- Hong Kong

- /

- Healthtech

- /

- SEHK:6819

IntelliCentrics Global Holdings (HKG:6819) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, IntelliCentrics Global Holdings Ltd. (HKG:6819) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for IntelliCentrics Global Holdings

What Is IntelliCentrics Global Holdings's Debt?

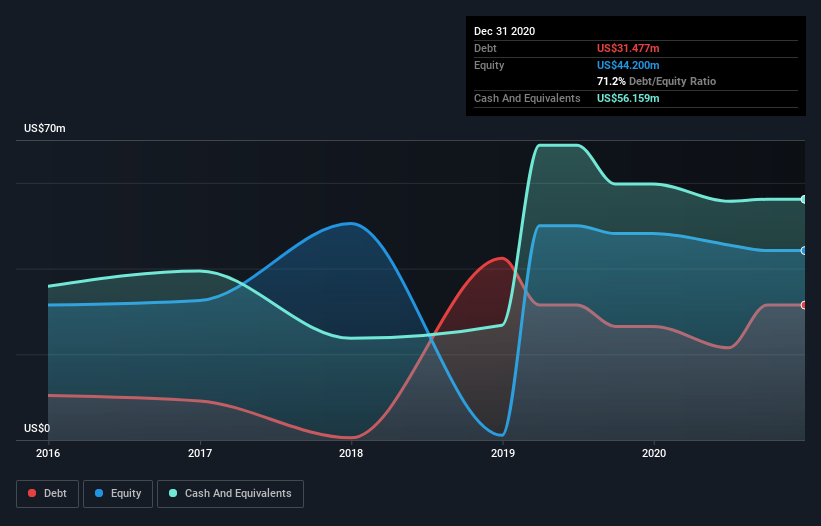

As you can see below, at the end of December 2020, IntelliCentrics Global Holdings had US$31.5m of debt, up from US$26.5m a year ago. Click the image for more detail. But on the other hand it also has US$56.2m in cash, leading to a US$24.7m net cash position.

How Strong Is IntelliCentrics Global Holdings' Balance Sheet?

According to the last reported balance sheet, IntelliCentrics Global Holdings had liabilities of US$28.6m due within 12 months, and liabilities of US$37.5m due beyond 12 months. Offsetting this, it had US$56.2m in cash and US$743.0k in receivables that were due within 12 months. So its liabilities total US$9.27m more than the combination of its cash and short-term receivables.

This state of affairs indicates that IntelliCentrics Global Holdings' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$480.1m company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, IntelliCentrics Global Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is IntelliCentrics Global Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, IntelliCentrics Global Holdings reported revenue of US$37m, which is a gain of 3.4%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is IntelliCentrics Global Holdings?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year IntelliCentrics Global Holdings had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$6.2m and booked a US$2.2m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of US$24.7m. That means it could keep spending at its current rate for more than two years. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with IntelliCentrics Global Holdings .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6819

IntelliCentrics Global Holdings

IntelliCentrics Global Holdings Ltd., an investment holding company, operates a healthcare technology platform.

Weak fundamentals or lack of information.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success