- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2159

Mediwelcome Healthcare Management & Technology Inc. (HKG:2159) Surges 28% Yet Its Low P/S Is No Reason For Excitement

Mediwelcome Healthcare Management & Technology Inc. (HKG:2159) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

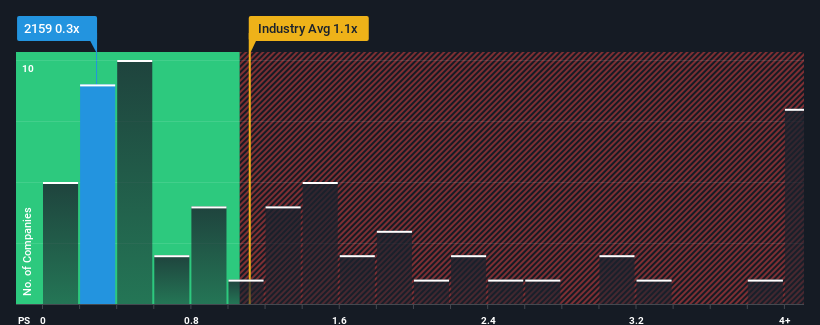

Even after such a large jump in price, when close to half the companies operating in Hong Kong's Healthcare industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Mediwelcome Healthcare Management & Technology as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Mediwelcome Healthcare Management & Technology

How Has Mediwelcome Healthcare Management & Technology Performed Recently?

We'd have to say that with no tangible growth over the last year, Mediwelcome Healthcare Management & Technology's revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. Those who are bullish on Mediwelcome Healthcare Management & Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Mediwelcome Healthcare Management & Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Mediwelcome Healthcare Management & Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Mediwelcome Healthcare Management & Technology would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 23% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Mediwelcome Healthcare Management & Technology's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Mediwelcome Healthcare Management & Technology's P/S

The latest share price surge wasn't enough to lift Mediwelcome Healthcare Management & Technology's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Mediwelcome Healthcare Management & Technology maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Mediwelcome Healthcare Management & Technology (at least 2 which can't be ignored), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Mediwelcome Healthcare Management & Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2159

Mediwelcome Healthcare Management & Technology

An investment holding company, provides integrated healthcare marketing solutions in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives