Stock Analysis

- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1789

Do AK Medical Holdings's (HKG:1789) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in AK Medical Holdings (HKG:1789). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for AK Medical Holdings

How Quickly Is AK Medical Holdings Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, AK Medical Holdings's EPS has grown 31% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. AK Medical Holdings shareholders can take confidence from the fact that EBIT margins are up from 29% to 37%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

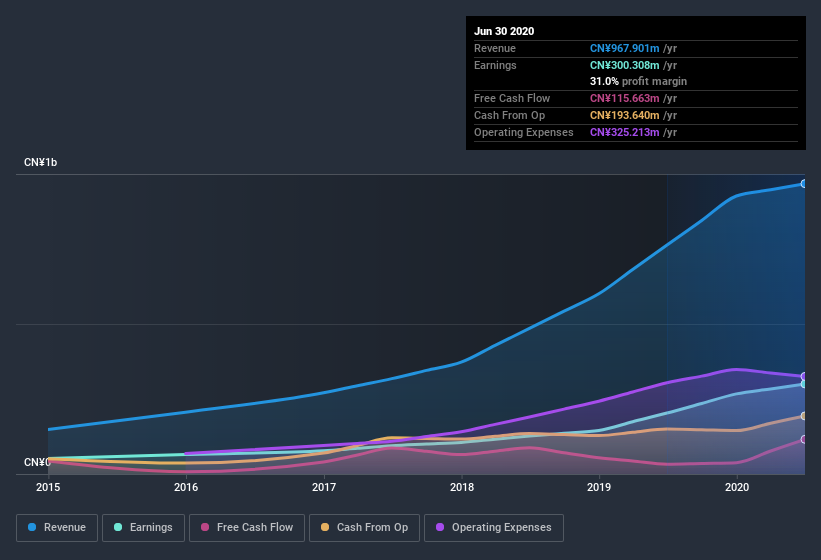

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of AK Medical Holdings's forecast profits?

Are AK Medical Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Even though there was some insider selling over the last year, that was outweighed by Chairman & CEO Zhijiang Li's huge outlay of CN¥802m, spent buying shares. We should note the average purchase price was around CN¥15.00. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

On top of the insider buying, we can also see that AK Medical Holdings insiders own a large chunk of the company. Indeed, with a collective holding of 52%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping CN¥8.1b. Now that's what I call some serious skin in the game!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Zhijiang Li is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between CN¥6.5b and CN¥21b, like AK Medical Holdings, the median CEO pay is around CN¥3.6m.

The AK Medical Holdings CEO received total compensation of just CN¥1.5m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is AK Medical Holdings Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about AK Medical Holdings's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. We should say that we've discovered 2 warning signs for AK Medical Holdings (1 is significant!) that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But AK Medical Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading AK Medical Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether AK Medical Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1789

AK Medical Holdings

An investment holding company, designs, develops, produces, and markets orthopedic joint implants and related products in China and internationally.

High growth potential with excellent balance sheet.