Returns At Tingyi (Cayman Islands) Holding (HKG:322) Appear To Be Weighed Down

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. In light of that, when we looked at Tingyi (Cayman Islands) Holding (HKG:322) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Tingyi (Cayman Islands) Holding is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = CN¥3.6b ÷ (CN¥59b - CN¥32b) (Based on the trailing twelve months to June 2023).

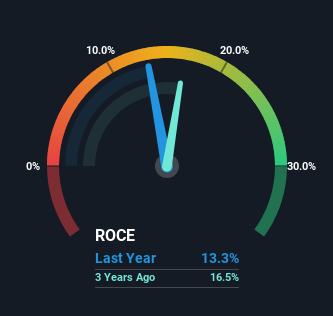

Therefore, Tingyi (Cayman Islands) Holding has an ROCE of 13%. In absolute terms, that's a satisfactory return, but compared to the Food industry average of 9.3% it's much better.

See our latest analysis for Tingyi (Cayman Islands) Holding

In the above chart we have measured Tingyi (Cayman Islands) Holding's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Tingyi (Cayman Islands) Holding here for free.

What Does the ROCE Trend For Tingyi (Cayman Islands) Holding Tell Us?

Over the past five years, Tingyi (Cayman Islands) Holding's ROCE and capital employed have both remained mostly flat. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. So don't be surprised if Tingyi (Cayman Islands) Holding doesn't end up being a multi-bagger in a few years time. That probably explains why Tingyi (Cayman Islands) Holding has been paying out 100% of its earnings as dividends to shareholders. These mature businesses typically have reliable earnings and not many places to reinvest them, so the next best option is to put the earnings into shareholders pockets.

On a separate but related note, it's important to know that Tingyi (Cayman Islands) Holding has a current liabilities to total assets ratio of 55%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

In Conclusion...

We can conclude that in regards to Tingyi (Cayman Islands) Holding's returns on capital employed and the trends, there isn't much change to report on. Unsurprisingly, the stock has only gained 21% over the last five years, which potentially indicates that investors are accounting for this going forward. Therefore, if you're looking for a multi-bagger, we'd propose looking at other options.

If you'd like to know about the risks facing Tingyi (Cayman Islands) Holding, we've discovered 1 warning sign that you should be aware of.

While Tingyi (Cayman Islands) Holding isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Tingyi (Cayman Islands) Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:322

Tingyi (Cayman Islands) Holding

An investment holding company, manufactures and sells instant noodles, beverages, and instant food products in the People’s Republic of China.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives