- Hong Kong

- /

- Healthcare Services

- /

- SEHK:383

Returns On Capital Signal Difficult Times Ahead For China Medical & HealthCare Group (HKG:383)

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. And from a first read, things don't look too good at China Medical & HealthCare Group (HKG:383), so let's see why.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for China Medical & HealthCare Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0071 = HK$14m ÷ (HK$3.3b - HK$1.3b) (Based on the trailing twelve months to June 2022).

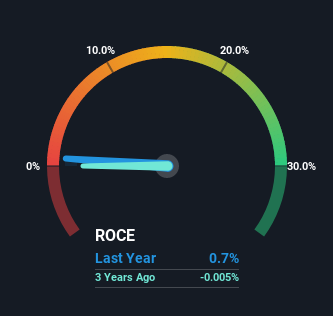

Therefore, China Medical & HealthCare Group has an ROCE of 0.7%. In absolute terms, that's a low return and it also under-performs the Healthcare industry average of 10%.

View our latest analysis for China Medical & HealthCare Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating China Medical & HealthCare Group's past further, check out this free graph of past earnings, revenue and cash flow.

What Can We Tell From China Medical & HealthCare Group's ROCE Trend?

We are a bit anxious about the trends of ROCE at China Medical & HealthCare Group. Unfortunately, returns have declined substantially over the last five years to the 0.7% we see today. What's equally concerning is that the amount of capital deployed in the business has shrunk by 20% over that same period. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

The Bottom Line On China Medical & HealthCare Group's ROCE

To see China Medical & HealthCare Group reducing the capital employed in the business in tandem with diminishing returns, is concerning. This could explain why the stock has sunk a total of 86% in the last five years. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

One more thing to note, we've identified 1 warning sign with China Medical & HealthCare Group and understanding this should be part of your investment process.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Tian An Medicare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:383

Tian An Medicare

An investment holding company, primarily operates hospitals in the People’s Republic of China and Hong Kong.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026