- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2189

Kato (Hong Kong) Holdings (HKG:2189) Is Due To Pay A Dividend Of HK$0.02

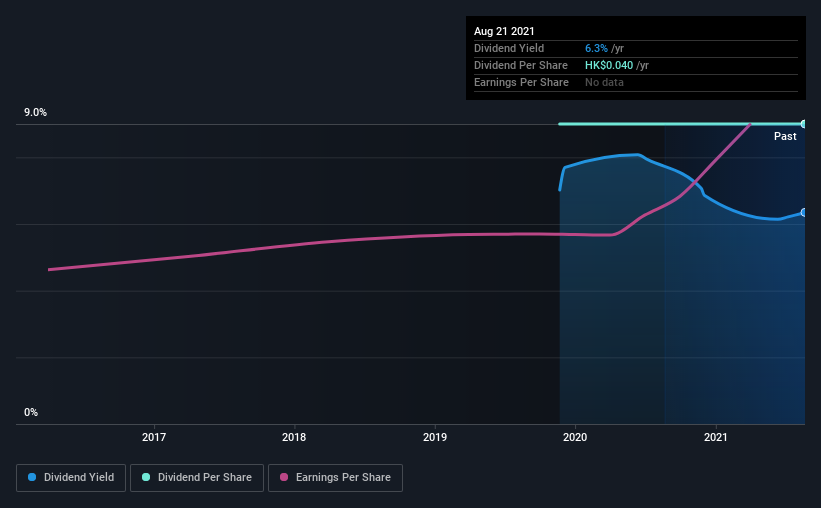

Kato (Hong Kong) Holdings Limited (HKG:2189) will pay a dividend of HK$0.02 on the 7th of September. This means the annual payment is 6.3% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Kato (Hong Kong) Holdings

Kato (Hong Kong) Holdings' Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Kato (Hong Kong) Holdings was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

If the trend of the last few years continues, EPS will grow by 14.2% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 44% by next year, which is in a pretty sustainable range.

Kato (Hong Kong) Holdings Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 2 years, which isn't that long in the grand scheme of things. The most recent annual payment of HK$0.04 is about the same as the first annual payment 2 years ago. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see Kato (Hong Kong) Holdings has been growing its earnings per share at 14% a year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

Kato (Hong Kong) Holdings Looks Like A Great Dividend Stock

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 3 warning signs for Kato (Hong Kong) Holdings that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Kato (Hong Kong) Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kato (Hong Kong) Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2189

Kato (Hong Kong) Holdings

An investment holding company, operates as a residential care home for the elderly in Hong Kong.

Good value with adequate balance sheet.

Market Insights

Community Narratives