Global markets have recently shown signs of optimism as trade tensions between major economies appear to be easing, leading to a rebound in U.S. equities and positive sentiment across several indices. Amidst these developments, investors are increasingly exploring opportunities beyond the traditional market leaders. Penny stocks, though an older term, continue to represent smaller or newer companies that can offer significant value when they possess strong financial foundations and clear growth potential.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.23 | SGD8.78B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.76 | SEK281.94M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.89 | MYR1.39B | ✅ 5 ⚠️ 2 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.345 | MYR1B | ✅ 4 ⚠️ 3 View Analysis > |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.42 | MYR675.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.06 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.765 | £425.47M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.974 | £2.18B | ✅ 5 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.405 | A$64.63M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,640 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tian Tu Capital (SEHK:1973)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm that invests in small and medium-sized companies across various growth stages, with a market cap of HK$2.05 billion.

Operations: The company's revenue segment primarily comprises Asset Management, which reported -CN¥662.24 million.

Market Cap: HK$2.05B

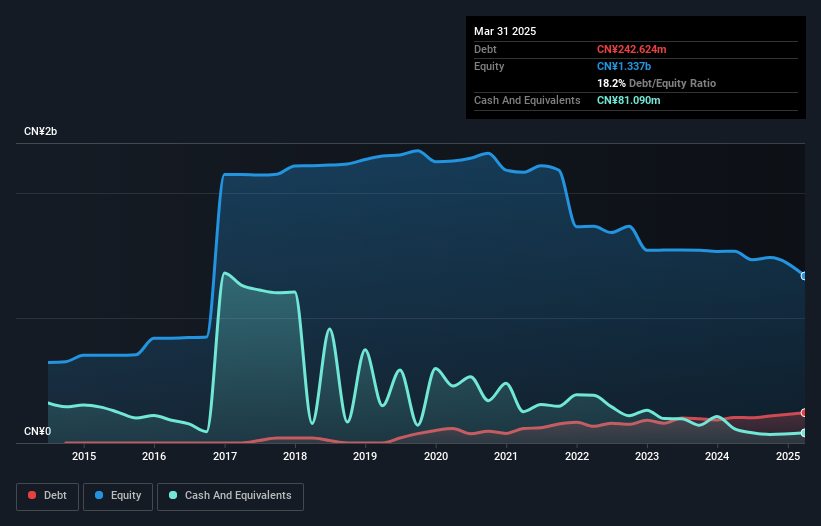

Tian Tu Capital, with a market cap of HK$2.05 billion, reported sales of CN¥42.43 million for 2024, showing a decline from the previous year. The company remains pre-revenue as its negative revenue stands at CN¥662.24 million. Despite being unprofitable with a net loss of CN¥891.49 million and negative return on equity, Tian Tu's debt situation has improved significantly over five years, reducing its debt to equity ratio from 56.1% to 15.6%. Short-term assets cover short-term liabilities but not long-term ones; however, the firm holds more cash than total debt and maintains stable weekly volatility at 10%.

- Jump into the full analysis health report here for a deeper understanding of Tian Tu Capital.

- Explore historical data to track Tian Tu Capital's performance over time in our past results report.

Broncus Holding (SEHK:2216)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Broncus Holding Corporation is a medical device company that develops interventional pulmonology products for markets in Mainland China, the European Union, the United States, and internationally, with a market cap of approximately HK$1.16 billion.

Operations: The company's revenue is derived entirely from its medical products segment, amounting to $8.13 million.

Market Cap: HK$1.16B

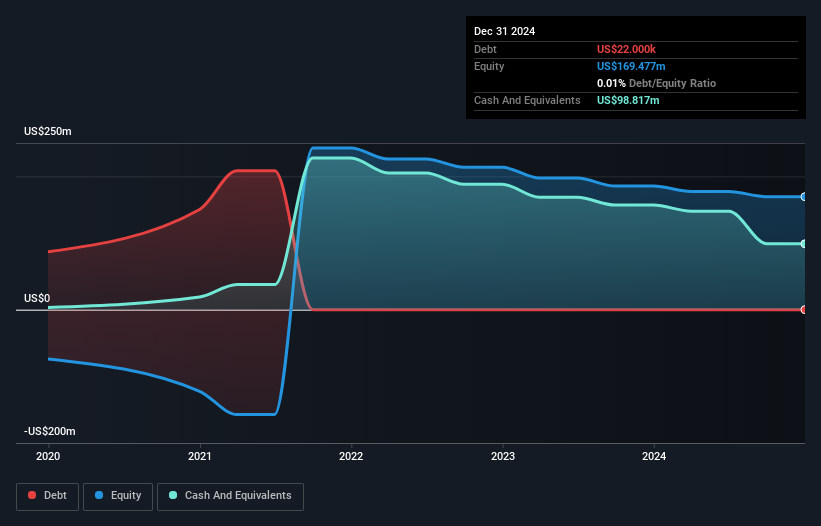

Broncus Holding Corporation, with a market cap of approximately HK$1.16 billion, reported US$8.13 million in sales for 2024, reflecting a decline from the previous year and remains unprofitable with a net loss of US$15.3 million. Despite this, the company has made strides in product development; its BroncAblate catheter received approval for marketing in China, marking an advancement in minimally invasive lung cancer treatment. The company's financial stability is supported by having more cash than debt and sufficient cash runway for over three years based on current free cash flow levels, although it experiences high share price volatility recently.

- Take a closer look at Broncus Holding's potential here in our financial health report.

- Evaluate Broncus Holding's prospects by accessing our earnings growth report.

Beijing VRV Software (SZSE:300352)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing VRV Software Corporation Limited offers network and information security solutions in China with a market cap of CN¥6.70 billion.

Operations: Beijing VRV Software Corporation Limited has not reported any specific revenue segments.

Market Cap: CN¥6.7B

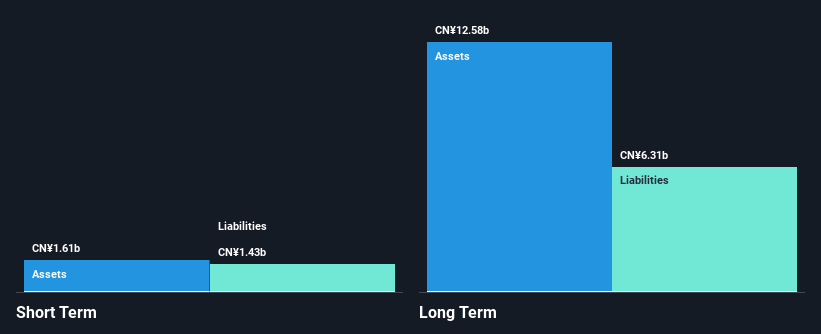

Beijing VRV Software Corporation Limited, with a market cap of CN¥6.70 billion, is navigating financial challenges as it reported a significant drop in quarterly sales to CN¥61.64 million and a net loss of CN¥52.82 million for Q1 2025. The company's debt to equity ratio has increased over the past five years, but its short-term assets exceed both long-term and short-term liabilities, suggesting some balance sheet strength. Despite being unprofitable with declining earnings over the past five years, Beijing VRV Software has secured approval for a private placement aiming to raise up to CN¥477 million, indicating efforts to bolster its financial position amidst high share price volatility.

- Click here to discover the nuances of Beijing VRV Software with our detailed analytical financial health report.

- Assess Beijing VRV Software's previous results with our detailed historical performance reports.

Taking Advantage

- Access the full spectrum of 5,640 Global Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing VRV Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300352

Beijing VRV Software

Provides network and information security solutions in China.

Excellent balance sheet minimal.

Market Insights

Community Narratives