- Hong Kong

- /

- Medical Equipment

- /

- SEHK:853

A Fresh Look at MicroPort Scientific (SEHK:853) Valuation Following Governance Reforms and Board Changes

Reviewed by Kshitija Bhandaru

MicroPort Scientific (SEHK:853) has announced a series of Board-level changes and proposed amendments to its core governance documents. These changes are set to be voted on at the upcoming annual general meeting. Investors are watching how these steps may shape oversight of the company moving forward.

See our latest analysis for MicroPort Scientific.

After a steady drumbeat of Board changes and governance news, MicroPort Scientific’s momentum has continued to build. The stock has delivered a remarkable 172% year-to-date share price return, and its one-year total shareholder return of 120% highlights how enthusiasm is translating into longer-term gains, even as recent headlines shift risk perceptions and growth expectations.

If recent leadership shake-ups intrigued you, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

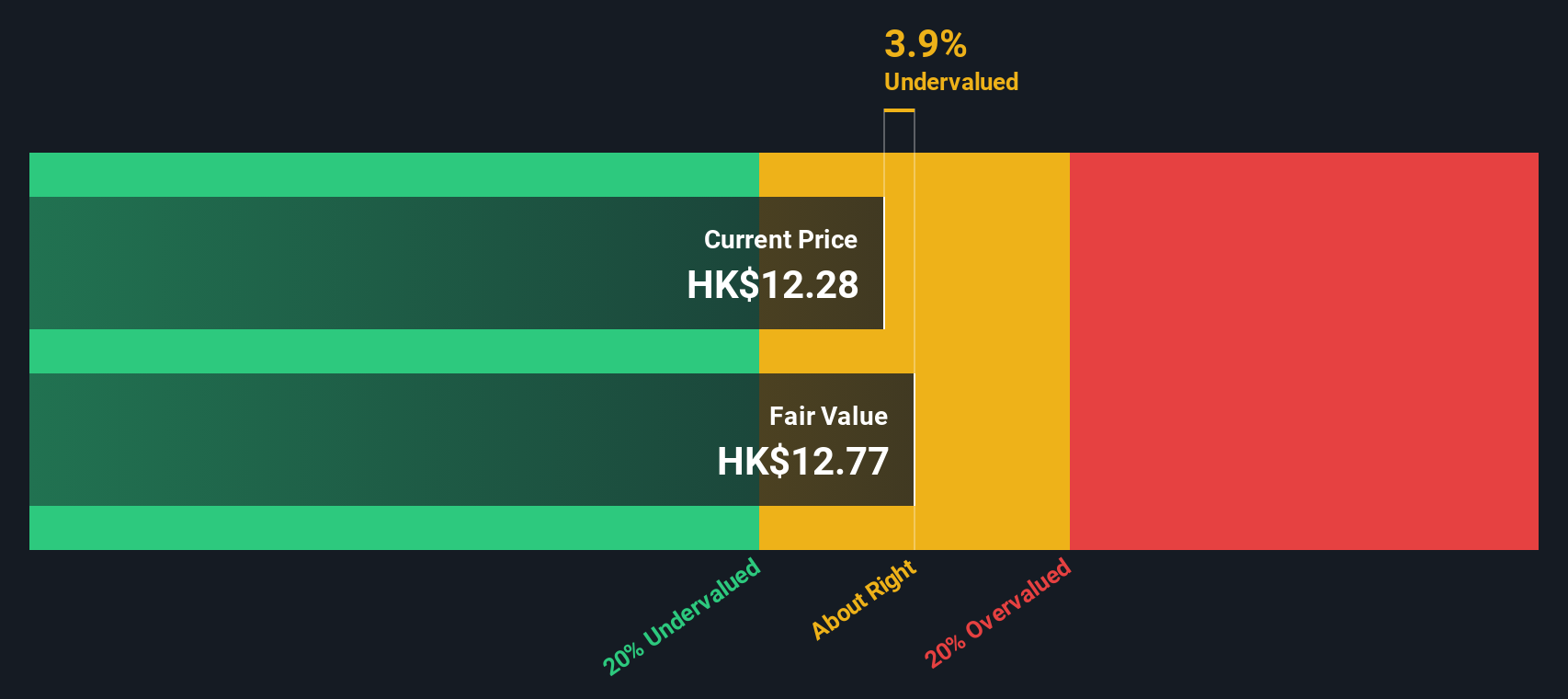

Yet with returns so strong and governance reforms arriving amid a growth resurgence, the real question is whether these gains signal that MicroPort Scientific is undervalued, or if the market has already priced in all future upside.

Price-to-Sales of 3.9x: Is it justified?

MicroPort Scientific is trading at a price-to-sales ratio of 3.9x, which compares very attractively with both its industry peers and broader market rivals. The most recent close, at HK$16.16, aligns with this lower-than-average multiple and suggests the stock may be trading at a meaningful discount to its sector.

The price-to-sales (P/S) ratio compares a company’s stock price to its revenues, making it useful for evaluating high-growth or unprofitable businesses in the medical equipment sector. For MicroPort Scientific, with profitability still ahead, the P/S ratio gives a valuable alternative to profit-based metrics and lets investors gauge revenue expectations versus peers.

This multiple stands out, given the peer average sits at 6.3x and the broader Hong Kong Medical Equipment industry averages 6.0x. In addition, the SWS fair price-to-sales ratio estimate is 4.4x, meaning MicroPort Scientific’s current valuation is already below levels the market could potentially move towards if revenue prospects strengthen further.

Explore the SWS fair ratio for MicroPort Scientific

Result: Preferred multiple of 3.9x (UNDERVALUED)

However, slower revenue growth or further declines in net income could challenge the view that MicroPort Scientific is undervalued at current levels.

Find out about the key risks to this MicroPort Scientific narrative.

Another View: DCF Model Challenges the Discount

While the current price-to-sales multiple points to a discount, our DCF model tells a different story. According to the DCF analysis, MicroPort Scientific’s share price (HK$16.16) is actually above its estimated fair value of HK$13.53. This could signal that future growth expectations are already factored into the price. Which method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MicroPort Scientific for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MicroPort Scientific Narrative

If you have a different perspective or want to draw your own conclusions from the numbers, it only takes a few minutes to build your own view. Do it your way

A great starting point for your MicroPort Scientific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game and jump ahead of the crowd by checking out what other innovative companies could do for your portfolio with these popular picks:

- Uncover new opportunities for growth by tapping into the upside potential in these 894 undervalued stocks based on cash flows that the market may have missed.

- Supercharge your returns with steady income by adding these 19 dividend stocks with yields > 3% featuring attractive yields to your watchlist.

- Get in early on game-changing technology trends by tracking these 25 AI penny stocks and see which companies are powering tomorrow’s digital revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:853

MicroPort Scientific

Engages in the innovating, manufacturing, and marketing medical devices globally in the People’s Republic of China, Europe, Middle East and Africa, Japan, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives