- Hong Kong

- /

- Semiconductors

- /

- SEHK:8257

3 Promising Penny Stocks With Market Caps Below US$90M

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainty, investors are increasingly looking for opportunities that balance risk with potential reward. Penny stocks, often seen as relics of past trading days, represent smaller or newer companies that can still offer significant growth potential when built on solid financials. By focusing on those with strong fundamentals and clear growth trajectories, investors can uncover hidden gems in this underappreciated segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,836 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sino ICT Holdings (SEHK:365)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino ICT Holdings Limited is an investment holding company that manufactures and sells surface mount technology and semiconductor equipment in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$293.91 million.

Operations: The company generates revenue of HK$222.41 million from its production and sales of industrial products.

Market Cap: HK$293.91M

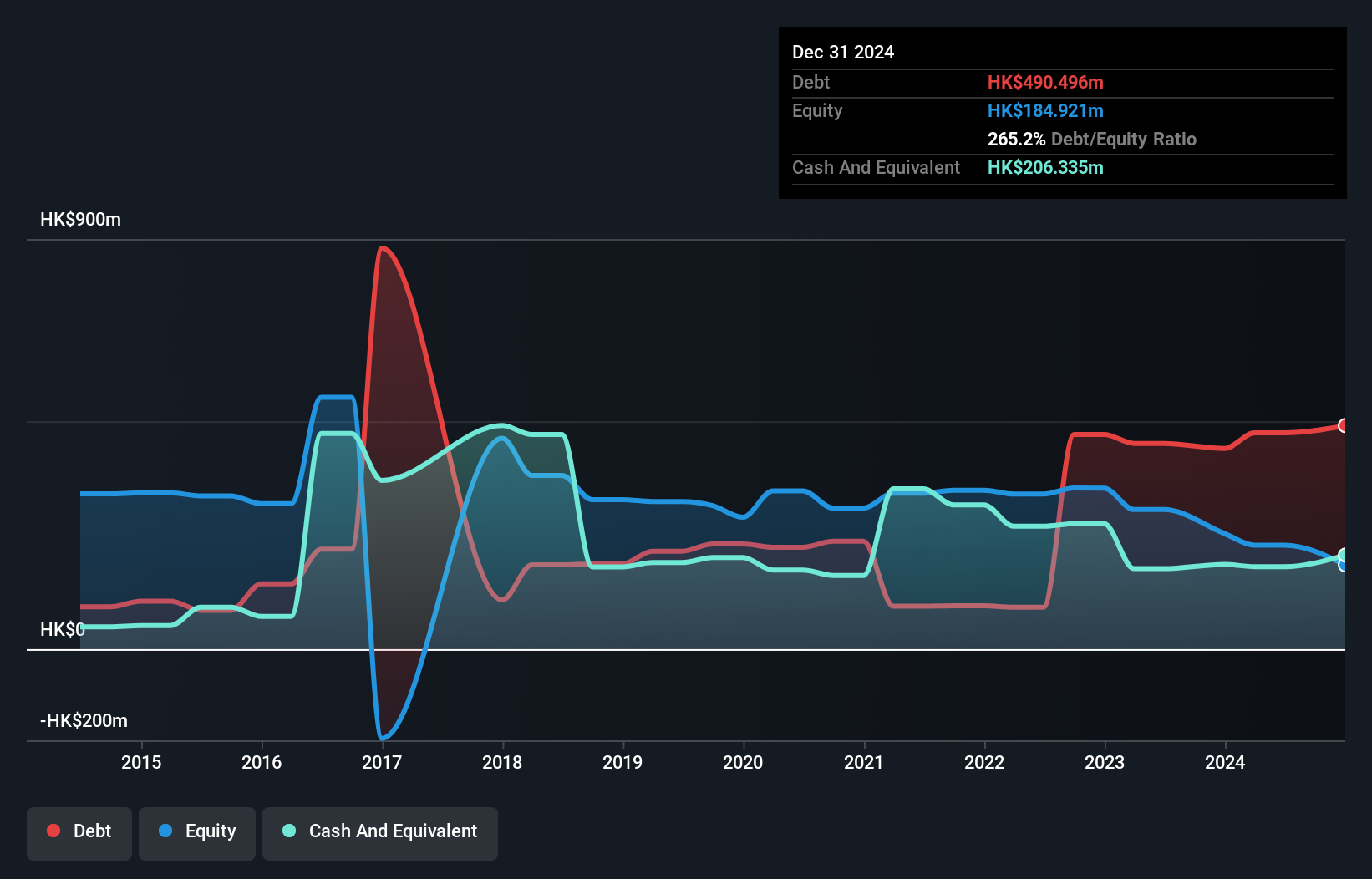

Sino ICT Holdings, with a market cap of HK$293.91 million, faces challenges typical of penny stocks. Despite generating HK$222.41 million in revenue from its industrial products, the company is unprofitable and has seen increasing losses over the past five years. Its debt-to-equity ratio has risen significantly to 208.1%, indicating high leverage, while share price volatility remains elevated. On a positive note, Sino ICT's management team and board are experienced, with average tenures exceeding industry norms. The company maintains a strong cash position relative to liabilities and has a cash runway exceeding three years even as free cash flow declines.

- Take a closer look at Sino ICT Holdings' potential here in our financial health report.

- Gain insights into Sino ICT Holdings' past trends and performance with our report on the company's historical track record.

Genes Tech Group Holdings (SEHK:8257)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genes Tech Group Holdings Company Limited is an investment holding company that offers turnkey solutions and trades in used semiconductor manufacturing equipment and parts, with a market cap of HK$62 million.

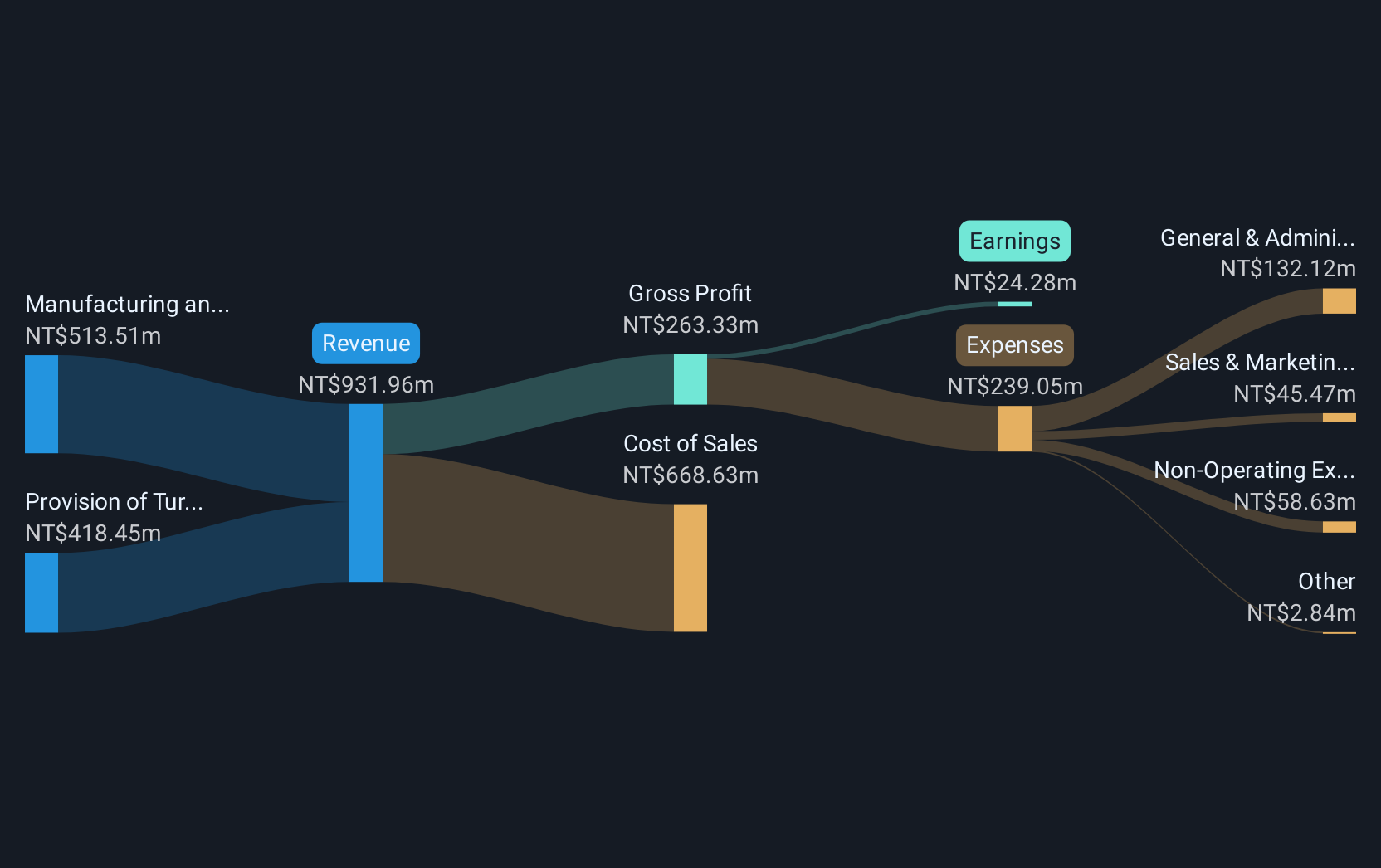

Operations: The company's revenue is derived from the provision of turnkey solutions (NT$562.16 million) and the manufacturing and trading of used semiconductor manufacturing equipment and parts (NT$556.17 million).

Market Cap: HK$62M

Genes Tech Group Holdings, with a market cap of HK$62 million, has shown improvement by becoming profitable this year. However, its earnings have declined by an average of 36.1% annually over the past five years. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating strong liquidity. Despite reducing its debt-to-equity ratio from 133.1% to 74.1% over five years, the net debt level remains high at 59.9%. While interest payments are well covered by EBIT (4.4x), operating cash flow does not adequately cover debt obligations (14.3%). The seasoned management team averages a tenure of 10.3 years.

- Click to explore a detailed breakdown of our findings in Genes Tech Group Holdings' financial health report.

- Examine Genes Tech Group Holdings' past performance report to understand how it has performed in prior years.

ClouDr Group (SEHK:9955)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ClouDr Group Limited is an investment holding company that offers SaaS to hospitals and pharmacies, digital marketing services to pharmaceutical companies, and online consultation and prescriptions for chronic condition management, with a market cap of HK$675.09 million.

Operations: The company generates revenue from its wholesale drug segment, amounting to CN¥4.01 billion.

Market Cap: HK$675.09M

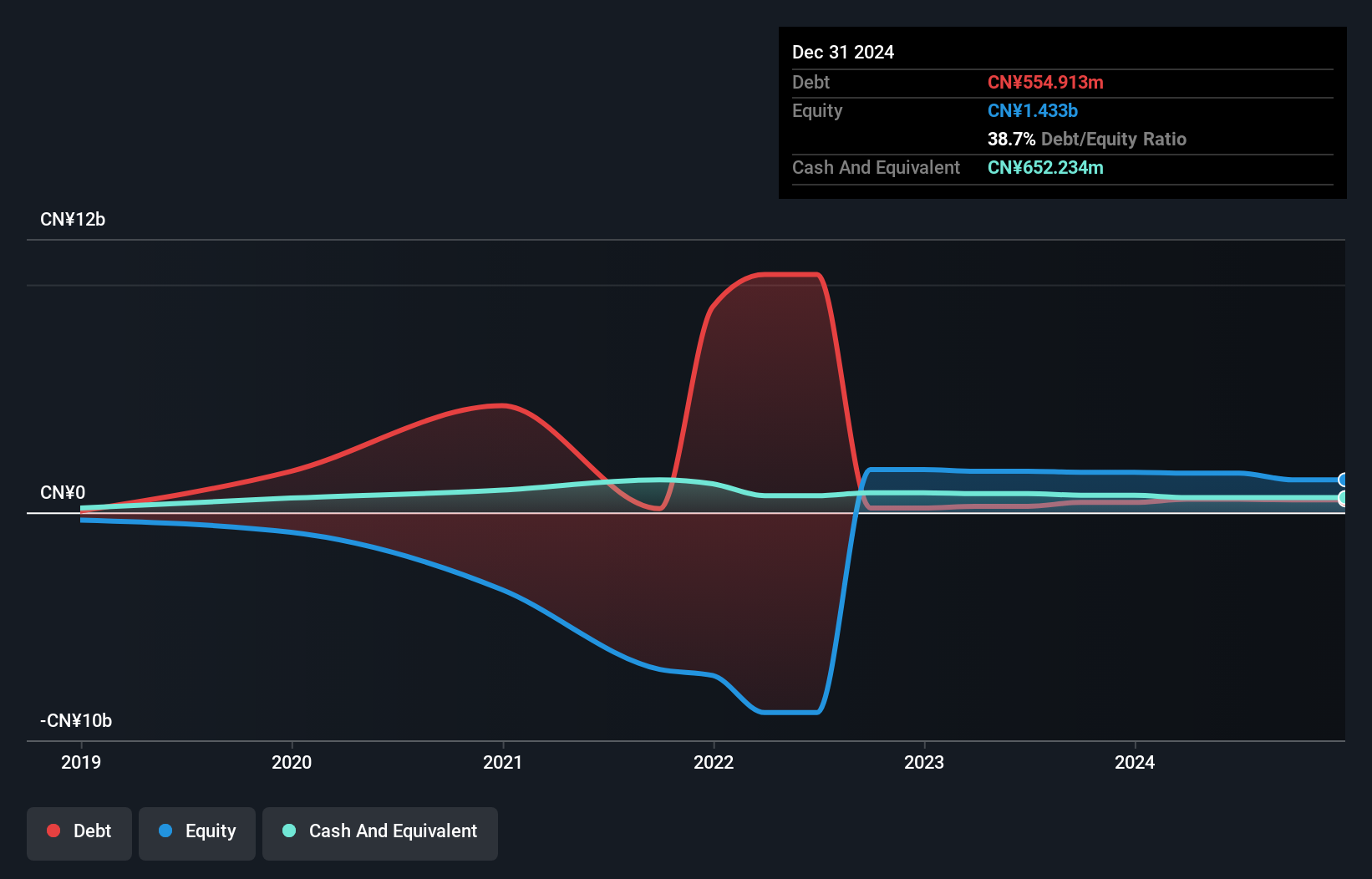

ClouDr Group Limited, with a market cap of HK$675.09 million, is navigating the penny stock landscape by leveraging its SaaS offerings and digital marketing services. The company generates significant revenue from its wholesale drug segment, amounting to CN¥4.01 billion. Despite being unprofitable, it has reduced losses over the past five years and maintains a positive cash runway for more than a year based on current free cash flow. Recent developments include the approval of ClouDT-01, a diabetes-related digital drug product in China, reflecting its commitment to innovative healthcare solutions amidst high share price volatility and an inexperienced management team.

- Click here and access our complete financial health analysis report to understand the dynamics of ClouDr Group.

- Explore ClouDr Group's analyst forecasts in our growth report.

Next Steps

- Take a closer look at our Penny Stocks list of 5,836 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8257

Genes Tech Group Holdings

An investment holding company, provides turnkey solutions and trades in used semiconductor manufacturing equipment (SME) and parts.

Flawless balance sheet and good value.

Market Insights

Community Narratives