- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1066

Evaluating Shandong Weigao Group Medical Polymer (SEHK:1066) After Dividend and Incentive Scheme Announcements

Reviewed by Kshitija Bhandaru

Shandong Weigao Group Medical Polymer (SEHK:1066) is making waves with its latest announcement of an interim cash dividend and a plan to roll out a new H Share Incentive Scheme. These moves highlight the company’s commitment to rewarding shareholders and enhancing governance.

See our latest analysis for Shandong Weigao Group Medical Polymer.

Shares of Shandong Weigao Group Medical Polymer have seen incremental upward movement lately as momentum builds around its interim dividend announcement and governance updates, including board changes and bylaw amendments. Despite these positive signals, the company’s 1-year total shareholder return remains flat, reflecting that optimism about future growth is just starting to take hold.

If the recent dividend action has you considering healthcare trends, why not explore more opportunities with our comprehensive See the full list for free.?

But with the stock up only modestly this year and fresh governance changes in motion, could investors be overlooking value here, or is the market already accounting for the company’s growth prospects in its current price?

Price-to-Earnings of 13x: Is it justified?

At a glance, Shandong Weigao Group Medical Polymer is trading at a price-to-earnings (P/E) ratio of 13x, which puts the last close of HK$6.16 firmly below the sector norm. Compared to peers, this suggests a significant discount in how the market is valuing its earnings today.

The price-to-earnings ratio shows how much investors are willing to pay for each dollar of current earnings. For a medical equipment company like Shandong Weigao, this figure is key because it captures how the market views its ongoing growth, profitability, and risk profile compared with other sector players.

Shandong Weigao’s 13x P/E stands well below both the industry average of 20.6x and the peer average of 23.8x. This points to undervalued potential if earnings expectations are met. Our analysis also places the fair price-to-earnings ratio at 17.9x, a level the market could return to as sentiment shifts.

Explore the SWS fair ratio for Shandong Weigao Group Medical Polymer

Result: Price-to-Earnings of 13x (UNDERVALUED)

However, continued soft long-term returns and lingering market skepticism could limit upside, particularly if future governance or earnings momentum slows.

Find out about the key risks to this Shandong Weigao Group Medical Polymer narrative.

Another View: What Does the SWS DCF Model Say?

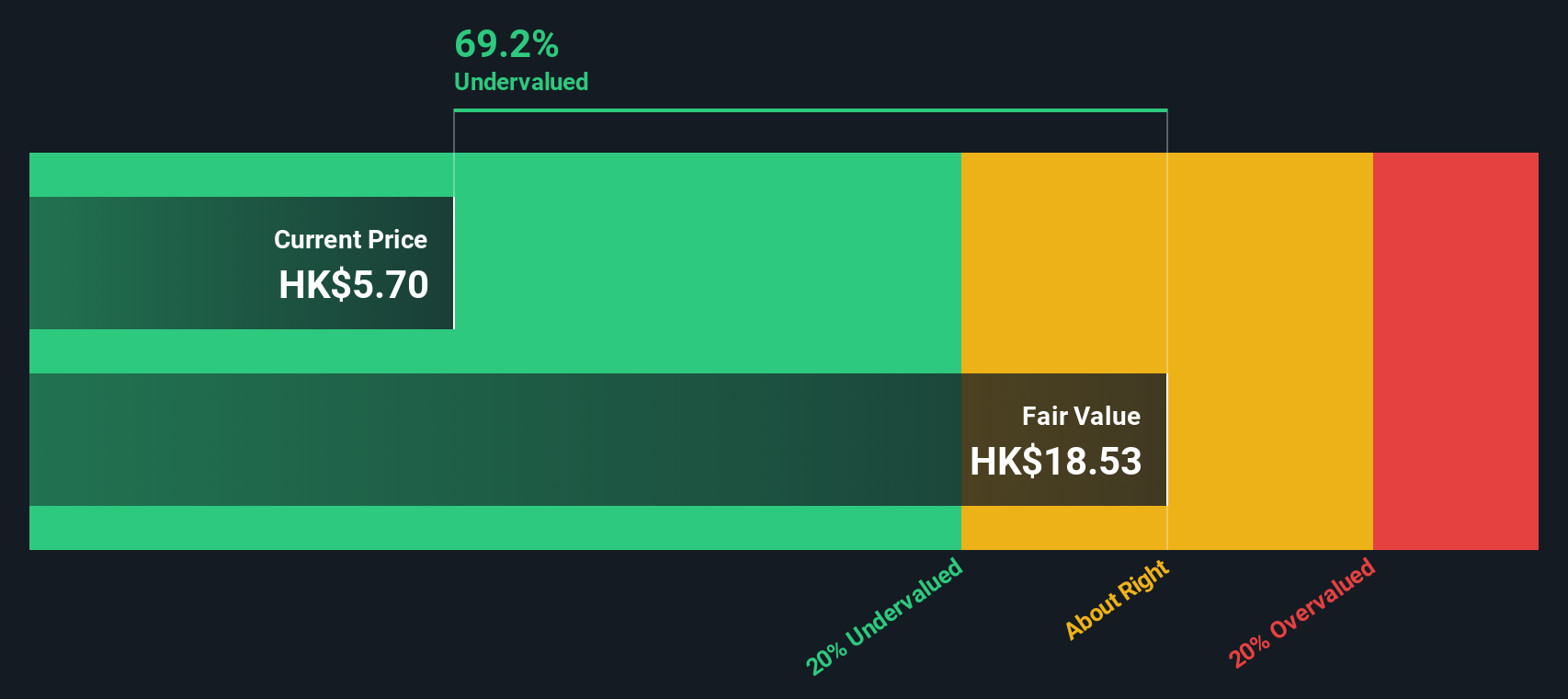

Taking a different angle, our SWS DCF model estimates Shandong Weigao Group Medical Polymer’s fair value at HK$18.69, which is 67% above its current share price of HK$6.16. This suggests the market may be missing the company’s potential. However, is it really that simple?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shandong Weigao Group Medical Polymer for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shandong Weigao Group Medical Polymer Narrative

Of course, if you see the numbers differently or want to dig deeper on your own terms, you’re invited to explore the data yourself and shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Shandong Weigao Group Medical Polymer research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not limit themselves to just one opportunity. Take action now and tap into unique stocks that could fuel your next portfolio win.

- Accelerate your hunt for standout returns with these 886 undervalued stocks based on cash flows, which feature attractive pricing and strong future cash flow potential.

- Unlock steady income with these 19 dividend stocks with yields > 3%, offering yields above 3 percent and robust dividend histories.

- Ride the momentum of market innovation by targeting these 25 AI penny stocks, positioned to benefit from the AI transformation sweeping across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1066

Shandong Weigao Group Medical Polymer

Engages in the research and development, production, wholesale, and sale of medical devices in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives