- Hong Kong

- /

- Healthcare Services

- /

- SEHK:6606

Benign Growth For New Horizon Health Limited (HKG:6606) Underpins Stock's 26% Plummet

New Horizon Health Limited (HKG:6606) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 10.0% in the last year.

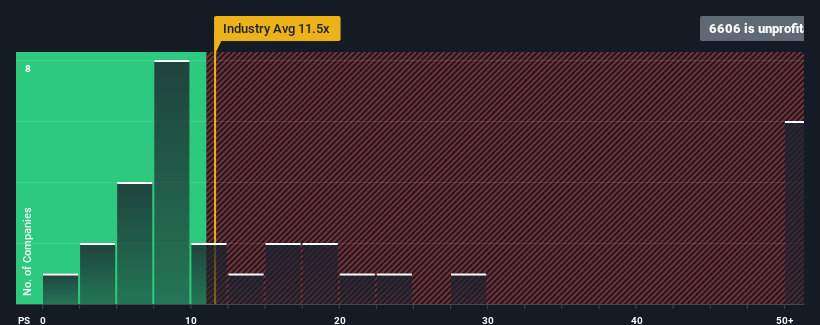

In spite of the heavy fall in price, New Horizon Health's price-to-earnings (or "P/E") ratio of -108.1x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 21x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for New Horizon Health as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for New Horizon Health

Does Growth Match The Low P/E?

New Horizon Health's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 98% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 21% as estimated by the six analysts watching the company. With the market predicted to deliver 25% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that New Horizon Health's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Having almost fallen off a cliff, New Horizon Health's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of New Horizon Health's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for New Horizon Health you should be aware of.

If these risks are making you reconsider your opinion on New Horizon Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if New Horizon Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6606

New Horizon Health

An investment holding company, engages in the research and development of screening products for colorectal, cervical, and other types of cancer in the People’s Republic of China.

High growth potential and fair value.

Market Insights

Community Narratives