- Hong Kong

- /

- Healthcare Services

- /

- SEHK:6639

Even With A 41% Surge, Cautious Investors Are Not Rewarding Arrail Group Limited's (HKG:6639) Performance Completely

Arrail Group Limited (HKG:6639) shareholders would be excited to see that the share price has had a great month, posting a 41% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

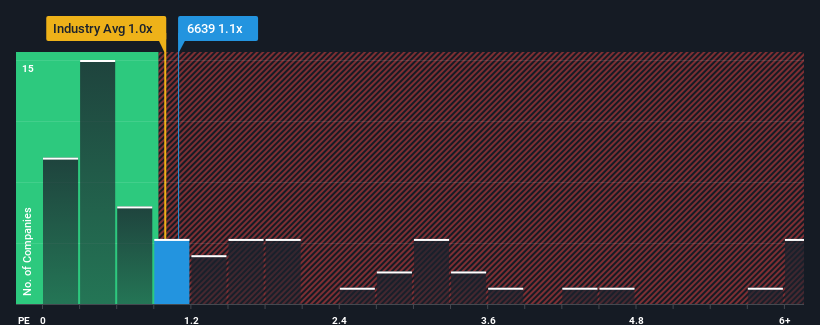

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Arrail Group's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in Hong Kong is also close to 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Arrail Group

How Arrail Group Has Been Performing

Recent times have been advantageous for Arrail Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arrail Group.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Arrail Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. Revenue has also lifted 15% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 17% per year during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11% per annum, which is noticeably less attractive.

In light of this, it's curious that Arrail Group's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Arrail Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Arrail Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Arrail Group is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Arrail Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6639

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives