- Hong Kong

- /

- Personal Products

- /

- SEHK:2145

With EPS Growth And More, Shanghai Chicmax Cosmetic (HKG:2145) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Shanghai Chicmax Cosmetic (HKG:2145). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Shanghai Chicmax Cosmetic

How Fast Is Shanghai Chicmax Cosmetic Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Shanghai Chicmax Cosmetic has grown EPS by 27% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

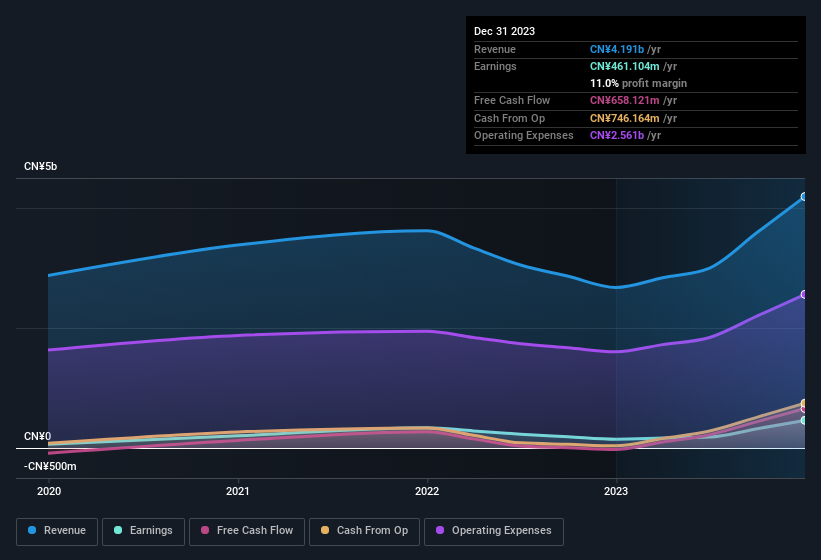

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Shanghai Chicmax Cosmetic shareholders is that EBIT margins have grown from 2.2% to 10% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Shanghai Chicmax Cosmetic's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Shanghai Chicmax Cosmetic Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that Shanghai Chicmax Cosmetic insiders spent a staggering CN¥35m on acquiring shares in just one year, without single share being sold in the meantime. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Independent Non-Executive Director Yan Luo who made the biggest single purchase, worth HK$12m, paying HK$40.51 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Shanghai Chicmax Cosmetic will reveal that insiders own a significant piece of the pie. In fact, they own 40% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. This insider holding amounts to That means they have plenty of their own capital riding on the performance of the business!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Yixiong Lyu is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between CN¥7.3b and CN¥23b, like Shanghai Chicmax Cosmetic, the median CEO pay is around CN¥4.1m.

The Shanghai Chicmax Cosmetic CEO received total compensation of just CN¥676k in the year to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Shanghai Chicmax Cosmetic Worth Keeping An Eye On?

For growth investors, Shanghai Chicmax Cosmetic's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. If you think Shanghai Chicmax Cosmetic might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Keen growth investors love to see insider activity. Thankfully, Shanghai Chicmax Cosmetic isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2145

Shanghai Chicmax Cosmetic

A multi-brand cosmetics company, engages in the research, development, manufacture, and sale of cosmetics products in Mainland China and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives