- Hong Kong

- /

- Hospitality

- /

- SEHK:6811

Discover 3 Penny Stocks With Market Caps Under US$200M

Reviewed by Simply Wall St

Global markets have been buoyed by optimism surrounding potential trade agreements and advancements in artificial intelligence, with major indices reaching new highs. As investors navigate these shifting economic landscapes, penny stocks—often representing smaller or newer companies—remain a relevant area of interest due to their unique blend of affordability and growth potential. In this article, we explore three penny stocks that stand out for their financial resilience and promise in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.71 | HK$42.19B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £780M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$641.14M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Arrail Group (SEHK:6639)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Arrail Group Limited operates dental hospitals and clinics in China, with a market cap of HK$1.01 billion.

Operations: The company's revenue is derived from its Arrail Dental segment, contributing CN¥796.65 million, and the Rytime Dental segment, which generates CN¥950.45 million.

Market Cap: HK$1.01B

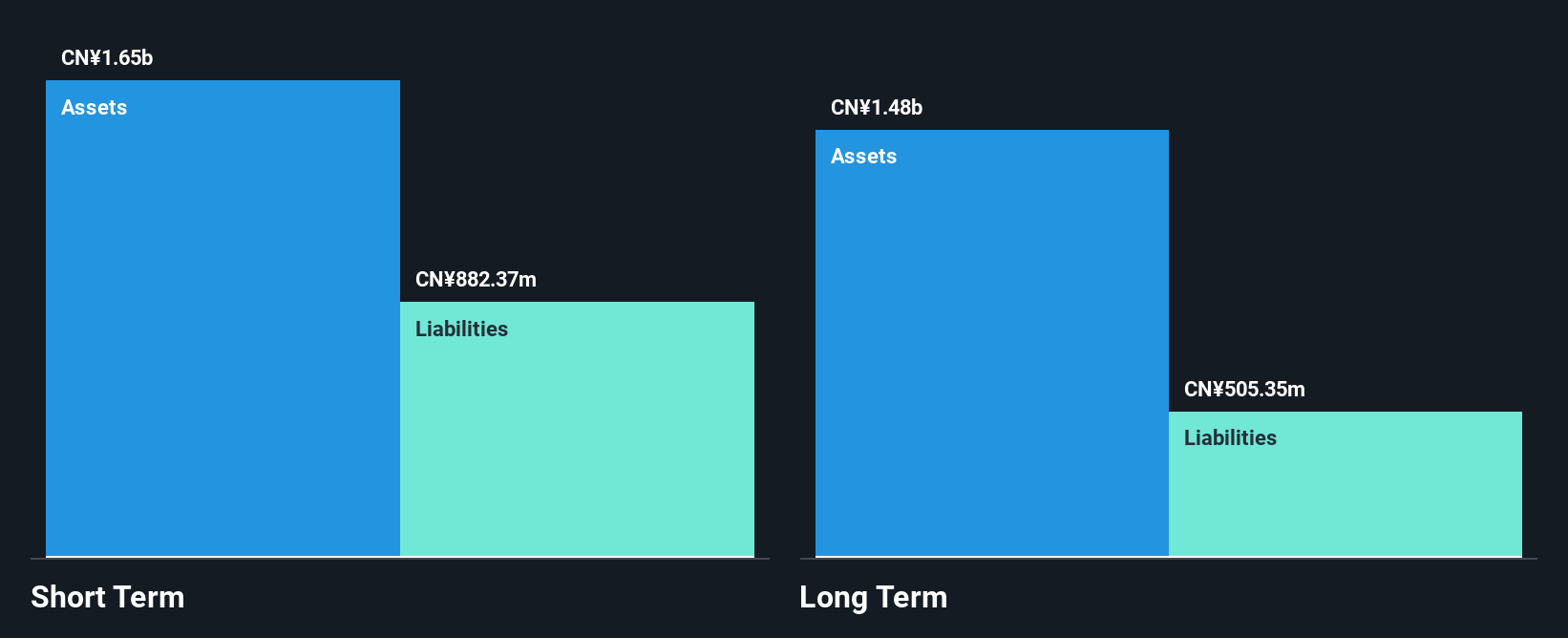

Arrail Group Limited, with a market cap of HK$1.01 billion, has shown profitability growth over the past year, aided by a one-off gain of CN¥23 million. The company reported half-year sales of CN¥887.47 million and net income of CN¥8.65 million as of September 2024, marking an improvement from the previous year. Its financial stability is supported by having more cash than total debt and short-term assets exceeding both short- and long-term liabilities. However, its return on equity remains low at 0.6%, and interest payments are not well covered by EBIT, indicating areas for potential improvement in operational efficiency.

- Click here to discover the nuances of Arrail Group with our detailed analytical financial health report.

- Examine Arrail Group's earnings growth report to understand how analysts expect it to perform.

Tai Hing Group Holdings (SEHK:6811)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tai Hing Group Holdings Limited is an investment holding company that operates and manages restaurants, with a market cap of HK$965.18 million.

Operations: The company generates revenue of HK$3.26 billion from its restaurant operations and management.

Market Cap: HK$965.18M

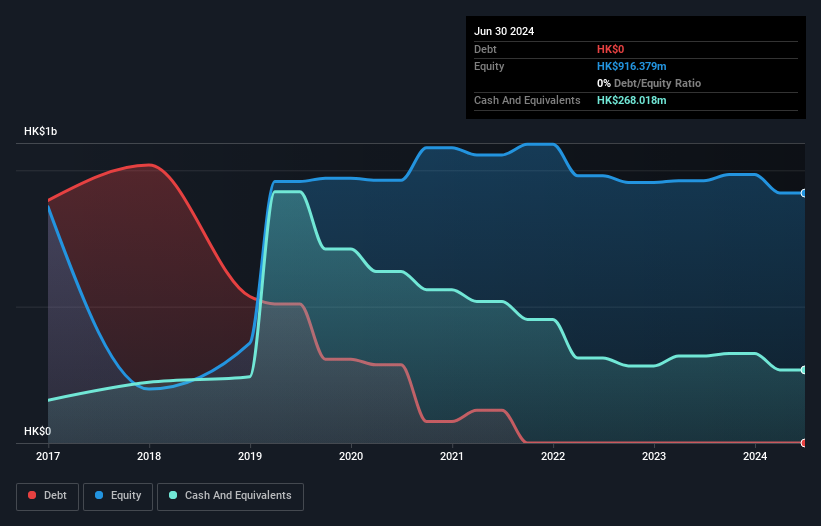

Tai Hing Group Holdings, with a market cap of HK$965.18 million, has initiated a share buyback program authorized to repurchase up to 10% of its issued shares, potentially enhancing net asset value and earnings per share. The company is debt-free but faces challenges with short-term assets not covering liabilities. Despite stable weekly volatility and an experienced board averaging 6.1 years in tenure, the company's return on equity is low at 6.5%. Past earnings have been impacted by a significant one-off loss of HK$46 million, and its dividend yield remains unsustainable against current earnings levels.

- Jump into the full analysis health report here for a deeper understanding of Tai Hing Group Holdings.

- Evaluate Tai Hing Group Holdings' prospects by accessing our earnings growth report.

Micro-Mechanics (Holdings) (SGX:5DD)

Simply Wall St Financial Health Rating: ★★★★★★

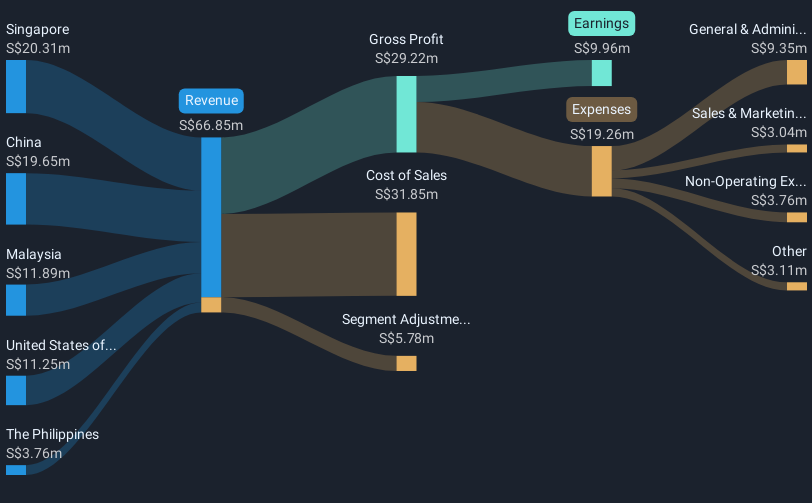

Overview: Micro-Mechanics (Holdings) Ltd. is a company that designs, manufactures, and markets high precision parts and tools for the semiconductor industry's wafer-fabrication, assembly, and testing processes across various international markets, with a market cap of SGD230.79 million.

Operations: Micro-Mechanics (Holdings) Ltd. does not report specific revenue segments.

Market Cap: SGD230.79M

Micro-Mechanics (Holdings) Ltd., with a market cap of SGD230.79 million, demonstrates robust financial health with short-term assets (SGD35.6M) comfortably exceeding both its short and long-term liabilities. The company has no debt, enhancing its financial stability and reducing interest payment concerns. Recent earnings growth of 28.6% outpaces the semiconductor industry's average, reflecting strong operational performance despite a decline in profits over the past five years. However, board experience is limited with an average tenure of two years, which may impact strategic continuity. A recent dividend approval indicates shareholder returns remain a focus despite an unstable track record.

- Get an in-depth perspective on Micro-Mechanics (Holdings)'s performance by reading our balance sheet health report here.

- Gain insights into Micro-Mechanics (Holdings)'s past trends and performance with our report on the company's historical track record.

Where To Now?

- Unlock more gems! Our Penny Stocks screener has unearthed 5,708 more companies for you to explore.Click here to unveil our expertly curated list of 5,711 Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tai Hing Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6811

Tai Hing Group Holdings

An investment holding company, operates and manages restaurants.

Good value with adequate balance sheet.

Market Insights

Community Narratives