- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9996

Subdued Growth No Barrier To Peijia Medical Limited (HKG:9996) With Shares Advancing 29%

Peijia Medical Limited (HKG:9996) shares have continued their recent momentum with a 29% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

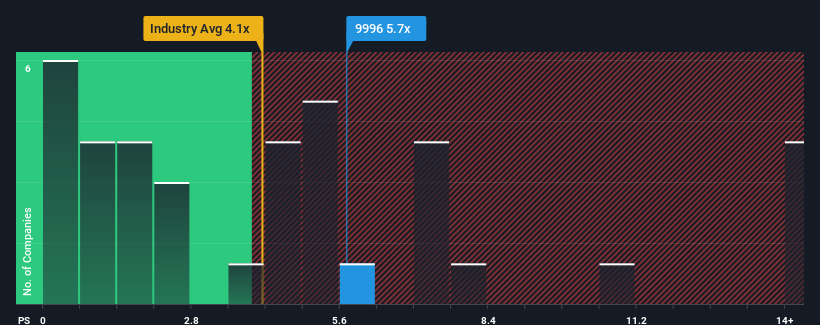

Following the firm bounce in price, Peijia Medical may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 5.7x, when you consider almost half of the companies in the Medical Equipment industry in Hong Kong have P/S ratios under 4.1x and even P/S lower than 1.2x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We check all companies for important risks. See what we found for Peijia Medical in our free report.View our latest analysis for Peijia Medical

How Has Peijia Medical Performed Recently?

Peijia Medical certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Peijia Medical.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Peijia Medical's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 30% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 30% per annum, which is not materially different.

With this in consideration, we find it intriguing that Peijia Medical's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

Peijia Medical's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Peijia Medical currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Peijia Medical with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Peijia Medical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9996

Peijia Medical

Engages in the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives