Dekon Food and Agriculture Group (SEHK:2419): Assessing Value Following New Share Buyback Program

Reviewed by Simply Wall St

Dekon Food and Agriculture Group (SEHK:2419) is initiating a share repurchase plan following approval at its latest Annual General Meeting. This move often draws attention because it signals management’s perspective on the company’s value.

See our latest analysis for Dekon Food and Agriculture Group.

Dekon Food and Agriculture Group’s share price has surged an impressive 145.56% so far this year, demonstrating strong momentum even with some recent volatility. Its 1-year total shareholder return sits at 110.31%. The combination of fresh buybacks and healthy long-term gains suggests investors are tuning in to the company’s evolving story and growth potential.

If you’re interested in what other fast-moving companies are capturing attention lately, now is an ideal time to broaden your perspective and discover fast growing stocks with high insider ownership

Given management’s strong buyback stance and solid growth, investors now face a key question: is Dekon Food and Agriculture Group undervalued at current levels, or is the market already factoring in all the future upside?

Price-to-Earnings of 7.3x: Is it justified?

At a price-to-earnings (P/E) ratio of 7.3x, Dekon Food and Agriculture Group stands out as attractively valued compared to its listed peers, with the last close at HK$74.65.

The P/E ratio tells us how much investors are willing to pay for each dollar of earnings. In the context of food and agriculture, a lower P/E may reflect undervaluation, especially if growth prospects and profitability are robust.

For Dekon, this multiple is notably below both its peer average (13.4x) and the Hong Kong food industry average (13.2x). This signals that the market may be underestimating the company’s recent profit growth and quality of earnings. Fair value analysis goes further and suggests the stock deserves a significantly higher P/E, which could prompt a rerating as investors catch on to its fundamentals.

Explore the SWS fair ratio for Dekon Food and Agriculture Group

Result: Price-to-Earnings of 7.3x (UNDERVALUED)

However, persistent market volatility or weaker-than-expected earnings growth could create challenges for Dekon Food and Agriculture Group’s momentum in the coming months.

Find out about the key risks to this Dekon Food and Agriculture Group narrative.

Another View: SWS DCF Model Offers a Different Perspective

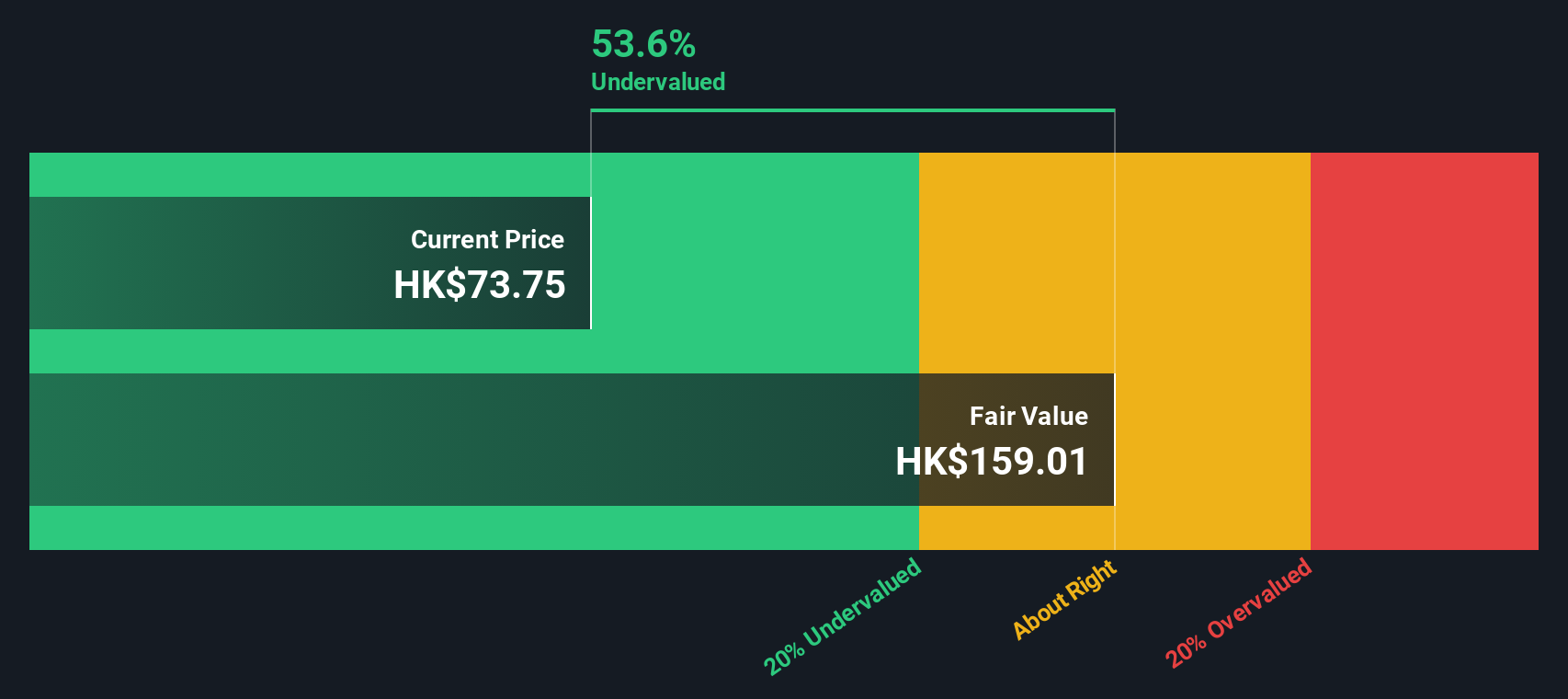

Taking a look at our SWS DCF model, the outlook for Dekon Food and Agriculture Group could be even more bullish. The DCF suggests the current price is 53% below intrinsic fair value, which raises the possibility that the stock is overlooked despite recent gains. Could this be an opportunity that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dekon Food and Agriculture Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dekon Food and Agriculture Group Narrative

If you’re keen to double-check the numbers or assemble your own thesis, our tools let you shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dekon Food and Agriculture Group.

Looking for more investment ideas?

Don’t let the next opportunity slip past you. The Simply Wall Street Screener is packed with fresh, high-potential stock ideas you can act on right now.

- Start growing your passive income and target yields above 3% by tapping into these 15 dividend stocks with yields > 3% built for strong dividend investors.

- Tap into the cutting edge of artificial intelligence and pinpoint emerging winners with these 25 AI penny stocks making waves in the digital economy.

- Unlock overlooked value and uncover companies trading below their intrinsic worth using these 933 undervalued stocks based on cash flows for smart, data-driven investing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2419

Dekon Food and Agriculture Group

Engages in the livestock and poultry breeding and farming businesses.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.