- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1345

Shanghai Pioneer Holding's (HKG:1345) Shareholders Will Receive A Smaller Dividend Than Last Year

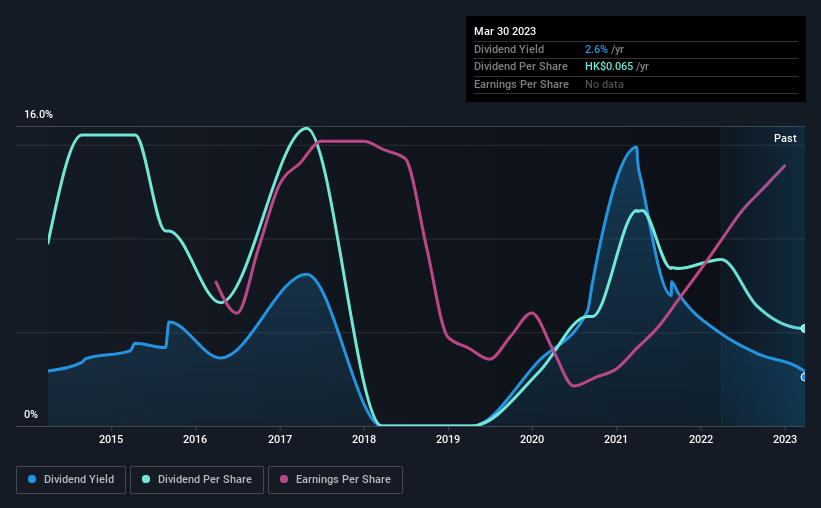

Shanghai Pioneer Holding Ltd (HKG:1345) has announced that on 15th of June, it will be paying a dividend ofCN¥0.048, which a reduction from last year's comparable dividend. However, the dividend yield of 2.6% still remains in a typical range for the industry.

View our latest analysis for Shanghai Pioneer Holding

Shanghai Pioneer Holding's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Based on the last payment, Shanghai Pioneer Holding was paying only paying out a fraction of earnings, but the payment was a massive 377% of cash flows. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Looking forward, EPS could fall by 1.8% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 32%, which is definitely feasible to continue.

Shanghai Pioneer Holding's Dividend Has Lacked Consistency

Shanghai Pioneer Holding has been paying dividends for a while, but the track record isn't stellar. This makes us cautious about the consistency of the dividend over a full economic cycle. The annual payment during the last 9 years was CN¥0.107 in 2014, and the most recent fiscal year payment was CN¥0.057. Doing the maths, this is a decline of about 6.8% per year. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Although it's important to note that Shanghai Pioneer Holding's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

The Dividend Could Prove To Be Unreliable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Shanghai Pioneer Holding that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1345

Shanghai Pioneer Holding

An investment holding company, engages in marketing, promotion and channel management of pharmaceutical products and medical devices primarily in the People’s Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives