- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1066

Earnings Not Telling The Story For Shandong Weigao Group Medical Polymer Company Limited (HKG:1066)

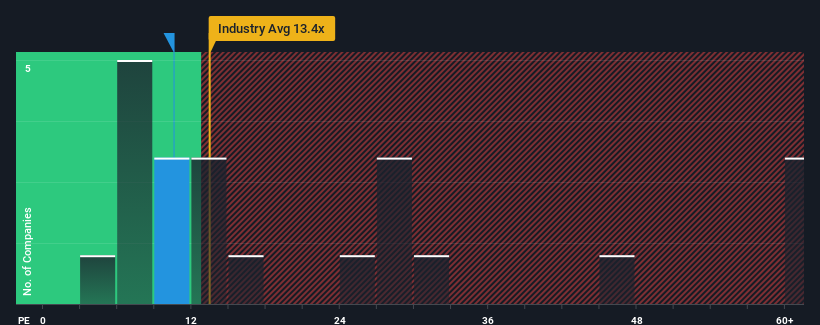

It's not a stretch to say that Shandong Weigao Group Medical Polymer Company Limited's (HKG:1066) price-to-earnings (or "P/E") ratio of 10.6x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Shandong Weigao Group Medical Polymer's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Shandong Weigao Group Medical Polymer

Is There Some Growth For Shandong Weigao Group Medical Polymer?

In order to justify its P/E ratio, Shandong Weigao Group Medical Polymer would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 5.8% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 10% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is noticeably more attractive.

With this information, we find it interesting that Shandong Weigao Group Medical Polymer is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Shandong Weigao Group Medical Polymer's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shandong Weigao Group Medical Polymer, and understanding should be part of your investment process.

If you're unsure about the strength of Shandong Weigao Group Medical Polymer's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1066

Shandong Weigao Group Medical Polymer

Engages in the research and development, production, wholesale, and sale of medical devices in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives