Will New Leadership Appointments Reshape China Resources Beer (SEHK:291)'s Management and Governance Narrative?

Reviewed by Sasha Jovanovic

- China Resources Beer (Holdings) announced the appointment of Mr. Xu Lin and Ms. Yang Hongxia as executive directors and Ms. Hon Wai Man Samantha as an independent non-executive director, with all appointments effective from November 18, 2025.

- With backgrounds spanning senior finance, operations and investment banking roles, these newly appointed directors bring deep expertise that could influence the company's future governance and business initiatives.

- We'll explore how the appointment of a chief financial officer with wide-ranging experience shapes China Resources Beer's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is China Resources Beer (Holdings)'s Investment Narrative?

To be a shareholder of China Resources Beer (Holdings), it comes down to confidence in the company's ability to deliver steady earnings growth, remain competitive in the beverage industry, and manage corporate governance effectively. The latest round of board changes, bringing in Ms. Yang Hongxia as CFO and executive director, and appointing Ms. Hon Wai Man Samantha as an independent non-executive director, signals an effort to strengthen both financial leadership and oversight. While the company still faces familiar catalysts and risks such as slower expected profit growth and board inexperience, these new appointments add fresh expertise that may help address governance challenges and improve decision-making. That said, the immediate impact on short-term catalysts or risk profile is likely to be limited, as share price moves have not shown a material change. Investors are watching for signs of greater board stability and operational clarity as the company moves forward.

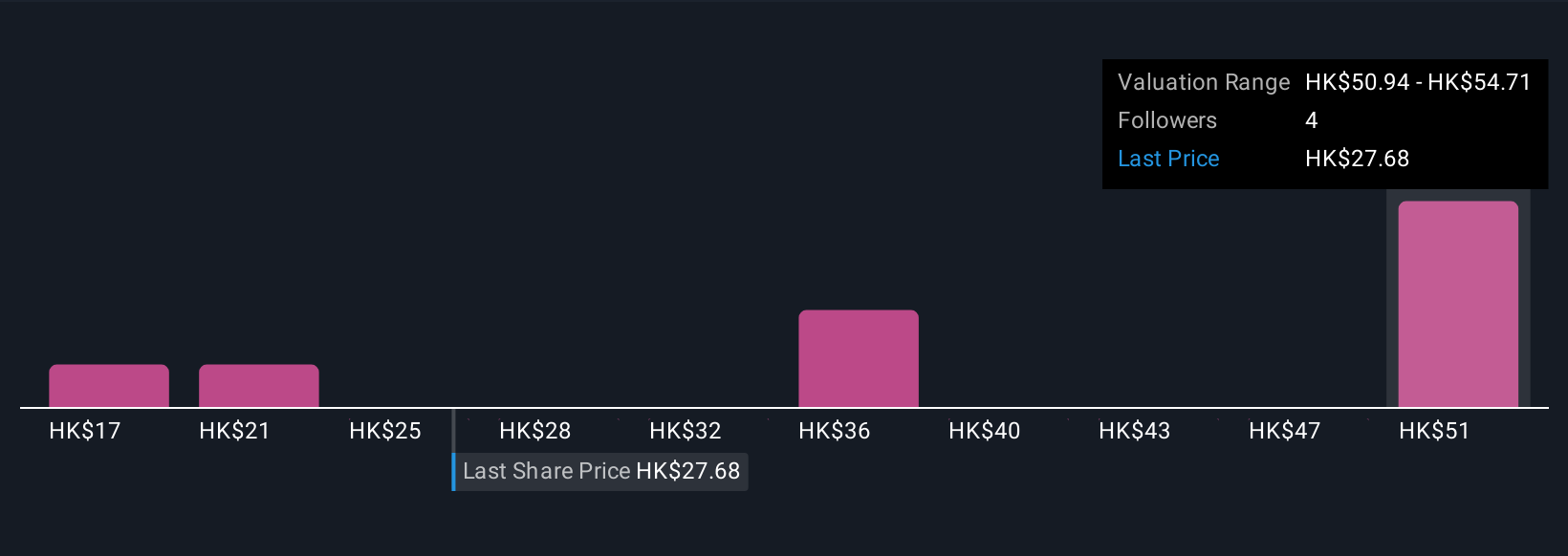

But on the flip side, the board's relative inexperience is still something investors should watch closely. Despite retreating, China Resources Beer (Holdings)'s shares might still be trading 50% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on China Resources Beer (Holdings) - why the stock might be worth 39% less than the current price!

Build Your Own China Resources Beer (Holdings) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Resources Beer (Holdings) research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Resources Beer (Holdings) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Resources Beer (Holdings)'s overall financial health at a glance.

No Opportunity In China Resources Beer (Holdings)?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:291

China Resources Beer (Holdings)

An investment holding company, manufactures, distributes, and sells alcoholic beverages in Mainland China.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives