- Hong Kong

- /

- Hospitality

- /

- SEHK:184

3 Promising Penny Stocks With Market Caps Up To US$200M

Reviewed by Simply Wall St

Global markets have experienced a mixed performance recently, with major indices showing varied results amid economic data releases and profit-taking trends. Despite these fluctuations, the search for promising investment opportunities continues, especially in less conventional areas like penny stocks. Often seen as smaller or newer companies, penny stocks can offer unique growth potential when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.66 | HK$40.08B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,802 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Keck Seng Investments (Hong Kong) (SEHK:184)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Keck Seng Investments (Hong Kong) Limited is an investment holding company involved in hotel and club operations, as well as property investment and development across Macau, Vietnam, China, Japan, Canada, the United States, and Hong Kong with a market cap of HK$711.02 million.

Operations: The company's revenue is primarily derived from its hotel operations in the United States (HK$801.38 million), Vietnam (HK$687.34 million), Canada (HK$56.23 million), Japan (HK$28.01 million), and China (HK$41.31 million), along with property investments in Macau amounting to HK$98.81 million.

Market Cap: HK$711.02M

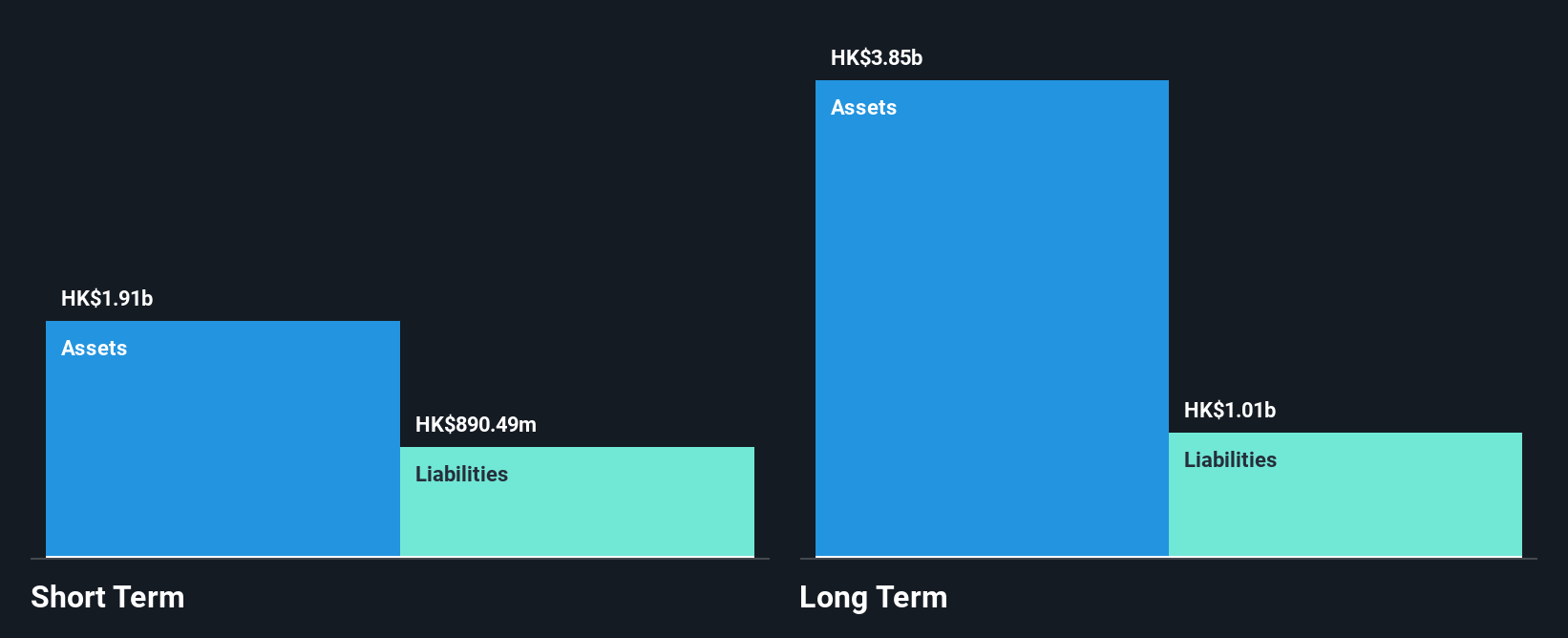

Keck Seng Investments (Hong Kong) Limited has demonstrated significant financial growth, with earnings increasing by a substantial 128.4% over the past year, outpacing the hospitality industry average. The company's balance sheet is robust, with short-term assets of HK$1.9 billion exceeding both its short and long-term liabilities. Despite a low return on equity at 9.7%, Keck Seng's debt levels are well-managed, supported by strong operating cash flow and more cash than total debt. However, its dividend history remains unstable and it trades significantly below estimated fair value, presenting potential opportunities for investors seeking undervalued stocks in this sector.

- Click here to discover the nuances of Keck Seng Investments (Hong Kong) with our detailed analytical financial health report.

- Explore historical data to track Keck Seng Investments (Hong Kong)'s performance over time in our past results report.

Shenguan Holdings (Group) (SEHK:829)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenguan Holdings (Group) Limited is an investment holding company that manufactures and sells edible collagen sausage casing products in Mainland China, Asia, and internationally, with a market cap of HK$920.69 million.

Operations: The company's revenue is primarily derived from its manufacture and sale of edible collagen sausage casing products, amounting to CN¥1.05 billion.

Market Cap: HK$920.69M

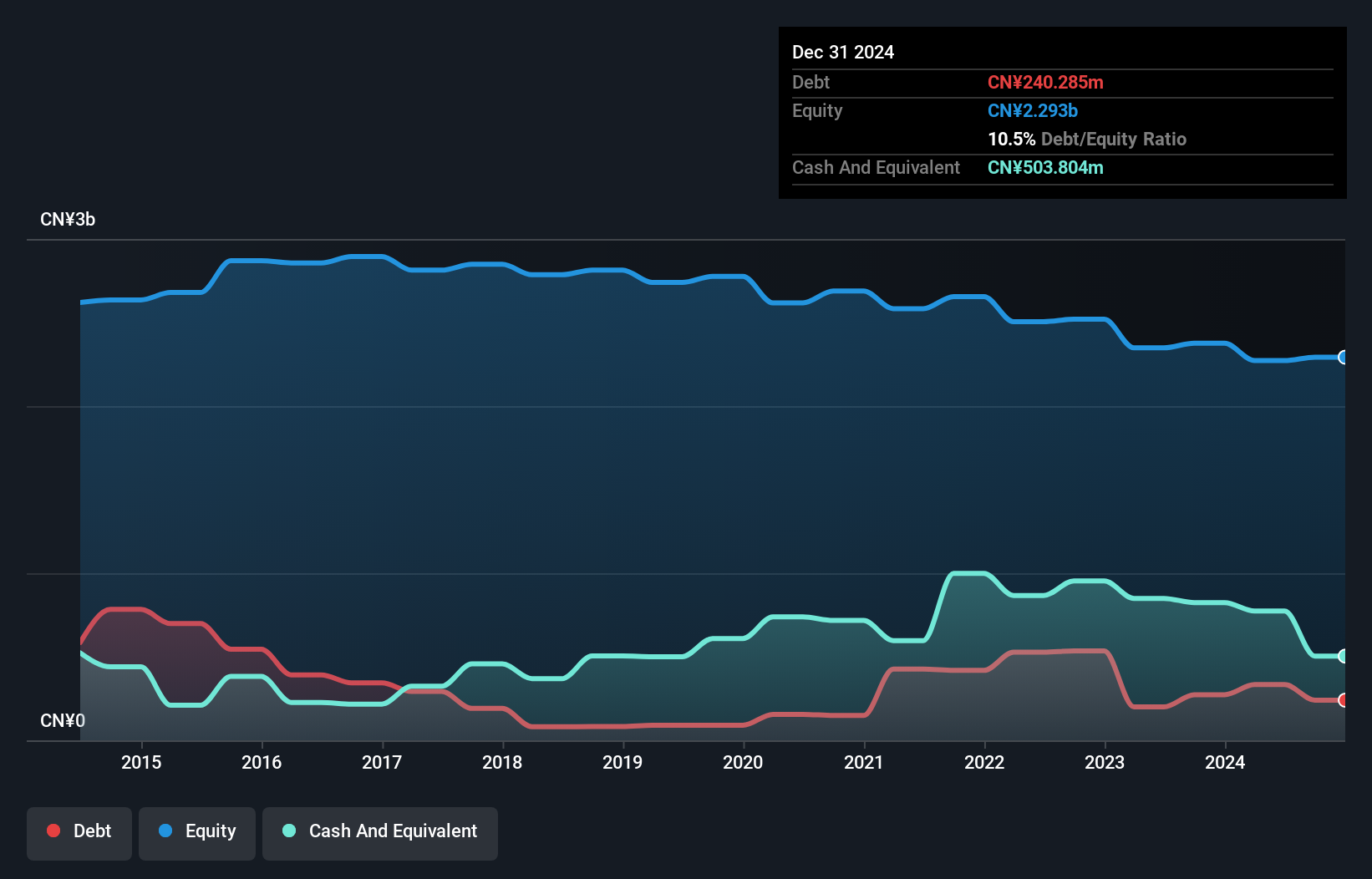

Shenguan Holdings (Group) Limited has seen a remarkable earnings growth of 240.4% over the past year, surpassing the food industry's decline, although its five-year average reveals a 20.6% annual decrease. The company maintains more cash than its total debt and covers short-term liabilities comfortably with CN¥1.7 billion in assets. However, Shenguan's return on equity is low at 1.7%, and its dividend of 12.97% is not well supported by earnings or free cash flows. Recent shareholder meetings have focused on revoking mandates for share issuance, indicating potential strategic shifts in capital management policies.

- Click here and access our complete financial health analysis report to understand the dynamics of Shenguan Holdings (Group).

- Gain insights into Shenguan Holdings (Group)'s historical outcomes by reviewing our past performance report.

Yggdrazil Group (SET:YGG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yggdrazil Group Public Company Limited offers computer graphics services for advertising, music, videos and movies, and animation in Thailand with a market cap of THB373.24 million.

Operations: The company's revenue is derived from three main segments: Games (THB78.52 million), Animation (THB64.41 million), and Computer Graphics, including Fine-Tuning Computer Graph Wings (THB72.17 million).

Market Cap: THB373.24M

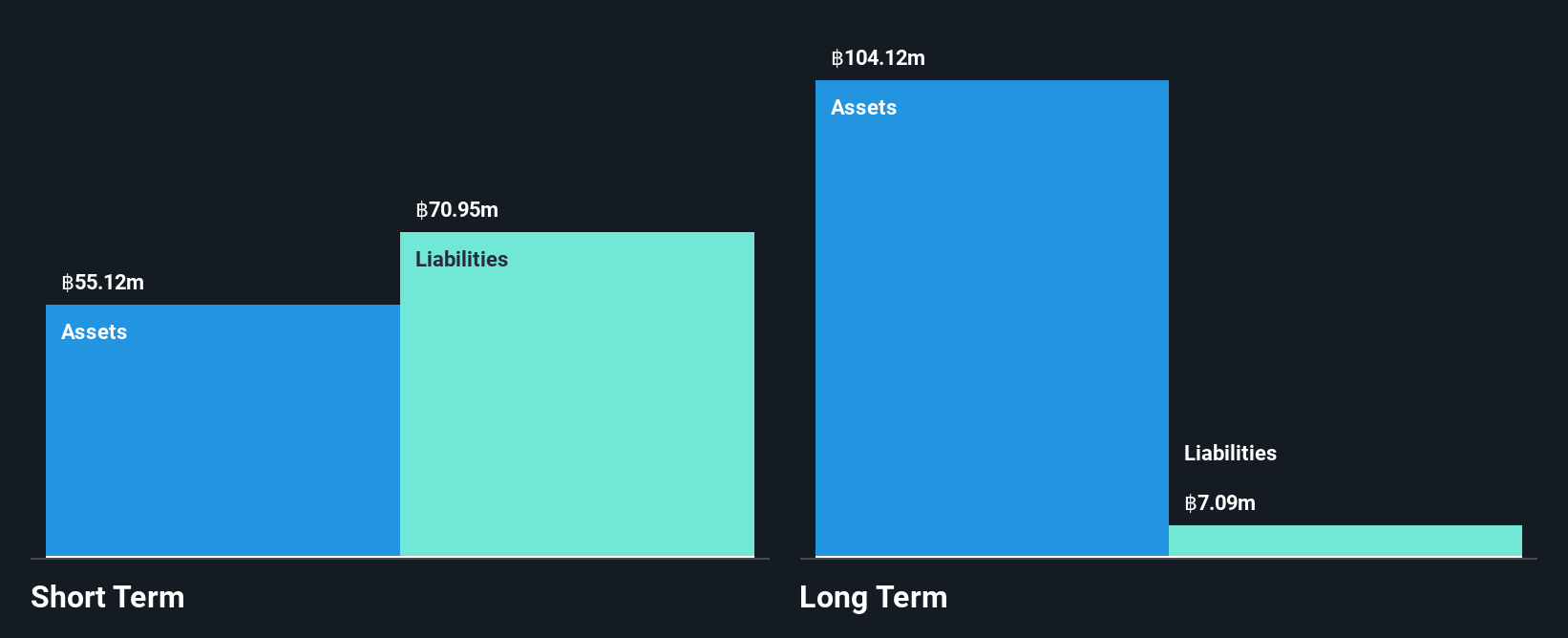

Yggdrazil Group faces challenges as its recent financial performance reveals declining sales and profitability. For the third quarter of 2024, sales fell to THB25.94 million from THB93.32 million a year prior, with a net loss of THB37.17 million compared to a previous net income of THB30.35 million. Despite having short-term assets exceeding liabilities and satisfactory debt levels, the company remains unprofitable with negative operating cash flow and high share price volatility. The board is actively addressing capital structure issues by reducing registered capital, reflecting ongoing efforts to stabilize financial health amidst significant earnings declines over the past five years.

- Get an in-depth perspective on Yggdrazil Group's performance by reading our balance sheet health report here.

- Explore Yggdrazil Group's analyst forecasts in our growth report.

Key Takeaways

- Gain an insight into the universe of 5,802 Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keck Seng Investments (Hong Kong) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:184

Keck Seng Investments (Hong Kong)

An investment holding company, engages in hotel and club operations, and property investment and development activities in Macau, Vietnam, the People's Republic of China, Japan, Canada, the United States, and Hong Kong.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success