Budweiser Brewing Company APAC's (HKG:1876) Returns Have Hit A Wall

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at Budweiser Brewing Company APAC (HKG:1876) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Budweiser Brewing Company APAC is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$1.3b ÷ (US$16b - US$4.7b) (Based on the trailing twelve months to September 2021).

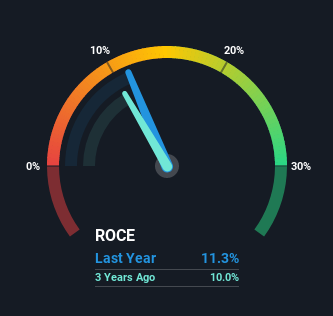

So, Budweiser Brewing Company APAC has an ROCE of 11%. That's a pretty standard return and it's in line with the industry average of 11%.

View our latest analysis for Budweiser Brewing Company APAC

In the above chart we have measured Budweiser Brewing Company APAC's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

How Are Returns Trending?

Things have been pretty stable at Budweiser Brewing Company APAC, with its capital employed and returns on that capital staying somewhat the same for the last three years. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. With that in mind, unless investment picks up again in the future, we wouldn't expect Budweiser Brewing Company APAC to be a multi-bagger going forward. With fewer investment opportunities, it makes sense that Budweiser Brewing Company APAC has been paying out a decent 31% of its earnings to shareholders. Unless businesses have highly compelling growth opportunities, they'll typically return some money to shareholders.

The Bottom Line

In summary, Budweiser Brewing Company APAC isn't compounding its earnings but is generating stable returns on the same amount of capital employed. And in the last year, the stock has given away 27% so the market doesn't look too hopeful on these trends strengthening any time soon. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

Budweiser Brewing Company APAC could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation on our platform quite valuable.

While Budweiser Brewing Company APAC may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Budweiser Brewing Company APAC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1876

Budweiser Brewing Company APAC

An investment holding company, produces, imports, markets, distributes, and sells beer and other non-beer beverages primarily in China, South Korea, India, Vietnam, and the other Asia Pacific regions.

Excellent balance sheet and good value.