- Hong Kong

- /

- Personal Products

- /

- SEHK:2145

3 Asian Stocks That Investors Might Be Undervaluing By Up To 35.8%

Reviewed by Simply Wall St

As the Bank of Japan raises its benchmark interest rate to the highest level in 30 years and Chinese markets show mixed signals, investors are closely watching for opportunities within Asia's evolving economic landscape. In this environment, identifying undervalued stocks can be crucial, as they may offer potential value when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.65 | CN¥303.05 | 49.3% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.35 | HK$16.31 | 48.8% |

| Mobvista (SEHK:1860) | HK$15.56 | HK$30.71 | 49.3% |

| KoMiCo (KOSDAQ:A183300) | ₩84000.00 | ₩166235.75 | 49.5% |

| JINS HOLDINGS (TSE:3046) | ¥5560.00 | ¥10935.75 | 49.2% |

| Globe-ing (TSE:277A) | ¥2608.00 | ¥5084.63 | 48.7% |

| Global Security Experts (TSE:4417) | ¥2894.00 | ¥5707.10 | 49.3% |

| Daiichi Sankyo Company (TSE:4568) | ¥3300.00 | ¥6544.37 | 49.6% |

| Astroscale Holdings (TSE:186A) | ¥615.00 | ¥1206.38 | 49% |

| Andes Technology (TWSE:6533) | NT$243.50 | NT$483.77 | 49.7% |

Let's uncover some gems from our specialized screener.

Shanghai Chicmax Cosmetic (SEHK:2145)

Overview: Shanghai Chicmax Cosmetic Co., Ltd. is a multi-brand cosmetics company involved in the research, development, manufacture, and sale of cosmetic products both in Mainland China and internationally, with a market cap of approximately HK$35.03 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of cosmetic products, totaling CN¥7.40 billion.

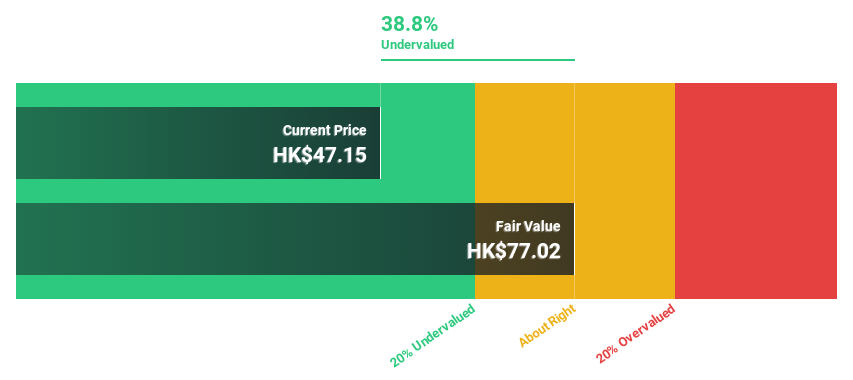

Estimated Discount To Fair Value: 16.6%

Shanghai Chicmax Cosmetic is trading at HK$88, below its estimated fair value of HK$105.52, indicating potential undervaluation based on cash flows. Despite recent insider selling and dividend decreases, the company shows strong growth prospects with earnings forecasted to grow 23.9% annually over the next three years, outpacing the Hong Kong market's growth. Recent board changes could enhance strategic direction, potentially supporting future revenue growth of 21.8% per year.

- Our expertly prepared growth report on Shanghai Chicmax Cosmetic implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Chicmax Cosmetic.

Shanghai MicroPort MedBot (Group) (SEHK:2252)

Overview: Shanghai MicroPort MedBot (Group) Co., Ltd. operates in the medical technology sector, focusing on developing and manufacturing surgical robots, with a market cap of HK$22.21 billion.

Operations: The company generates revenue from the sale of medical devices, amounting to CN¥333.70 million.

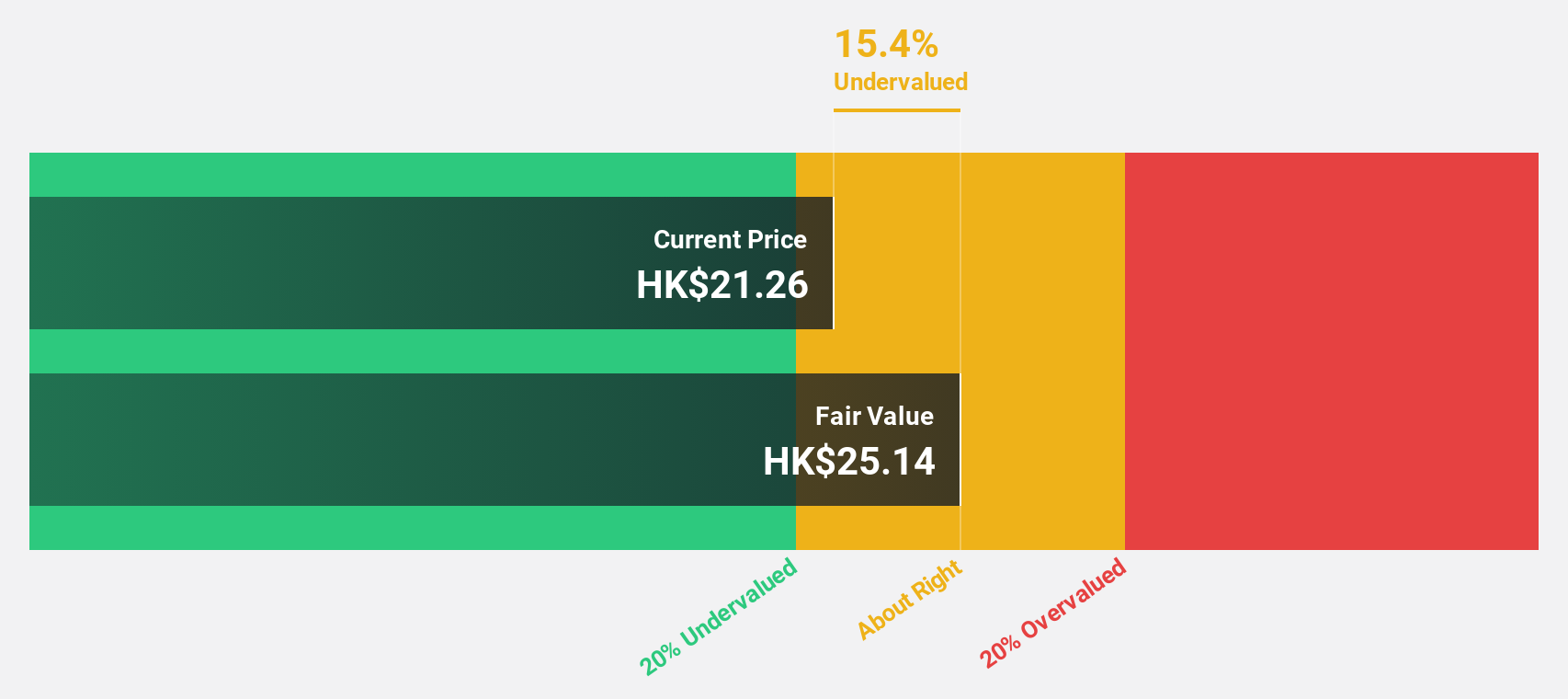

Estimated Discount To Fair Value: 14.3%

Shanghai MicroPort MedBot (Group) is trading at HK$21.54, which is 14.3% below its estimated fair value of HK$25.14, reflecting potential undervaluation based on cash flows. The company is expected to become profitable within three years and achieve revenue growth of 59.6% annually, surpassing the Hong Kong market average. Recent board restructuring could positively impact strategic direction and governance, enhancing its ability to capitalize on forecasted high earnings growth of over 100% per year.

- The analysis detailed in our Shanghai MicroPort MedBot (Group) growth report hints at robust future financial performance.

- Dive into the specifics of Shanghai MicroPort MedBot (Group) here with our thorough financial health report.

Xinjiang GuannongLtd (SHSE:600251)

Overview: Xinjiang Guannong Co., Ltd. is involved in the manufacturing, processing, trading, and selling of agricultural products in China with a market capitalization of CN¥6.97 billion.

Operations: Xinjiang Guannong Co., Ltd. generates revenue through its activities in manufacturing, processing, trading, and selling agricultural products within China.

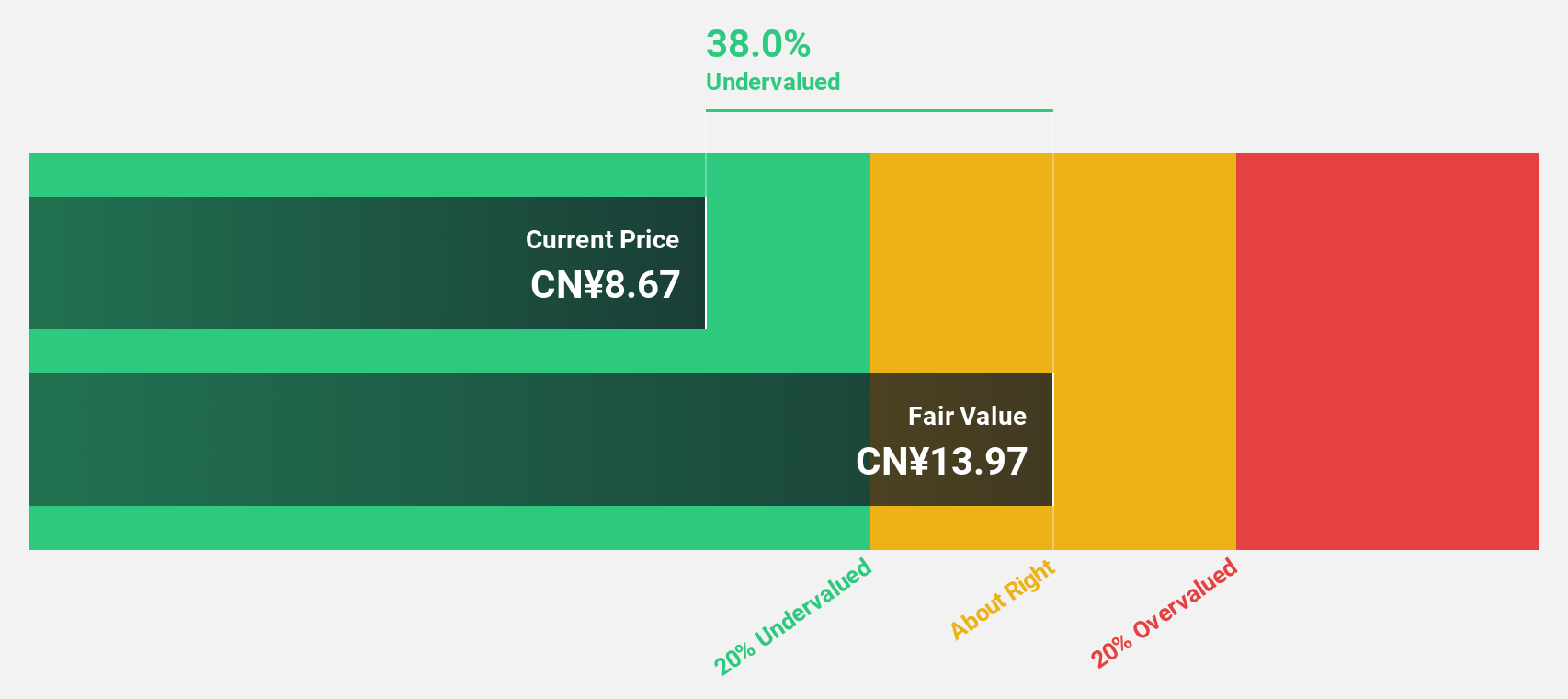

Estimated Discount To Fair Value: 35.8%

Xinjiang Guannong Ltd. is trading at CN¥8.97, significantly below its fair value estimate of CN¥13.97, indicating undervaluation based on cash flows. Despite a drop in sales to CN¥2.14 billion from the previous year's CN¥2.84 billion, net income rose to CN¥347 million from CN¥331.87 million, suggesting operational efficiency improvements. Earnings are projected to grow 48.2% annually, outpacing the Chinese market average; however, profit margins have declined and dividend stability remains an issue.

- Upon reviewing our latest growth report, Xinjiang GuannongLtd's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Xinjiang GuannongLtd's balance sheet by reading our health report here.

Next Steps

- Access the full spectrum of 272 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2145

Shanghai Chicmax Cosmetic

A multi-brand cosmetics company, engages in the research, development, manufacture, and sale of cosmetics products in Mainland China and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion