- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2291

LEPU ScienTech Medical Technology (Shanghai) Co., Ltd.'s (HKG:2291) Shareholders Might Be Looking For Exit

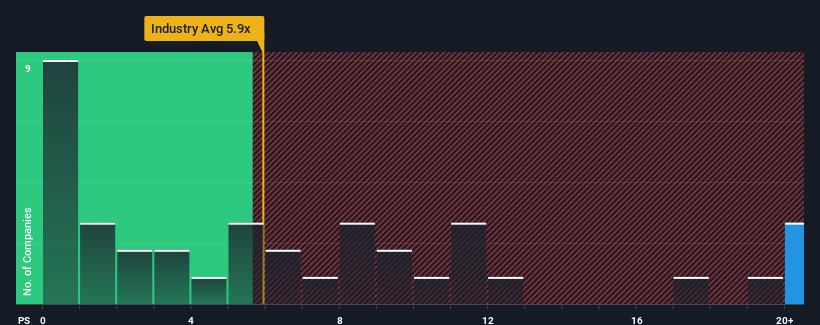

With a price-to-sales (or "P/S") ratio of 38.5x LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. (HKG:2291) may be sending very bearish signals at the moment, given that almost half of all the Medical Equipment companies in Hong Kong have P/S ratios under 5.9x and even P/S lower than 1.3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for LEPU ScienTech Medical Technology (Shanghai)

How Has LEPU ScienTech Medical Technology (Shanghai) Performed Recently?

LEPU ScienTech Medical Technology (Shanghai) has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for LEPU ScienTech Medical Technology (Shanghai), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is LEPU ScienTech Medical Technology (Shanghai)'s Revenue Growth Trending?

In order to justify its P/S ratio, LEPU ScienTech Medical Technology (Shanghai) would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Pleasingly, revenue has also lifted 113% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 118% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it concerning that LEPU ScienTech Medical Technology (Shanghai) is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does LEPU ScienTech Medical Technology (Shanghai)'s P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of LEPU ScienTech Medical Technology (Shanghai) revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for LEPU ScienTech Medical Technology (Shanghai) with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2291

LEPU ScienTech Medical Technology (Shanghai)

An investment holding company, engages in the manufacture and sale of interventional treatment series occluders for defective congenital heart disease.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026