- Hong Kong

- /

- Personal Products

- /

- SEHK:1962

Investors Don't See Light At End Of Evergreen Products Group Limited's (HKG:1962) Tunnel

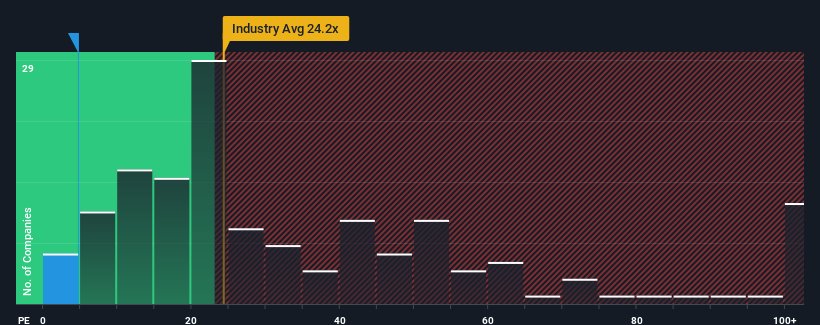

Evergreen Products Group Limited's (HKG:1962) price-to-earnings (or "P/E") ratio of 4.7x might make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 9x and even P/E's above 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Evergreen Products Group certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Evergreen Products Group

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Evergreen Products Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 39%. The strong recent performance means it was also able to grow EPS by 43% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Evergreen Products Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Evergreen Products Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Evergreen Products Group you should be aware of, and 2 of them are a bit unpleasant.

You might be able to find a better investment than Evergreen Products Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Evergreen Products Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1962

Evergreen Products Group

An investment holding company, engages in the manufacturing and trading of hair products in the United States of America, Germany, Japan, the People’s Republic of China, the United Kingdom, and internationally.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026