- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2190

There's Reason For Concern Over Zylox-Tonbridge Medical Technology Co., Ltd.'s (HKG:2190) Price

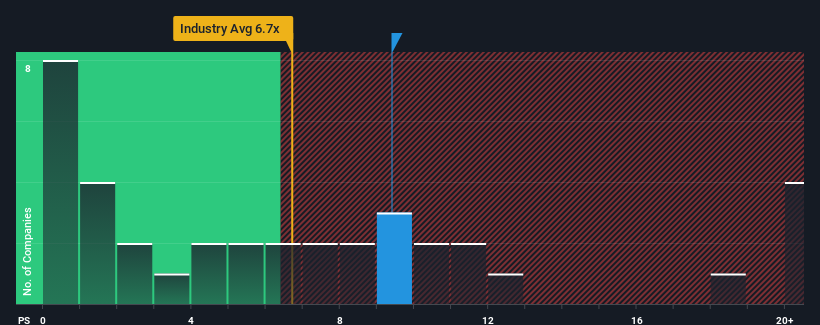

With a price-to-sales (or "P/S") ratio of 9.4x Zylox-Tonbridge Medical Technology Co., Ltd. (HKG:2190) may be sending bearish signals at the moment, given that almost half of all Medical Equipment companies in Hong Kong have P/S ratios under 6.7x and even P/S lower than 1.5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Zylox-Tonbridge Medical Technology

What Does Zylox-Tonbridge Medical Technology's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Zylox-Tonbridge Medical Technology has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Zylox-Tonbridge Medical Technology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Zylox-Tonbridge Medical Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 88%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 50% per year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 132% each year growth forecast for the broader industry.

In light of this, it's alarming that Zylox-Tonbridge Medical Technology's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Zylox-Tonbridge Medical Technology's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Zylox-Tonbridge Medical Technology trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Zylox-Tonbridge Medical Technology with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Zylox-Tonbridge Medical Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zylox-Tonbridge Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2190

Zylox-Tonbridge Medical Technology

A medical device company, provides neuro- and peripheral-vascular interventional medical devices in the People’s Republic of China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives