As global markets navigate a complex landscape marked by inflation concerns and shifting economic policies, investors are keenly observing the performance of various indices. With U.S. equities experiencing declines amid political uncertainty and inflation fears, attention turns to value stocks that have shown resilience in such turbulent times. In this environment, identifying stocks trading below their estimated fair value can offer potential opportunities for investors seeking to capitalize on market inefficiencies while maintaining a focus on long-term fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.11 | CN¥34.17 | 49.9% |

| Clear Secure (NYSE:YOU) | US$26.72 | US$53.44 | 50% |

| Helens International Holdings (SEHK:9869) | HK$1.93 | HK$3.85 | 49.9% |

| Ningbo Haitian Precision MachineryLtd (SHSE:601882) | CN¥20.34 | CN¥40.47 | 49.7% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.99 | CLP580.39 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.93 | CN¥43.67 | 49.8% |

| Constellium (NYSE:CSTM) | US$10.35 | US$20.64 | 49.8% |

| Q Technology (Group) (SEHK:1478) | HK$5.31 | HK$10.61 | 49.9% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.88 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

ZJLD Group (SEHK:6979)

Overview: ZJLD Group Inc is involved in the production and sale of baijiu products in China, with a market capitalization of approximately HK$21.65 billion.

Operations: The company's revenue is primarily derived from its baijiu product lines, with CN¥4.98 billion from Zhen Jiu, CN¥1.29 billion from Li Du, CN¥844.13 million from Xiang Jiao, and CN¥388.16 million from Kai Kou Xiao.

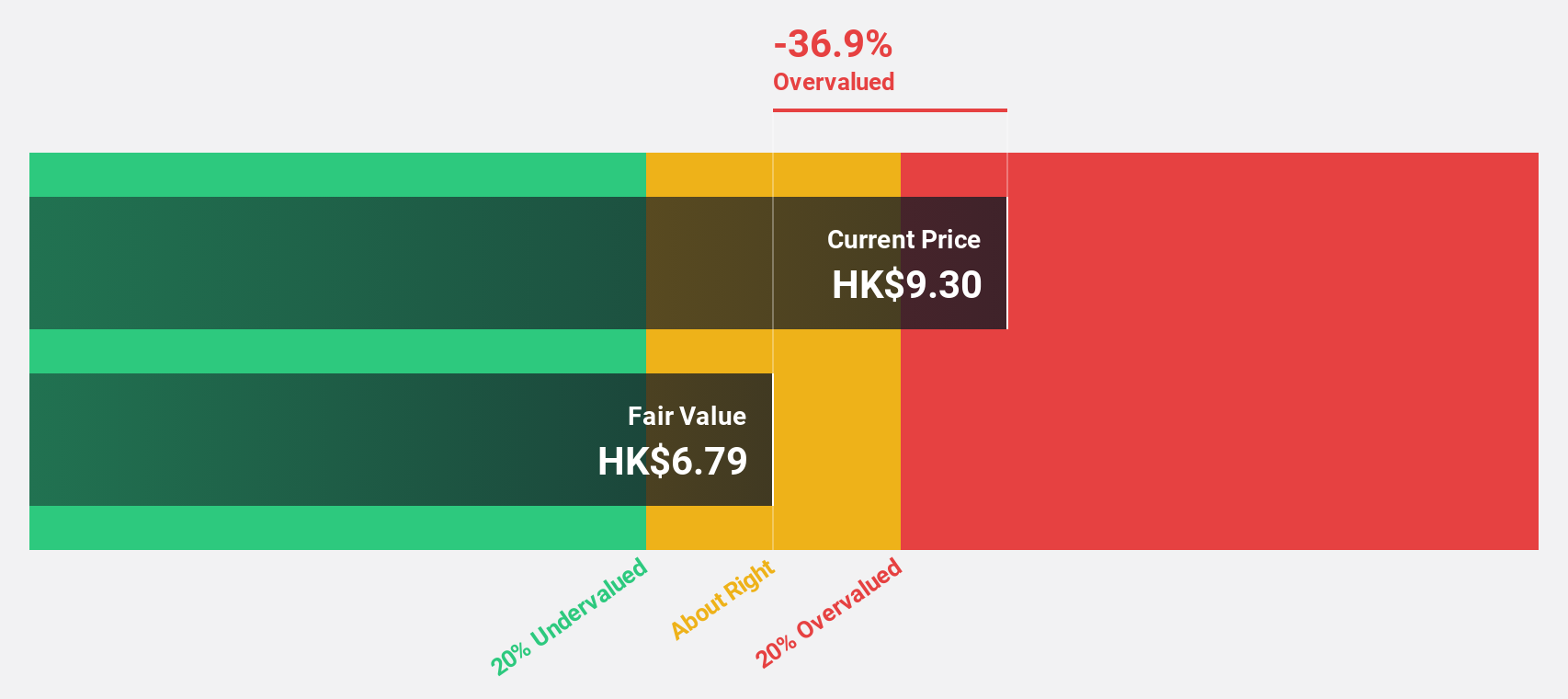

Estimated Discount To Fair Value: 32.5%

ZJLD Group is trading at HK$6.4, below its estimated fair value of HK$9.47, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution and a decrease in profit margins from 33.1% to 19.5%, the company's earnings are forecasted to grow significantly at 21.1% annually, outpacing the Hong Kong market's growth rate of 10.6%. However, insider selling in the past quarter warrants cautious observation.

- Our growth report here indicates ZJLD Group may be poised for an improving outlook.

- Navigate through the intricacies of ZJLD Group with our comprehensive financial health report here.

Tongqinglou Catering (SHSE:605108)

Overview: Tongqinglou Catering Co., Ltd. operates as a provider of catering services in China and has a market capitalization of CN¥5.59 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue primarily from its catering services in China.

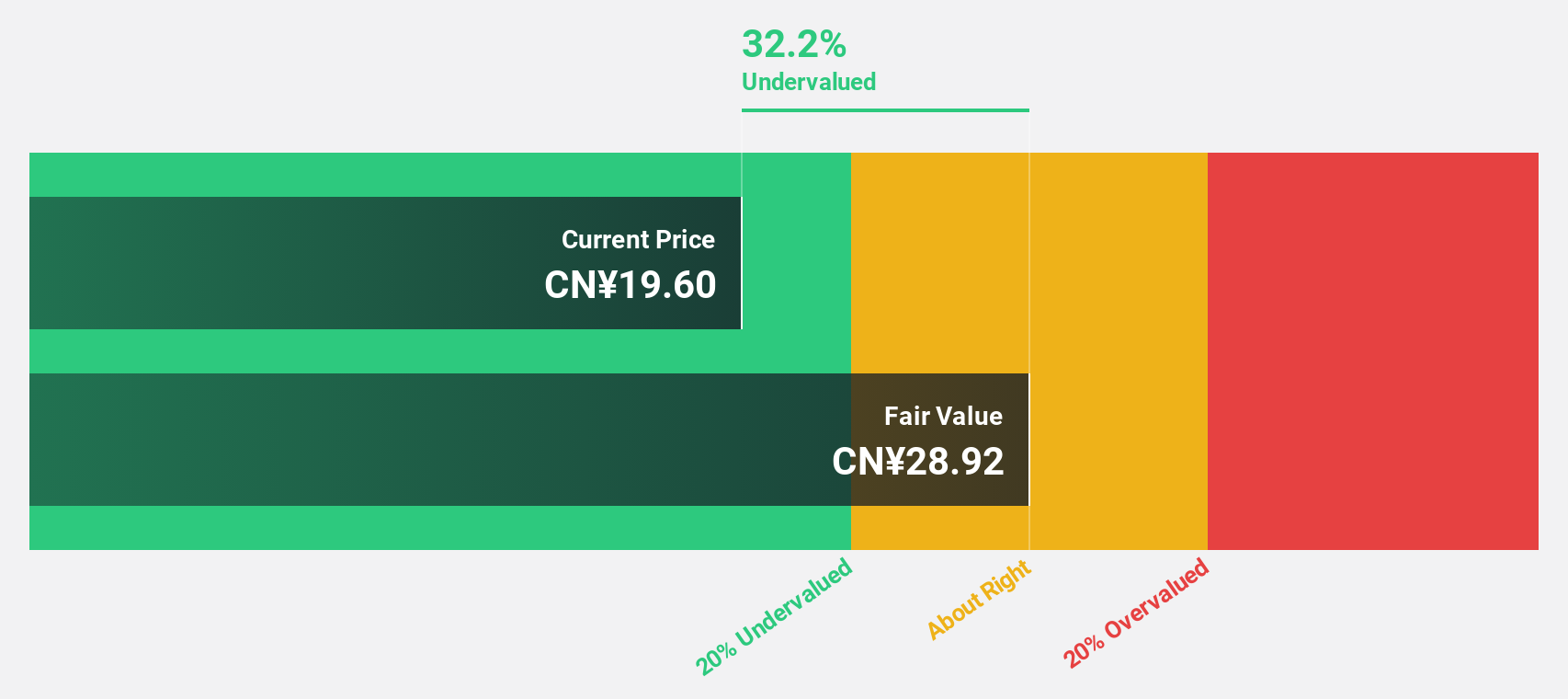

Estimated Discount To Fair Value: 49.8%

Tongqinglou Catering, trading at CN¥21.93, is considered undervalued with a fair value estimate of CN¥43.67, highlighting potential based on cash flows despite its high debt level. Revenue growth is projected at 20.6% annually, surpassing the Chinese market average of 13.3%, while earnings are expected to rise significantly by 40.8% per year over three years. However, recent results show declining net income and earnings per share compared to the previous year.

- Our earnings growth report unveils the potential for significant increases in Tongqinglou Catering's future results.

- Click to explore a detailed breakdown of our findings in Tongqinglou Catering's balance sheet health report.

Shandong Link Science and TechnologyLtd (SZSE:001207)

Overview: Shandong Link Science and Technology Co., Ltd. operates in the technology sector with a market capitalization of CN¥3.92 billion.

Operations: The company's revenue segments are not specified in the provided text.

Estimated Discount To Fair Value: 36.7%

Shandong Link Science and Technology Ltd., trading at CN¥19.57, is significantly undervalued with a fair value estimate of CN¥30.93, offering potential based on cash flows. The company reported strong earnings growth for the past year and forecasts indicate continued significant profit growth of 24.8% annually over the next three years, outpacing the market average. Recent revenue increased to CN¥1.65 billion from CN¥1.42 billion, although dividend stability remains a concern due to an unstable track record.

- According our earnings growth report, there's an indication that Shandong Link Science and TechnologyLtd might be ready to expand.

- Take a closer look at Shandong Link Science and TechnologyLtd's balance sheet health here in our report.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 880 more companies for you to explore.Click here to unveil our expertly curated list of 883 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZJLD Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6979

ZJLD Group

Engages in the production and sale of baijiu products in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives