- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9996

More Unpleasant Surprises Could Be In Store For Peijia Medical Limited's (HKG:9996) Shares After Tumbling 29%

Peijia Medical Limited (HKG:9996) shares have had a horrible month, losing 29% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

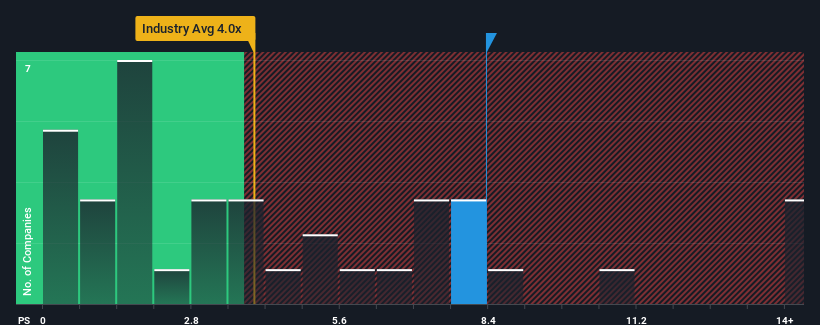

Even after such a large drop in price, Peijia Medical may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.4x, when you consider almost half of the companies in the Medical Equipment industry in Hong Kong have P/S ratios under 4x and even P/S lower than 1.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Peijia Medical

How Peijia Medical Has Been Performing

With revenue growth that's inferior to most other companies of late, Peijia Medical has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Peijia Medical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Peijia Medical's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 75% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 56% each year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 90% per annum, which is noticeably more attractive.

In light of this, it's alarming that Peijia Medical's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Peijia Medical's P/S?

Even after such a strong price drop, Peijia Medical's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Peijia Medical currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Peijia Medical is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9996

Peijia Medical

Engages in the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives