- Hong Kong

- /

- Real Estate

- /

- SEHK:1109

3 SEHK Dividend Stocks To Consider With Yields From 4% To 8.7%

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties, the Hong Kong market has shown resilience, with the Hang Seng Index experiencing only a modest decline of 0.43% amidst broader concerns about inflation and economic growth in China. In this context, dividend stocks can offer a stable income stream and potential for capital appreciation. In today's volatile market environment, selecting dividend stocks with strong fundamentals and attractive yields can provide investors with both income stability and long-term growth potential.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.63% | ★★★★★★ |

| Consun Pharmaceutical Group (SEHK:1681) | 9.95% | ★★★★★☆ |

| Luk Fook Holdings (International) (SEHK:590) | 9.51% | ★★★★★☆ |

| Lenovo Group (SEHK:992) | 4.04% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.74% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.82% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.56% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.58% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.96% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.80% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our Top SEHK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

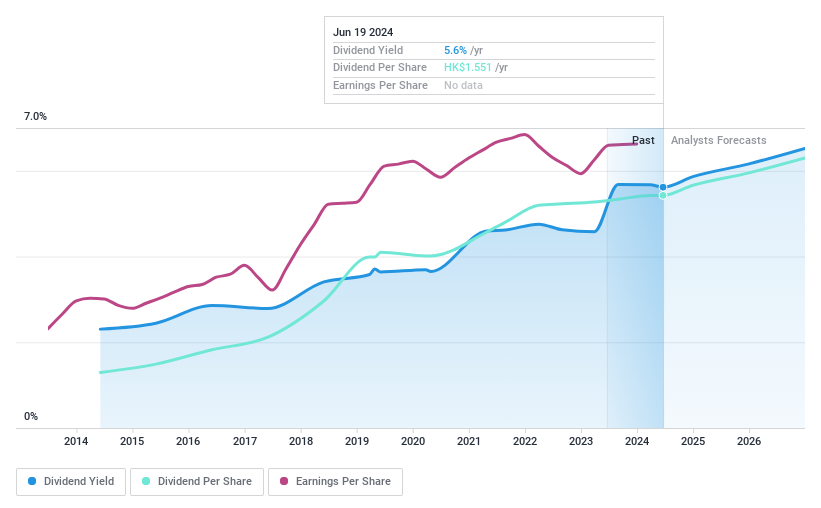

China Resources Land (SEHK:1109)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Resources Land Limited, with a market cap of HK$148.32 billion, engages in the investment, development, management, and sale of properties in the People’s Republic of China.

Operations: China Resources Land Limited generates revenue from several segments, including CN¥216.89 billion from its development property business, CN¥23.92 billion from its investment property business, CN¥15.66 billion from its eco-system elementary business, and CN¥14.74 billion from its asset-light management business.

Dividend Yield: 7.6%

China Resources Land offers a stable dividend history over the past decade, with recent interim dividends of RMB 0.2 per share for H1 2024. Despite a lower-than-top-tier yield of 7.64%, dividends are well-covered by earnings (payout ratio: 36.9%) and cash flows (cash payout ratio: 22.3%). However, the company's debt isn't well covered by operating cash flow, which could be a concern for long-term sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of China Resources Land.

- Our valuation report here indicates China Resources Land may be undervalued.

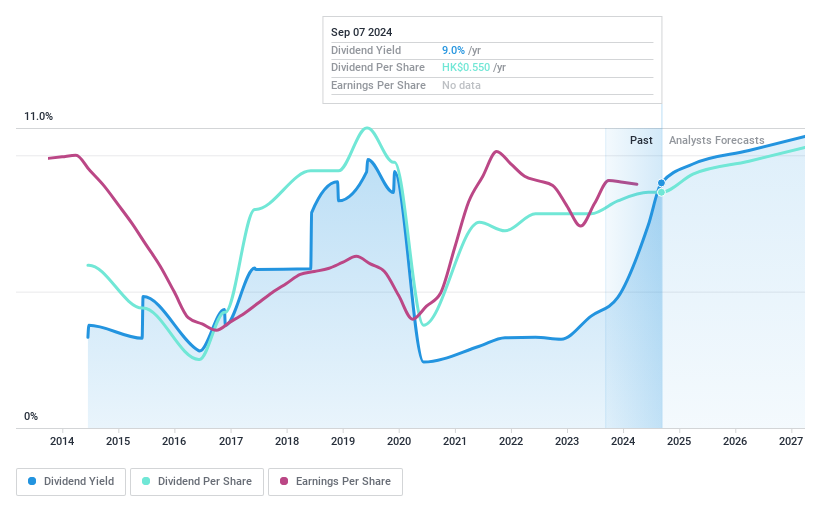

Chow Tai Fook Jewellery Group (SEHK:1929)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chow Tai Fook Jewellery Group Limited, an investment holding company with a market cap of HK$62.82 billion, manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally.

Operations: Chow Tai Fook Jewellery Group Limited generates revenue primarily from Mainland China (HK$89.70 billion) and Hong Kong & Macau of China and Other Markets (HK$19.92 billion).

Dividend Yield: 8.7%

Chow Tai Fook Jewellery Group's dividend yield is among the top 25% in Hong Kong, though its track record has been volatile. The company recently declared a final dividend of HK$0.30 per share for FY2024, with payments well-covered by both earnings (payout ratio: 84.6%) and cash flows (cash payout ratio: 42.7%). Despite high debt levels, the brand's new concept store in Hong Kong reflects ongoing business expansion and commitment to enhancing customer experience.

- Take a closer look at Chow Tai Fook Jewellery Group's potential here in our dividend report.

- The valuation report we've compiled suggests that Chow Tai Fook Jewellery Group's current price could be quite moderate.

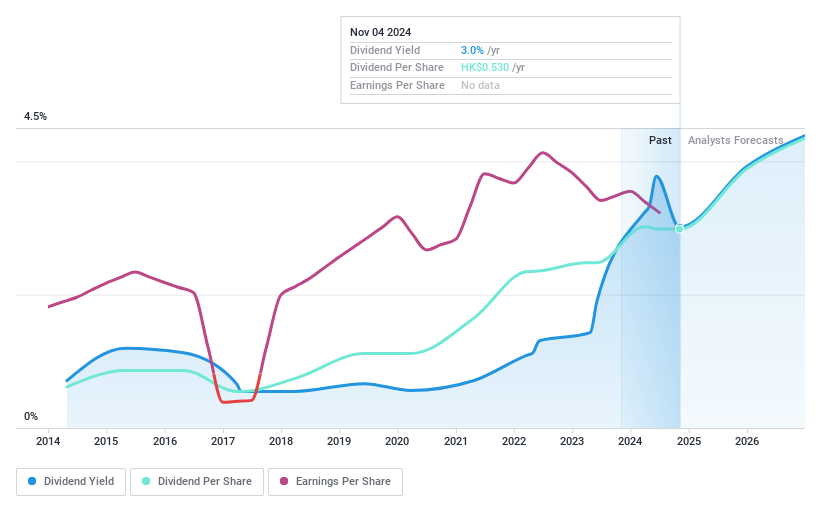

China Mengniu Dairy (SEHK:2319)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Mengniu Dairy Company Limited, with a market cap of HK$52.48 billion, manufactures and distributes dairy products under the MENGNIU brand in China and internationally.

Operations: China Mengniu Dairy Company Limited generates revenue primarily from its Liquid Milk Business (CN¥77.79 billion), Ice Cream Business (CN¥5.15 billion), Cheese Business (CN¥4.23 billion), and Milk Formula Business (CN¥3.56 billion).

Dividend Yield: 4%

China Mengniu Dairy's recent share repurchase program, worth HK$2 billion, aims to enhance earnings per share. Despite a decline in H1 2024 earnings and sales, the company's dividends are well-covered by both earnings (payout ratio: 45.4%) and cash flows (cash payout ratio: 44.7%). However, the dividend yield of 4.04% is lower compared to top dividend payers in Hong Kong, and its dividend history has been volatile over the past decade.

- Dive into the specifics of China Mengniu Dairy here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that China Mengniu Dairy is priced lower than what may be justified by its financials.

Summing It All Up

- Navigate through the entire inventory of 76 Top SEHK Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1109

China Resources Land

An investment holding company, engages in the investment, development, management, and sale of properties in the People’s Republic of China.

Very undervalued with adequate balance sheet and pays a dividend.