- Hong Kong

- /

- Healthcare Services

- /

- SEHK:6606

Need To Know: Analysts Are Much More Bullish On New Horizon Health Limited (HKG:6606) Revenues

Celebrations may be in order for New Horizon Health Limited (HKG:6606) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 41% to HK$29.05 in the last 7 days. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

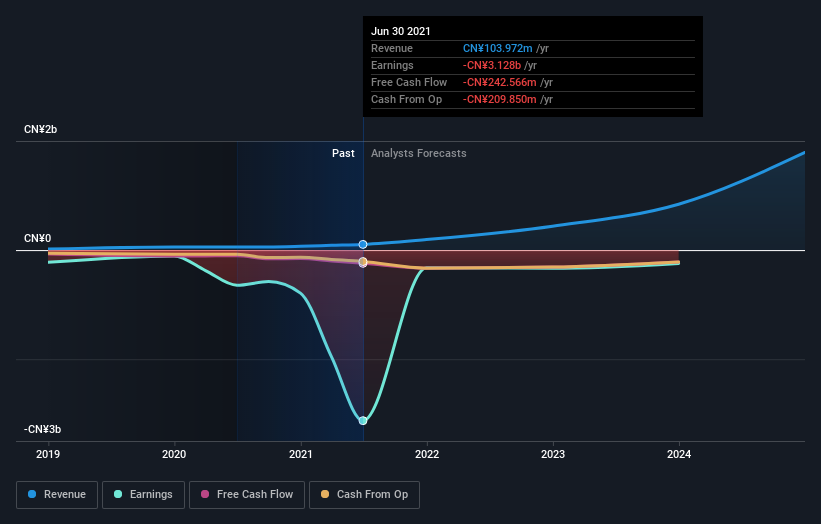

Following the upgrade, the most recent consensus for New Horizon Health from its three analysts is for revenues of CN¥192m in 2021 which, if met, would be a sizeable 85% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 91% to CN¥0.68. Yet before this consensus update, the analysts had been forecasting revenues of CN¥170m and losses of CN¥0.68 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, withthe analysts noticeably increasing their revenue forecasts while also expecting losses per share to hold steady.

See our latest analysis for New Horizon Health

The consensus price target held steady at CN¥57.84 despite the upgrade to revenue forecasts and ongoing losses. Analysts seem to think the business is otherwise performing roughly in line with expectations. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic New Horizon Health analyst has a price target of CN¥82.19 per share, while the most pessimistic values it at CN¥52.00. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that New Horizon Health's rate of growth is expected to accelerate meaningfully, with the forecast 242% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 87% over the past year. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 20% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that New Horizon Health is expected to grow much faster than its industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting New Horizon Health is moving incrementally towards profitability. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at New Horizon Health.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple New Horizon Health analysts - going out to 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if New Horizon Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6606

New Horizon Health

An investment holding company, engages in the research and development of screening products for colorectal, cervical, and other types of cancer in the People’s Republic of China.

High growth potential and fair value.

Market Insights

Community Narratives