- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1302

LifeTech Scientific (SEHK:1302): Valuation Insights Following China Approval of G-BranchTM Stent Graft System

Reviewed by Simply Wall St

LifeTech Scientific (SEHK:1302) has received official approval from the China National Medical Products Administration for its G-BranchTM thoracoabdominal artery stent graft system. This marks a major regulatory milestone for the company and its medical device portfolio.

See our latest analysis for LifeTech Scientific.

Even with this breakthrough regulatory approval, LifeTech Scientific’s stock has experienced some choppiness in recent months. While the 1-year total shareholder return sits at an impressive 23.03%, the share price is still down over the last quarter. Short-term volatility aside, momentum remains positive for long-term holders, showing that the market is recognizing both the growth potential and past headwinds.

If LifeTech’s regulatory progress has your attention, you might also want to see which other healthcare leaders are gaining momentum. See the full list for free.

So with shares still trading at a sizable discount to analyst price targets despite recent catalysts, does this present investors with an attractive entry point, or has the market already priced in LifeTech Scientific’s next leg of growth?

Price-to-Earnings of 110x: Is it justified?

LifeTech Scientific trades at a price-to-earnings (P/E) ratio of 110x, far exceeding both peer and industry averages, despite its last close at HK$1.87. This lofty multiple stands out even before considering the company’s recent stock performance and earnings profile.

The P/E ratio measures how much investors are willing to pay for each dollar of the company’s earnings, making it a key tool in evaluating whether a stock is priced for growth, stability, or something else entirely. For a medical equipment company facing volatile results and negative earnings growth, such a high P/E suggests the market is anticipating significant future performance, or perhaps is overly optimistic given recent history.

Compared to its peers, LifeTech Scientific’s P/E ratio is more than three times the peer average of 30.9x and over five times higher than the Hong Kong Medical Equipment industry average of 21x. This differential shows an extreme level of optimism that may not be mirrored in comparable companies.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 110x (OVERVALUED)

However, risks remain if LifeTech Scientific cannot sustain profitability or if market optimism fades. This could quickly erode the stock’s premium valuation.

Find out about the key risks to this LifeTech Scientific narrative.

Another View: Discounted Cash Flow Estimate

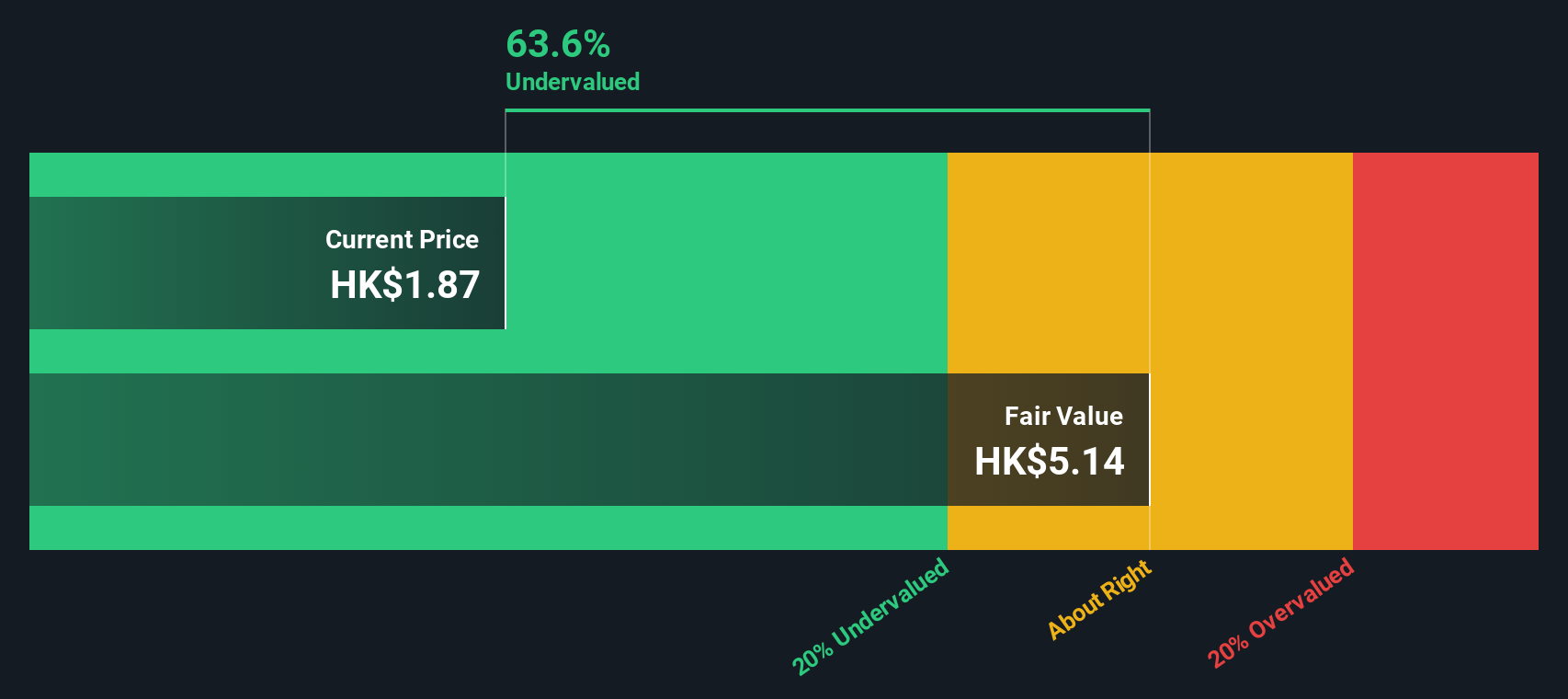

While LifeTech Scientific’s price-to-earnings ratio appears expensive compared to its peers and the broader industry, another approach offers a different perspective. Our DCF model estimates the company's fair value at HK$5.12 per share, which is about 63.5% above the current price. Are investors overlooking deeper potential, or is the market being realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out LifeTech Scientific for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own LifeTech Scientific Narrative

If you want to see things from another angle or prefer digging into the numbers yourself, it’s quick and easy to build your own story. Do it your way

A great starting point for your LifeTech Scientific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investments don't wait. Broaden your opportunities now and make the most of new market trends using the tailored stock screeners on Simply Wall Street.

- Uncover tomorrow’s tech leaders by checking out these 27 AI penny stocks, where promising innovators in artificial intelligence are gaining traction.

- Lock in potential income with these 15 dividend stocks with yields > 3%, a shortcut to companies offering attractive yields above 3% and robust fundamentals.

- Catch early-stage opportunities with these 3585 penny stocks with strong financials, putting you at the forefront of small-cap growth stories with big potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1302

LifeTech Scientific

An investment holding company, develops, manufactures, and trades in interventional medical devices for cardiovascular and peripheral vascular diseases and disorders in Mainland China, Europe, Rest of Asia, India, South America, Africa, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives