Stock Analysis

As global markets navigate through varying economic signals, the Hang Seng Index in Hong Kong has shown resilience with a modest gain during a holiday-shortened week. Amid these fluctuating conditions, dividend stocks continue to attract attention for their potential to offer steady returns. In this context, selecting strong dividend-yielding stocks can be particularly prudent, providing investors with a possible buffer against market volatility while potentially enhancing long-term investment portfolios.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| CITIC Telecom International Holdings (SEHK:1883) | 9.37% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.77% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.97% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.14% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.97% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 8.57% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.11% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.26% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.24% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.45% | ★★★★★☆ |

Click here to see the full list of 91 stocks from our Top SEHK Dividend Stocks screener.

We'll examine a selection from our screener results.

Xtep International Holdings (SEHK:1368)

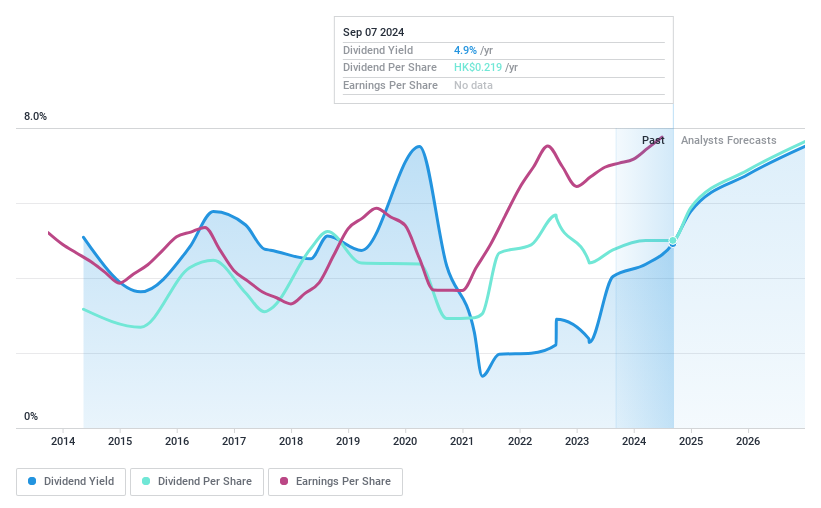

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xtep International Holdings Limited, based in China, specializes in the design, development, manufacturing, and marketing of sports footwear, apparel, and accessories for adults and children with a market capitalization of approximately HK$12.67 billion.

Operations: Xtep International Holdings Limited generates revenue primarily through three segments: Mass Market at CN¥11.95 billion, Fashion Sports at CN¥1.60 billion, and Professional Sports at CN¥0.80 billion.

Dividend Yield: 4.3%

Xtep International Holdings offers a dividend yield of 4.28%, which is modest compared to Hong Kong's top dividend payers. While its dividends are supported by earnings and cash flows with payout ratios of 48.8% and 58.6% respectively, the company has experienced volatility in its dividend payments over the past decade. Recent operational updates indicate a positive retail growth trajectory, yet changes in executive roles and amendments in company bylaws suggest transitional phases that could impact future financial strategies and dividend policies.

- Take a closer look at Xtep International Holdings' potential here in our dividend report.

- The analysis detailed in our Xtep International Holdings valuation report hints at an deflated share price compared to its estimated value.

Tsingtao Brewery (SEHK:168)

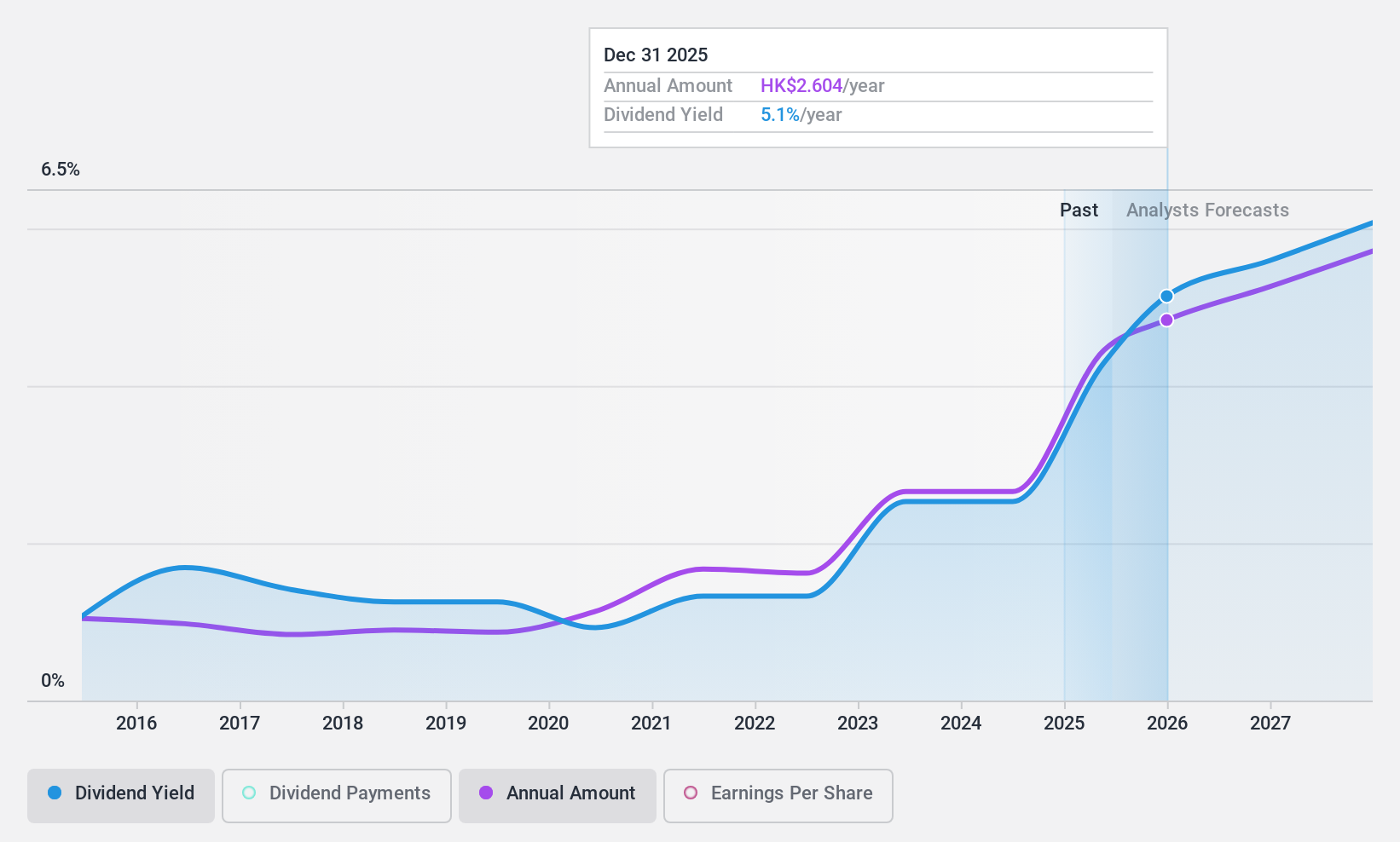

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsingtao Brewery Company Limited operates globally, focusing on the production, distribution, wholesale, and retail sale of beer products with a market capitalization of approximately HK$85.88 billion.

Operations: Tsingtao Brewery Company Limited generates its revenue primarily through the production and sale of beer products globally.

Dividend Yield: 4.3%

Tsingtao Brewery recently approved a final dividend of RMB 2 per share, payable on August 9, with changes in its board and auditor signaling a strategic realignment. While the company's dividends have shown growth over the past decade, its current yield of 4.25% is low compared to Hong Kong's top dividend stocks. Despite trading below fair value by 36.7%, concerns about coverage by earnings and free cash flows persist, as indicated by a high cash payout ratio of 145.5%.

- Click here to discover the nuances of Tsingtao Brewery with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Tsingtao Brewery is trading behind its estimated value.

Chow Tai Fook Jewellery Group (SEHK:1929)

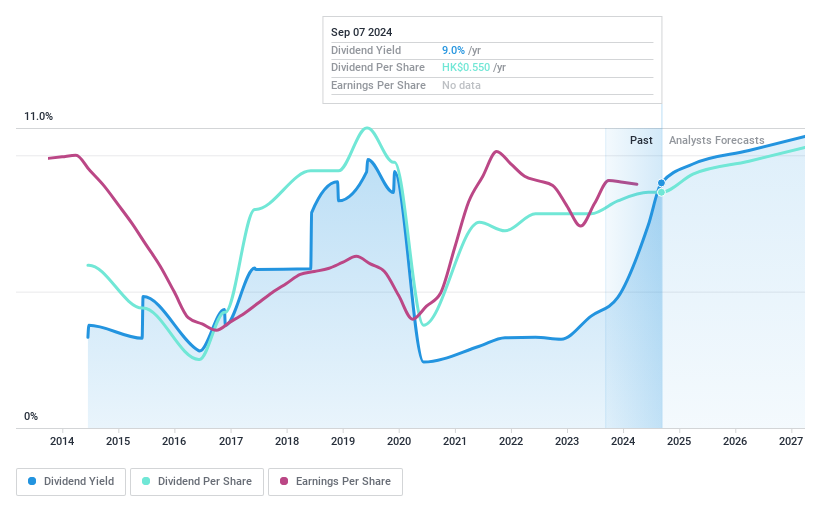

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Tai Fook Jewellery Group Limited operates as an investment holding company that manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and other international markets, with a market capitalization of approximately HK$83.70 billion.

Operations: Chow Tai Fook Jewellery Group Limited generates HK$89.70 billion from its Mainland China operations and HK$19.92 billion from its combined Hong Kong, Macau, and other international markets.

Dividend Yield: 6.6%

Chow Tai Fook Jewellery Group Limited reported a robust financial year with sales reaching HK$108.71 billion, up from HK$94.68 billion the previous year, and net income increasing to HK$6.50 billion. Despite this growth, the company's dividend history shows variability, with a recent proposal of HK$0.3 per share for 2024. The dividends are well-covered by earnings and cash flows, with payout ratios at 84.6% and 42.7% respectively, suggesting sustainability despite past fluctuations in dividend consistency.

- Navigate through the intricacies of Chow Tai Fook Jewellery Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Chow Tai Fook Jewellery Group's share price might be on the expensive side.

Key Takeaways

- Gain an insight into the universe of 91 Top SEHK Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsingtao Brewery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:168

Tsingtao Brewery

Engages in the production, distribution, wholesale, and retail sale of beer products in Mainland China, Hong Kong, Macau, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.