- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2276

Shanghai Conant Optical Co., Ltd. (HKG:2276) Shares May Have Slumped 30% But Getting In Cheap Is Still Unlikely

Shanghai Conant Optical Co., Ltd. (HKG:2276) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 158% in the last twelve months.

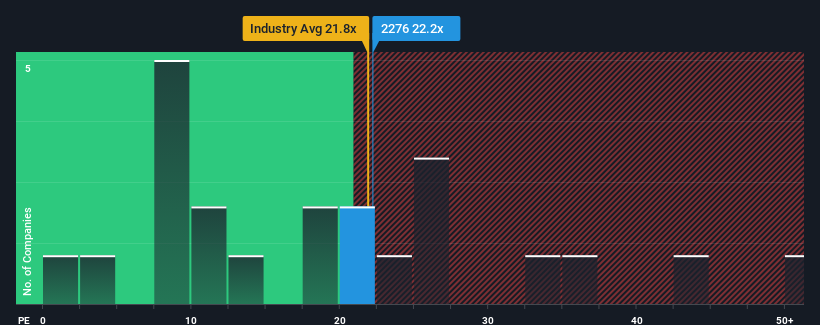

Although its price has dipped substantially, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 10x, you may still consider Shanghai Conant Optical as a stock to avoid entirely with its 22.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Shanghai Conant Optical as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Shanghai Conant Optical

Is There Enough Growth For Shanghai Conant Optical?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shanghai Conant Optical's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 34% last year. The strong recent performance means it was also able to grow EPS by 51% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 17% over the next year. With the market predicted to deliver 18% growth , the company is positioned for a comparable earnings result.

With this information, we find it interesting that Shanghai Conant Optical is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Even after such a strong price drop, Shanghai Conant Optical's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shanghai Conant Optical's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Shanghai Conant Optical has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2276

Shanghai Conant Optical

Manufactures and sells resin spectacle lenses in Mainland China, the Americas, Asia, Europe, Oceania, and Africa.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives