- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

If You Had Bought Alibaba Health Information Technology (HKG:241) Stock Three Years Ago, You Could Pocket A 457% Gain Today

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Not every pick can be a winner, but when you pick the right stock, you can win big. One bright shining star stock has been Alibaba Health Information Technology Limited (HKG:241), which is 457% higher than three years ago. On top of that, the share price is up 21% in about a quarter. But this could be related to the strong market, which is up 13% in the last three months.

Check out our latest analysis for Alibaba Health Information Technology

While Alibaba Health Information Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years Alibaba Health Information Technology has grown its revenue at 63% annually. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 77% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like Alibaba Health Information Technology can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

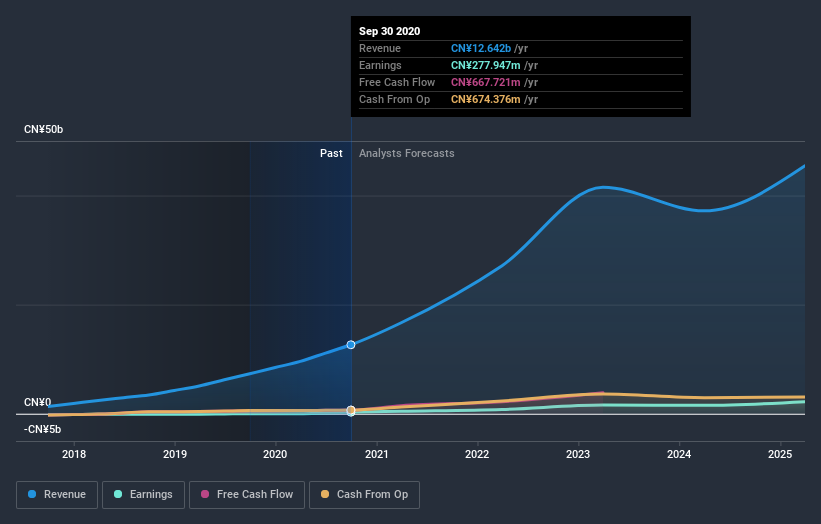

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Alibaba Health Information Technology is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Alibaba Health Information Technology stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that Alibaba Health Information Technology shareholders have received a total shareholder return of 151% over the last year. That gain is better than the annual TSR over five years, which is 36%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Alibaba Health Information Technology better, we need to consider many other factors. Even so, be aware that Alibaba Health Information Technology is showing 2 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Alibaba Health Information Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives