- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9996

Why Investors Shouldn't Be Surprised By Peijia Medical Limited's (HKG:9996) 31% Share Price Surge

Peijia Medical Limited (HKG:9996) shares have had a really impressive month, gaining 31% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

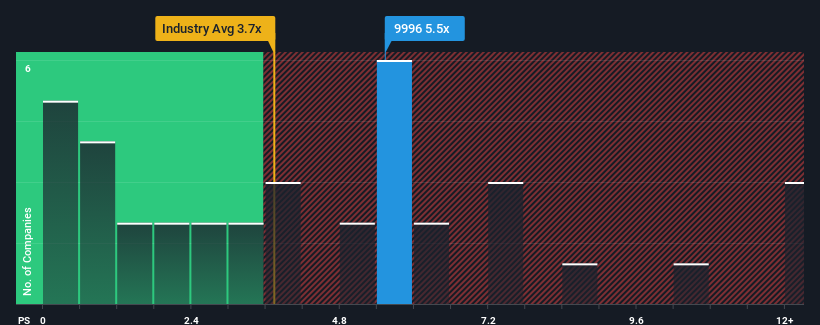

Following the firm bounce in price, Peijia Medical's price-to-sales (or "P/S") ratio of 5.5x might make it look like a sell right now compared to the wider Medical Equipment industry in Hong Kong, where around half of the companies have P/S ratios below 3.7x and even P/S below 1.6x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Peijia Medical

What Does Peijia Medical's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Peijia Medical has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Peijia Medical will help you uncover what's on the horizon.How Is Peijia Medical's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Peijia Medical's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 37% per year over the next three years. That's shaping up to be materially higher than the 22% per year growth forecast for the broader industry.

With this information, we can see why Peijia Medical is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Peijia Medical's P/S

Peijia Medical shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Peijia Medical shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Peijia Medical that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Peijia Medical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9996

Peijia Medical

Engages in the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives