- Hong Kong

- /

- Healthcare Services

- /

- SEHK:6606

New Horizon Health Limited (HKG:6606) Stocks Shoot Up 29% But Its P/S Still Looks Reasonable

New Horizon Health Limited (HKG:6606) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

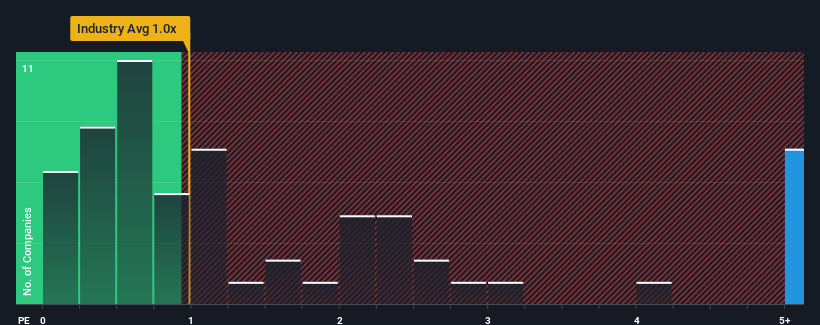

Since its price has surged higher, when almost half of the companies in Hong Kong's Healthcare industry have price-to-sales ratios (or "P/S") below 1x, you may consider New Horizon Health as a stock not worth researching with its 6.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for New Horizon Health

How Has New Horizon Health Performed Recently?

Recent times have been advantageous for New Horizon Health as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on New Horizon Health will help you uncover what's on the horizon.How Is New Horizon Health's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like New Horizon Health's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 245% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 40% per year over the next three years. With the industry only predicted to deliver 16% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why New Horizon Health's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On New Horizon Health's P/S

New Horizon Health's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into New Horizon Health shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for New Horizon Health that you need to be mindful of.

If these risks are making you reconsider your opinion on New Horizon Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if New Horizon Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6606

New Horizon Health

An investment holding company, engages in the research and development of screening products for colorectal, cervical, and other types of cancer in the People’s Republic of China.

High growth potential and fair value.

Market Insights

Community Narratives