- Hong Kong

- /

- Healthtech

- /

- SEHK:2361

Discover Atlas Consolidated Mining and Development Alongside 2 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced fluctuations, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic signals, such as a cooling labor market and expanding manufacturing activity. In this context, investors often seek opportunities that balance risk with potential growth. Penny stocks, although sometimes seen as relics of past market eras, remain relevant due to their affordability and growth potential when backed by strong financials. This article will explore several penny stocks that stand out for their financial strength and long-term promise in today's evolving market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.77B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.53M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £3.83 | £309.02M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.27 | £161.95M | ★★★★★☆ |

Click here to see the full list of 5,699 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Atlas Consolidated Mining and Development (PSE:AT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlas Consolidated Mining and Development Corporation, with a market cap of ₱14.41 billion, operates through its subsidiaries in the exploration and mining of metallic mineral properties in the Philippines.

Operations: The company generates revenue of ₱19.65 billion from its operations in the Philippines.

Market Cap: ₱14.41B

Atlas Consolidated Mining and Development Corporation has demonstrated robust earnings growth of 33% over the past year, surpassing the industry average. Despite reporting a net loss in Q3 2024, its nine-month net income improved compared to the previous year. The company is trading below its estimated fair value and maintains a satisfactory debt level with well-covered interest payments. However, short-term assets do not cover liabilities, indicating potential liquidity challenges. The board and management are experienced, contributing to high-quality earnings and stable weekly volatility, though Return on Equity remains low at 2.9%.

- Navigate through the intricacies of Atlas Consolidated Mining and Development with our comprehensive balance sheet health report here.

- Evaluate Atlas Consolidated Mining and Development's historical performance by accessing our past performance report.

Sinohealth Holdings (SEHK:2361)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sinohealth Holdings Limited offers healthcare insight solutions tailored to the sales and marketing needs of medical product manufacturers in Mainland China and internationally, with a market cap of HK$1.15 billion.

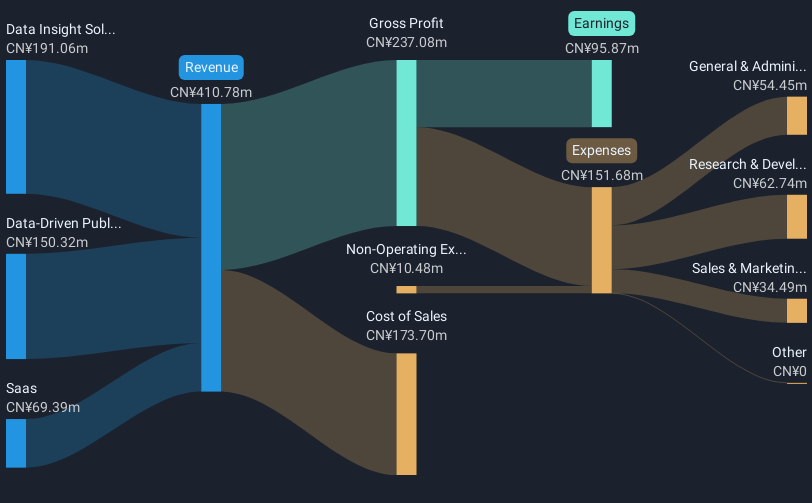

Operations: The company's revenue is derived from three segments: SaaS generating CN¥69.39 million, Data Insight Solutions contributing CN¥191.06 million, and Data-Driven Publications and Events bringing in CN¥150.32 million.

Market Cap: HK$1.15B

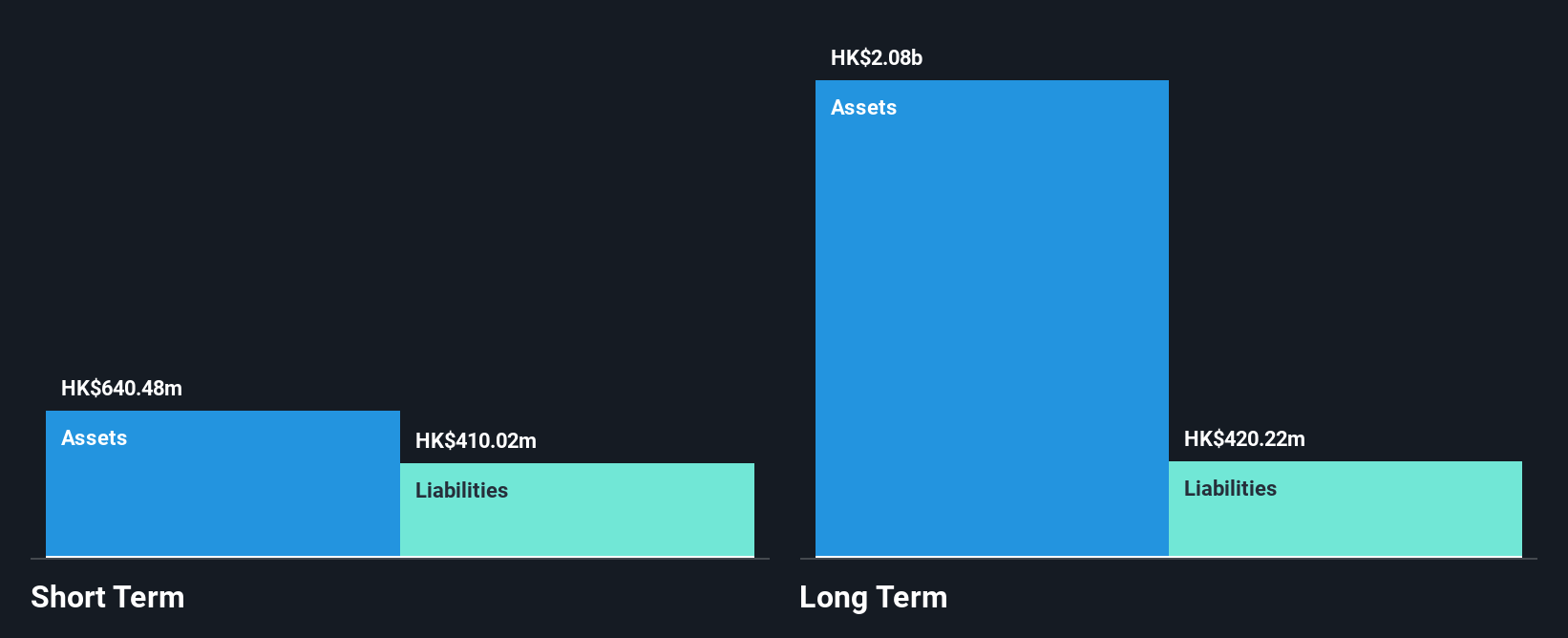

Sinohealth Holdings Limited, with a market cap of HK$1.15 billion, derives revenue from SaaS (CN¥69.39M), Data Insight Solutions (CN¥191.06M), and Data-Driven Publications and Events (CN¥150.32M). The company is debt-free, with short-term assets significantly exceeding liabilities. Despite negative earnings growth of -3.9% last year, it maintains a stable weekly volatility at 9%. Its Price-To-Earnings ratio of 12x suggests good value compared to the industry average of 24.1x, although Return on Equity remains low at 14.1%. Recent announcements include a special dividend payment scheduled for December 2024.

- Click here to discover the nuances of Sinohealth Holdings with our detailed analytical financial health report.

- Gain insights into Sinohealth Holdings' outlook and expected performance with our report on the company's earnings estimates.

C-MER Medical Holdings (SEHK:3309)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: C-MER Medical Holdings Limited is an investment holding company that offers ophthalmic services under the C-MER Dennis Lam brand in Hong Kong and Mainland China, with a market cap of HK$2.40 billion.

Operations: The company's revenue is derived from its Hong Kong medical operations (HK$889.68 million), Mainland China dental services (HK$440.81 million), and Mainland China ophthalmic services (HK$565.70 million).

Market Cap: HK$2.4B

C-MER Medical Holdings, with a market cap of HK$2.40 billion, has shown financial resilience despite recent challenges. The company became profitable last year and maintains high-quality earnings with more cash than total debt, indicating robust financial health. Its debt is well covered by operating cash flow at 1443%, and interest payments are comfortably managed with an EBIT coverage of 53.1x. However, recent guidance indicates expected impairments leading to a projected loss for FY2024 due to intensified competition and weakened consumer sentiment affecting some hospitals' performance. Revenue remains stable at approximately HKD 1,900 million for FY2024.

- Dive into the specifics of C-MER Medical Holdings here with our thorough balance sheet health report.

- Gain insights into C-MER Medical Holdings' historical outcomes by reviewing our past performance report.

Taking Advantage

- Click through to start exploring the rest of the 5,696 Penny Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2361

Sinohealth Holdings

Provides healthcare solutions for sales and marketing needs of medical product manufacturer clients in Mainland China, the Netherland, England, Hong Kong, Singapore, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives