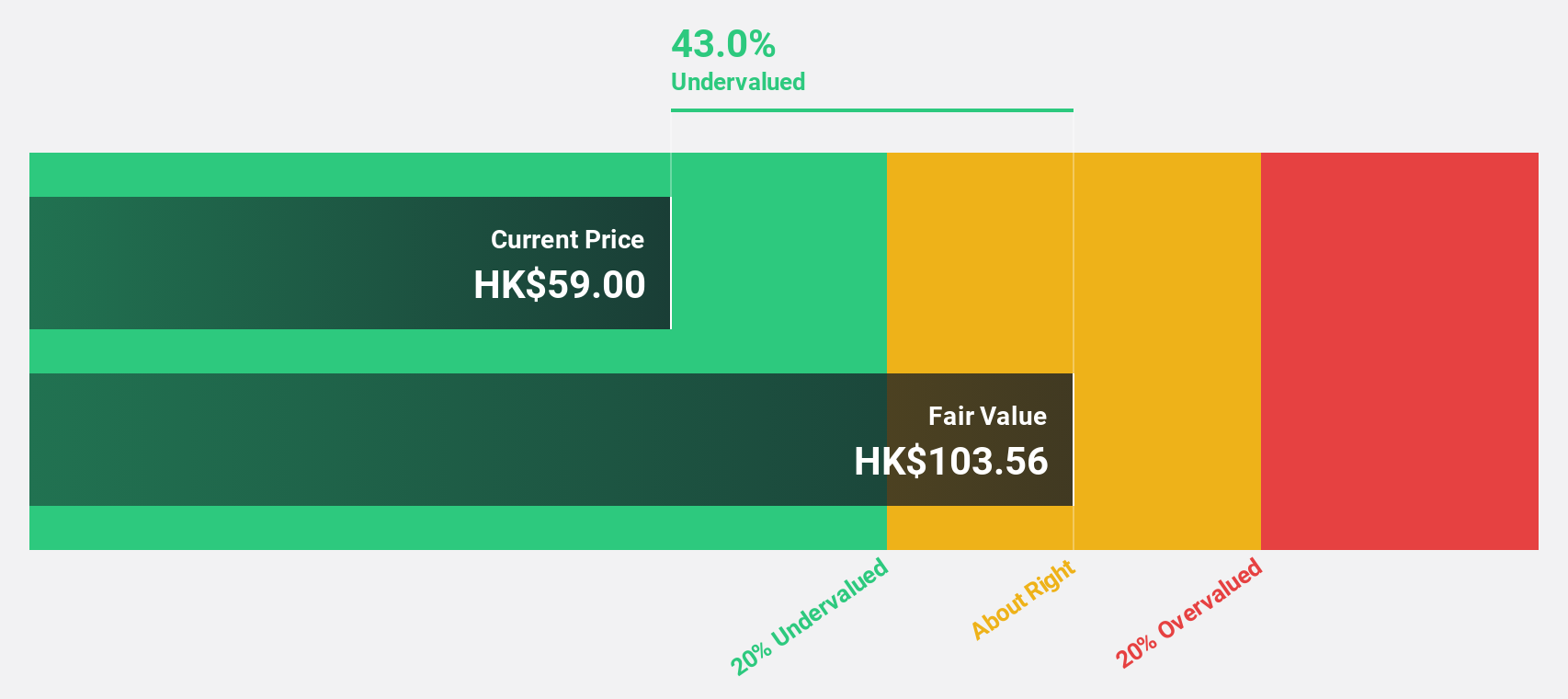

Estimated Discount To Fair Value: 37.7%

Giant Biogene Holding, priced at HK$45.85, is considered undervalued, trading 37.7% below the estimated fair value of HK$73.6. The company's revenue and earnings are expected to grow by 24.8% and 22.06% annually, respectively, surpassing Hong Kong market averages significantly. Recent activities include a follow-on equity offering raising HKD 1.64 billion and declaring dividends totaling HKD 0.97 per share, enhancing shareholder returns despite some concerns over recent significant insider selling.

- In light of our recent growth report, it seems possible that Giant Biogene Holding's financial performance will exceed current levels.

- Get an in-depth perspective on Giant Biogene Holding's balance sheet by reading our health report here.

Key Takeaways

- Get an in-depth perspective on all 42 Undervalued SEHK Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Giant Biogene Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2367

Giant Biogene Holding

An investment holding company, engages in the research, development, manufacture, and sale of bioactive material-based beauty and health products in the People’s Republic of China.

Exceptional growth potential with outstanding track record.