Introducing Coslight Technology International Group, The Stock That Dropped 41% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

It is doubtless a positive to see that the Coslight Technology International Group Limited (HKG:1043) share price has gained some 37% in the last three months. But over the last half decade, the stock has not performed well. After all, the share price is down 41% in that time, significantly under-performing the market.

Check out our latest analysis for Coslight Technology International Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

In the last five years Coslight Technology International Group improved its bottom line results, having previously been loss-making. That would generally be considered a positive, so we are surprised to see the share price is down.

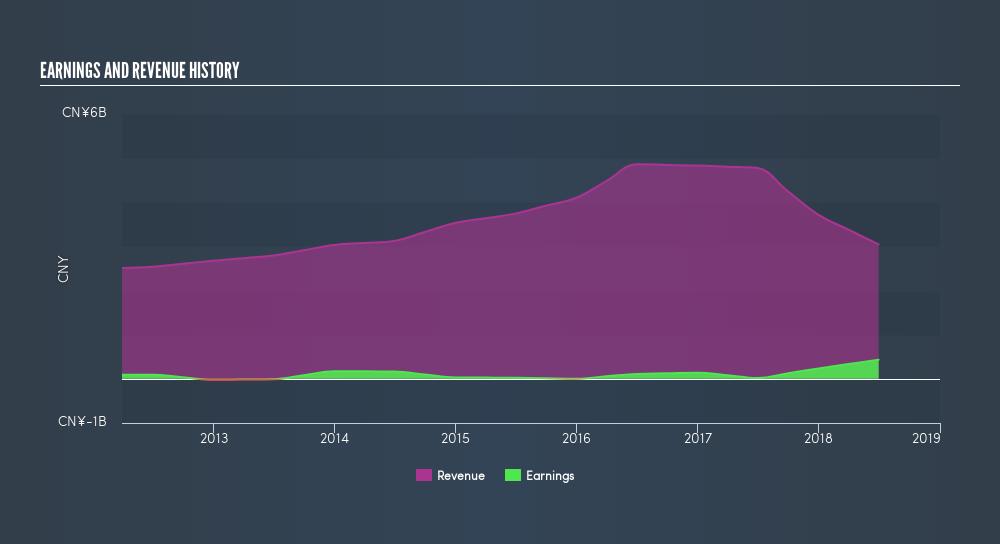

Revenue is actually up 6.7% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Coslight Technology International Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Coslight Technology International Group has rewarded shareholders with a total shareholder return of 1.6% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives